Fixed income for family offices: Attractive time across public and private markets

As an introduction to our readership, can you talk about the origins and aims of PIMCO? How has PIMCO been partnering with family offices globally?

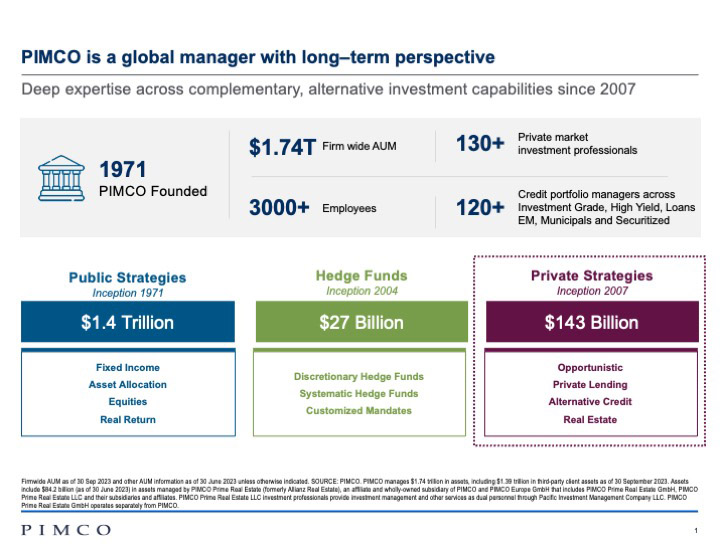

Founded more than 50 years ago, PIMCO has been a global leader in active fixed income and credit with deep expertise across public and private markets over multiple market cycles. As of September 30, 2023, PIMCO manages US$1.74 trillion third-party assets, making the firm one of the largest active fixed income players in the world. As a natural extension to its fixed income and credit DNA, PIMCO also developed a sizable and fast-growing alternatives and private credit platform over the past 15 years. Currently, PIMCO manages ~US$143 billion in (Exhibit 1) private strategies including private credit and real estate, and is one of the largest real estate investors globally after assuming the leadership and oversight of Allianz Real Estate (now known as PIMCO Prime Real Estate).

We have decades of experience partnering with global family offices around the world, and today manage approximately US$60 billion in AUM for family capital and non-profit clients. The partnerships cover the entire liquidity spectrum including traditional public fixed income, hedge funds, private credit and real estate. In addition to investment management, we offer a full-service platform for family offices, including market insights and customised portfolio analytics, and networking opportunities.

PIMCO has been a long-term credit investor in both public and private markets. Many UHNW families are more familiar with equity investing. Why should these credit areas be of interest to them?

Credit represents a loan or bond agreement between a lender and a borrower where the borrower agrees to repay the principle at the maturity date and also pay interests periodically. In addition, borrowers are bound by certain covenants to maintain financial health and protect the lenders from potential risk of credit deterioration or default. Some loans may be secured by collateral, which further protects the lender in the event of nonpayment. Because the upside of a credit investment is capped (the principal plus the interests), it is important to protect the downside, therefore considering the default risk and recovery value is important when assessing a credit investment.

Because of its specific nature, a credit investment may provide benefits to family office portfolios. In summary:

- High income distribution due to interest payment

- Increased defensiveness as borrowers are expected to pay back the principal. Select forms of credit have hard assets as collaterals, and creditors have payment priority in the capital structure (i.e. creditors get paid first before equity investors)

- Diversification due to varying interest payment profiles and economic impacts on borrowers

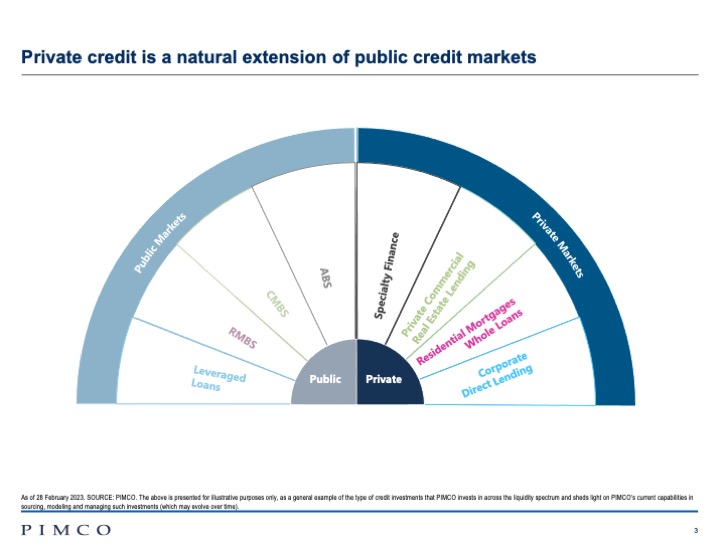

Related to the last point, it is worth noting that credit investments can be originated and sourced from different types of borrowers. For example, borrowers can include governments (through sovereign debt), companies (with corporate credit), consumers (of credit card and auto loans), or loans secured by real assets (such as commercial real estate loans and residential mortgages). Diversifying the borrower base is an important risk management tool, which PIMCO believes leads to more stable returns and income generation over time.

