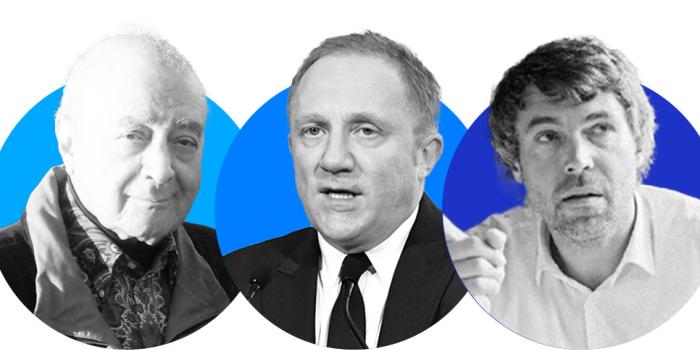

Family Business

By Jamie Yuenger

18 April 2024

By Glen Ferris

25 April 2024

By Glen Ferris

22 April 2024

By Jamie Yuenger

18 April 2024

Top Stories

Top Stories

-

By Jamie Yuenger18 April 2024

-

By Giles Graves16 April 2024

-

By Glen Ferris15 April 2024

Don't Miss the Latest Family Business News and Investment Trends

Market Insights

Featured Videos

-

Campden Wealth - Supporting multi-generational business families

3:23 -

Campden Education - The Family Wealth Essentials Series

04:02 -

Campden Club - A global membership for families, the next generation and their private offices

01:38 -

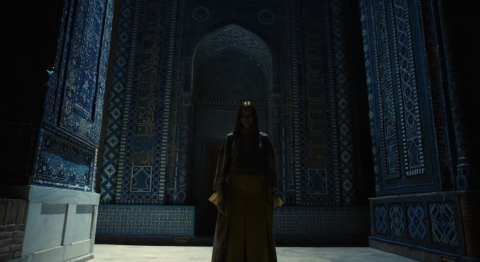

Asia Alliance Bank - Commercial bank of Uzbekistan

2:16 -

Surviving a family business as a non-family executive

03:00 -

Kleinwort Hambros on the New Philanthropist

01:27