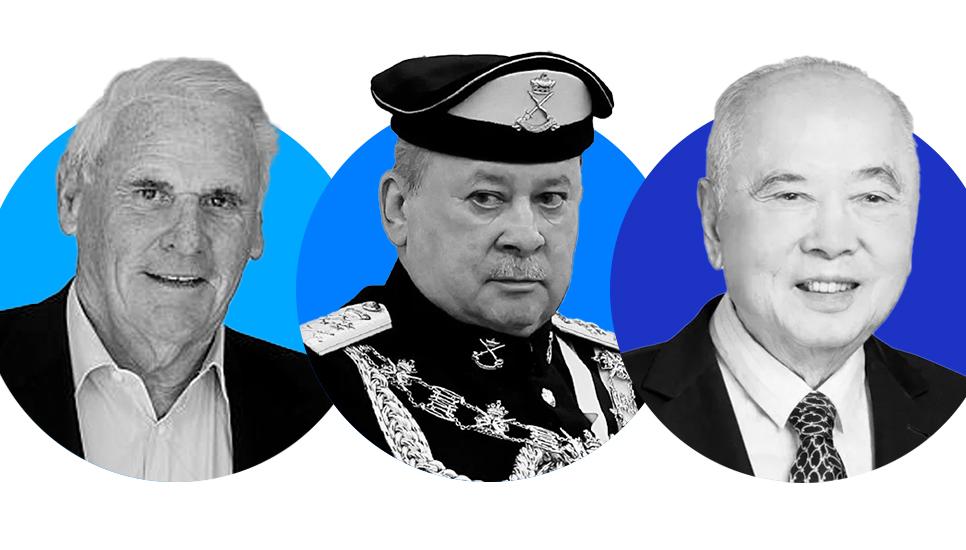

FB Roundup: Lang Walker, Sultan Ibrahim Iskandar, Wee Cho Yaw

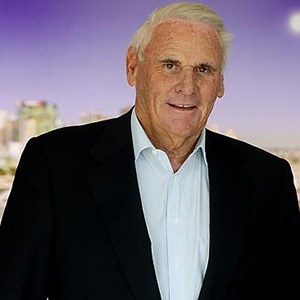

Tributes paid to Australian property developer Lang Walker

The family of billionaire Sydney property developer Lang Walker have led tributes following his passing at the age of 78.

Hailing Walker as a “devoted and loving husband, father and grandfather” and “visionary” who shaped postwar Australia with his expansive builds,” in a statement the family went on to praise the Walker Group founder for “creating incredible places where people can live and work”, adding “he loved his family more than anything else in the world and his generosity and affection had no boundaries… His zest for life and his relentless pursuit of perfection lives on within everyone in the Walker family.”

“Lang’s vision will remain an enduring force through the Walker DNA and the Walker way which he actively passed on – it is embedded in our culture and our modus operandi,” said David Gallant, the current managing director and CEO of the Walker Group. “The vital importance of business continuity and the need to maintain key relationships to retain our pre-eminent position has been instilled in all of us.”

The Australian property magnate, who developed office towers, industrial estates and residential projects, started out in business in 1964 as a partner in his father’s earth-moving business, A&L Walker.

In 1972, he formed the Walker Group and moved into property development, eventually specialising in redeveloping large city sites and overseeing ambitious billion-dollar projects. Notable developments include King Street wharf, Finger wharf, Parramatta square, Collins square in Melbourne and Festival tower in Adelaide.

According to The Guardian, “Walker first entered the Australian Financial Review’s rich list in 1986 with an estimated net worth of $20 million and never left. He went on to sell the bulk of his company twice, first in 1999 before the dot-com bubble burst and in 2006 before the global financial crisis.

“As of 2023, Walker was considered the 16th richest man in Australia, boasting a personal wealth of $5.1 billion, including a private island in Fiji and a luxury superyacht – all named ‘Kokomo’, the pseudonym of a composer whose music he played as a child.”

Walker, who was awarded the Officer of the Order of Australia for his services to business and philanthropy, is survived by his wife, Sue, three adult children, Blake, Chad and Georgia, and ten grandchildren.

Sultan Ibrahim Iskandar sworn in as Malaysia’s 17th king

As part of Malaysia’s unique rotating monarchy system, billionaire Sultan Ibrahim Sultan Iskandar has been officially sworn in as the nation’s new king.

Following nine previous Malay state rulers, who have taken turns as king for five-year terms since Malaysia gained independence from Britain in 1957, the 65-year-old took his oath of office at the palace and signed the instrument of the proclamation of office in a ceremony witnessed by other royal families, Prime Minister Anwar Ibrahim, and cabinet members.

One of Malaysia’s wealthiest people, Sultan Ibrahim oversees a vast business empire, ranging from real estate to telecoms and power plants.

While the Sultan’s new position is seen as largely ceremonial, it has, according to a report by The Guardian “in recent years featured heavily in the country’s fractured political landscape, prompting the king to wield rarely used discretionary powers to quell political instability.”

In an interview with Singapore’s The Straits Times, the Sultan (who is also the fifth Sultan of modern Johor since ascending to the throne following the death of his father, Sultan Iskandar in 2010) said he was not keen on becoming a “puppet king”.

“There’re 222 of you [lawmakers] in parliament. There’re over 30 million [population] outside. I’m not with you, I’m with them,” he said. “I will support the government, but if I think they are doing something improper, I will tell them.”

Known for his large collection of luxury cars and motorbikes, Bloomberg estimates Sultan Ibrahim and his family have a net worth of at least $5.7 billion.

Singaporean banking giant Wee Cho Yaw passes away aged 95

Luminaries from Singapore’s financial industries have paid tribute to billionaire banker Wee Cho Yaw, who has passed away at the age of 95.

Considered to be one of the last of Singapore’s 20th century banking giants, the chairman emeritus and honorary adviser of the United Overseas Bank (UOB), and chairman of the UOL Group, was credited with helping to shape Singapore’s financial landscape by amalgamating several old family-controlled banks.

“My father has left an indelible mark in Singapore and the region,” said Wee Ee Cheong, CEO of UOB since 2007, in a statement. “Whether it is through thinking for the long-term, the importance of deep relationships, doing the right thing or giving a helping hand to those in need, the influence of my father and his values will endure at UOB.”

According to Fortune, “Wee was one of the last of a generation of bankers born before World War II who came to dominate Singapore’s financial system after the country gained independence from Britain in the 1960s. He spearheaded the acquisition of banks across Southeast Asia to form UOB, one of the region’s largest lenders, after his father co-founded its predecessor in 1935.”

“Dr Wee was a visionary business leader, pioneering entrepreneur and philanthropist,” said UOL Group Ltd, one of Singapore’s largest property developers, in a statement. “Wee was chairman for over 50 years since 1973. Under his helm, UOL grew from a local firm with assets of S$70 million ($52.1 million) to one with a presence in 15 countries and total assets of more than S$20 billion.”

Wee amassed a net worth of $10.4 billion (according to the Bloomberg Billionaires Index), thanks to a series of savvy investments, including the 2001 takeover of Singapore’s Overseas Union Bank Ltd (in which he beat off stiff competition from regional giant DBS Group Holdings Ltd). He also diversified into other product areas such as trade finance and foreign exchange.