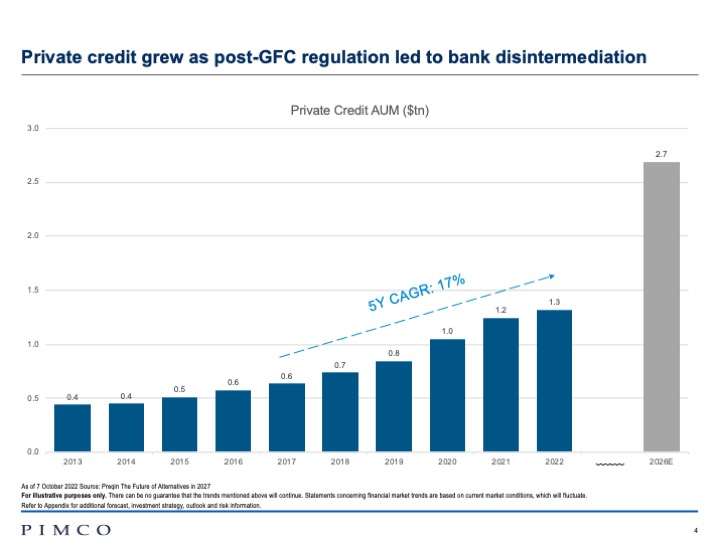

While both public and private credit share a lot of similarities, private credit – which has grown due to greater regulation following the global financial crisis (GFC) which led banks to reduce their balance sheets and pull back lending practices (Exhibit 4) – can provide higher return potential and better diversification compared to public credit, as investors can earn illiquidity and complexity premiums in private credit opportunities.

How does the outlook for credit markets today compare with what you’ve seen at other times during your career? Why is now a good time?

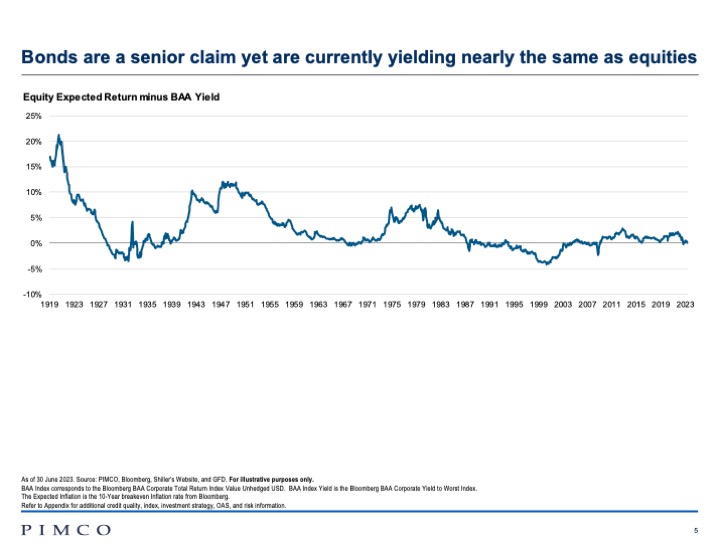

Today’s market environment provides a very attractive entry point for fresh capital. Yields are at their highest levels in about 15 years. From a strategic asset allocation perspective, we believe credit is more attractive than equity. The chart below shows that credit can currently offer equity-like returns but with one-third of the volatility.

We view the current market opportunity in credit to be very attractive, as rates are likely to stay higher for longer. Additionally, in our base case, we do not expect a deep recession such as the one experienced during the GFC or COVID-19 pandemic. There are three themes in credit investments today:

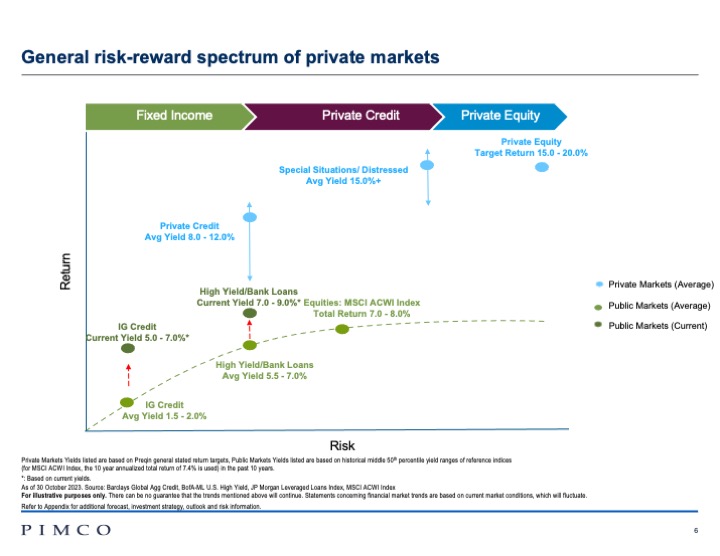

1) Public, high-quality fixed income now offer 5-8% yields with limited default risks

2) Senior performing private credit, such as asset-based financing and diversified senior lending, can offer 10-12% returns with 6-9% income distribution

3) Another high conviction area in private assets is capital solutions, where privately negotiated loans are customized for companies seeking capital for various needs. Due to limited supply of liquidity, the current market conditions favour lenders. Capital solution deals are yielding returns similar to those seen in private equity (15-20%), and meanwhile offering terms that prioritize capital preservation and provide downside mitigation.

According to Campden Wealth’s Asia-Pacific Family Office Report, APAC-based family offices are increasingly adopting strategies to mitigate the adverse impact of inflation, The report found that 88% of respondents cited inflation as the biggest risk to financial markets (a marked increase of 19% from 69% in the 2021 Asia-Pacific report), closely followed by rising interest rates (72%) and geopolitical risk (58%). Does this approach chime with PIMCO’s response to current global events?

This is a great question. In PIMCO’s quarterly cyclical outlook reports, which provide our investment views for next 6-12 months, we discuss tail risks and how they could impact our baseline views and portfolio returns. Inflation, interest rates and geopolitics are the risks that we discuss extensively.

In our latest edition published in October 2023, we believe private credit investments can help mitigate many of the risks you highlighted. Private credit markets, being generally floating rate instruments, have demonstrated strong performance during the recent bouts of inflation and steep increases in interest rates. This characteristic is a key reason why we consider private credit as a portfolio diversifier compared to traditional fixed income investments, which tend to have longer duration, i.e. greater interest rate sensitivity. In a higher-for-longer interest rate scenario, private credit markets will continue to benefit from elevated yields.

For rising interest rates, we believe major central banks are reaching the end of their tightening cycles. It is now a good time to add bonds to the portfolio, as they offer attractive starting yields and the additional benefit of price appreciation in anticipation of rate cuts.

Lastly, on geopolitical risks, our investment team – being a macro house – is well informed of the latest developments and we look to incorporate and mitigate this risk in our granular credit underwriting. Geographically, we prefer private credit in developed markets with the majority from the US, and to a lesser extent the UK and Europe, where banks have scaled back the most and private credit markets are deepest.

According to the same report, 42% of family offices are adopting a balanced investment strategy (an increase of 2% from 2021), while 30% are adopting a growth strategy (a decrease of 2% from the previous year). The remaining 28% adopt a wealth preservation-based strategy, a higher proportion than the global average (18%). What are your thoughts on these various strategies? How can each benefit from private credit allocation?

Considering all the points highlighted above, we believe private credit allocations have an important role to play across a variety of portfolios that can cater to family offices’ styles and needs.

For investors looking for growth and willing to take risks, incorporating certain performing credit strategies (such as specialty finance) and opportunistic credit strategies (such as capital solutions and stress and distress) can offer underwritten IRR of 15-20% in today’s market. Adding these strategies to a portfolio can enhance returns and increase the resiliency of a growth-oriented portfolio with returns being more contractual and downside protected.

For conservative investors, senior lending solutions that are typically secured by real assets as collaterals and that offer consistent income distribution can be considered and are particularly attractive in today’s high interest rate environment.

Through decades of experiences, PIMCO has developed deep expertise in all the above areas and have a suite of solutions available for family office investors. We can also combine multiple solutions and be the one-stop shop to provide diversified returns from both public and private markets for families adopting a balanced investment strategy.

Some family offices paused fresh dealmaking because of economic uncertainty. Without the benefit of a crystal ball, what does the future hold for private credit market?

We expect the private credit market to continue its rapid growth with banks increasingly retreating from the lending market as a result of regulations imposed post-GFC. Having a liquidity provider that has a 'fresh' balance sheet without troubled loans is key to a healthy investment strategy. Flexible capital that spans multiple borrower types is also beneficial for investors as it can lead to more consistent capital deployment across a more diversified opportunity set.

The uncertainty surrounding inflation, growth, geopolitics and interest rates can have varying impacts on economies and markets. Therefore, we advocate for a flexible approach to investing that can adapt to different opportunities as the markets evolve.

At PIMCO, our alternatives platform – which currently manages US$143 billion – is experiencing continuous growth and we are putting tremendous resources into expanding the platform. We have built a highly differentiated platform focused on asset-based private lending, corporate and real estate lending, and special situations. We believe our disciplined and differentiated approach positions us well to capitalize on what we anticipate to be a highly opportune investment environment.

With further global volatility and market dislocations to come, it is more important than ever to have an experienced manager to select and underwrite each credit. PIMCO’s investment and risk management process has been through multiple cycles in the past 50 years and continues to provide value and protection for clients’ portfolios.

Source: PIMCO. All investments contain risk and may lose value. Investors should consult their investment professional prior to making an investment decision. Investing in the bond market is subject to certain risks including market, interest rate, issuer, call, credit, liquidity, and inflation risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Private credit involves an investment in non-publically traded securities which are subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Investments in Private Credit may also be subject to real estate-related risks, which include new regulatory or legislative developments, the attractiveness and location of properties, the financial condition of tenants, potential liability under environmental and other laws, as well as natural disasters and other factors beyond a manager’s control.

PIMCO manages $1.74 trillion in assets, including $1.39 trillion in third-party client assets as of 30 September 2023. Assets include $84 billion (as of 30 June 2023) in assets managed by PIMCO Prime Real Estate (formerly Allianz Real Estate), an affiliate and wholly-owned subsidiary of PIMCO and PIMCO Europe GmbH that includes PIMCO Prime Real Estate GmbH, PIMCO Prime Real Estate LLC and their subsidiaries and affiliates. PIMCO Prime Real Estate LLC investment professionals provide investment management and other services as dual personnel through Pacific Investment Management Company LLC. PIMCO Prime Real Estate GmbH operates separately from PIMCO.

It is not possible to invest directly in an unmanaged index.

This material contains the current opinions of the and such opinions are subject to change without notice. This material is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. | PIMCO Europe Ltd (Company No. 2604517, 11 Baker Street, London W1U 3AH, United Kingdom) is authorised and regulated by the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963, Corso Vittorio Emanuele II, 37/Piano 5, 20122 Milano, Italy), PIMCO Europe GmbH Irish Branch (Company No. 909462, 57B Harcourt Street Dublin D02 F721, Ireland), PIMCO Europe GmbH UK Branch (Company No. FC037712, 11 Baker Street, London W1U 3AH, UK), PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E, Paseo de la Castellana 43, Oficina 05-111, 28046 Madrid, Spain) and PIMCO Europe GmbH French Branch (Company No. 918745621 R.C.S. Paris, 50–52 Boulevard Haussmann, 75009 Paris, France) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch, Spanish Branch and French Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) (Giovanni Battista Martini, 3 - 00198 Rome) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland (New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3) in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN); (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) (Edison, 4, 28006 Madrid) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively and (5) French Branch: ACPR/Banque de France (4 Place de Budapest, CS 92459, 75436 Paris Cedex 09) in accordance with Art. 35 of Directive 2014/65/EU on markets in financial instruments and under the surveillance of ACPR and AMF. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2, Brandschenkestrasse 41 Zurich 8002, Switzerland). The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (8 Marina View, #30-01, Asia Square Tower 1, Singapore 018960, Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited (Suite 2201, 22nd Floor, Two International Finance Centre, No. 8 Finance Street, Central, Hong Kong) is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. PIMCO Asia Limited is registered as a cross-border discretionary investment manager with the Financial Supervisory Commission of Korea (Registration No. 08-02-307). The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Investment Management (Shanghai) Limited. Office address: Suite 7204, Shanghai Tower, 479 Lujiazui Ring Road, Pudong, Shanghai 200120, China (Unified social credit code: 91310115MA1K41MU72) is registered with Asset Management Association of China as Private Fund Manager (Registration No. P1071502, Type: Other). | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision, investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. To the extent it involves Pacific Investment Management Co LLC (PIMCO LLC) providing financial services to wholesale clients, PIMCO LLC is exempt from the requirement to hold an Australian financial services licence in respect of financial services provided to wholesale clients in Australia. PIMCO LLC is regulated by the Securities and Exchange Commission under US laws, which differ from Australian laws. | PIMCO Japan Ltd, Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association, The Investment Trusts Association, Japan and Type II Financial Instruments Firms Association. All investments contain risk. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Taiwan Limited is an independently operated and managed company. The reference number of business license of the company approved by the competent authority is (112) Jin Guan Tou Gu Xin Zi No. 015 . The registered address of the company is 40F., No.68, Sec. 5, Zhongxiao East Rd., Xinyi District, Taipei City 110, Taiwan (R.O.C.), and the telephone number is +886 2 8729-5500. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

Private Markets Yields listed are based on Preqin general stated return targets, Public Markets Yields listed are based on historical middle 50th percentile yield ranges of reference indices: Barclays Global Agg Credit for IG credit, BofA-ML U.S. High Yield for HY credit, JP Morgan Leveraged Loans Index for Bank Loans asset class, and MSCI ACWI Index for Global Equity.