Building a lasting family legacy in Asia: Values, governance and policy

A large and growing cohort of next generation (Next Gen) investors in the Asia-Pacific (APAC) are preparing to take on the responsibility of managing their family’s wealth.

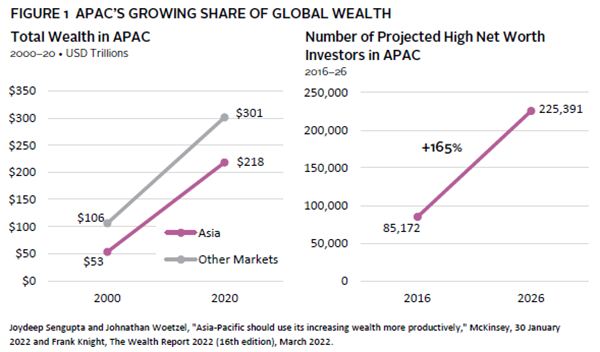

The region accounts for a large and growing sum of total wealth worldwide (Figure 1). In Singapore alone, the number of family offices increased from approximately 200 to 400 between 2019 and 2020 according to the Singapore Economic Development Board. High net worth families throughout APAC face both shared opportunities and challenges unique to their country, and Next Gen investors are keen to learn from established global families as they help build their own families’ futures. They are also bringing fresh perspectives to bear - often an outgrowth of their own educational and career experiences.

Each family is unique, and there is no standardised playbook for establishing sustainable generational success. As Next Gen investors and principal wealth owners think about meeting both near and long-term wealth management challenges, they should consider three core pillars of building a lasting family legacy: shared values, strong wealth governance and a clear, long-term investment policy.

Values: Establishing a Shared Mission

A family’s values drive their wealth management decisions. Each family’s value system is distinct and is defined by the attitudes and beliefs that make them who they are. These can include loyalty, respect, perseverance in the face of adversity, a commitment to hard work, and a desire to give back to society. The rising generation of wealth owners keeps the challenges faced by their predecessors front of mind while acknowledging their obligation to carry forward their success. Many also seek to advance these values in new ways as businesspersons, impact investors, and philanthropists.

For both principal wealth owners and their descendants, establishing shared awareness around the family value system is a vital precondition of putting capital to work in the name of the family’s continued success. Honouring a family’s long-held ideals is as important as maintaining flexibility about their potential to evolve. Confident decisions about investing and wealth management can only come from establishing a clear understanding of mission and purpose, which is sometimes easier said than done. For example, it can take time to balance a principal’s penchant for stock trading and trying to time the market with a longer-term investment approach based on sector analysis and ongoing changes in demographics and technology.

Yet capturing divergent viewpoints and upholding an established family values framework are not mutually exclusive goals. Because consensus is never guaranteed, values should be considered a shared responsibility. Principal wealth owners can strengthen the family’s wealth ownership principles by engaging, educating, and empowering Next Gen investors. For example, introducing the Next Gen to the family’s wealth management team, including investment advisors or managers, can help foster dialogue around wealth ownership responsibilities, concerns, and possibilities. Both formal and informal educational opportunities can help minimise conflict and impart to future stakeholders the knowledge and skills that families have developed over time.

Principal wealth owners and their successors are often also tasked with presiding over the continued success - and entrepreneurial spirit - of the family business. When it comes to generational changes in business ownership, organisational stability is paramount. Several important questions should be asked before any changeover decisions are made, including an assessment of the interest and ability of the next generation to take over, the transition time needed, and how changes might be viewed both within and outside of the company. The period between generational shifts should be sufficiently long to pass down institutional knowledge, networks, and wisdom. A proper plan to oversee management and decision making can provide families with the structural support they need to help strengthen the new generation’s chances of success.

Many members of the Next Gen are seeking to carry on their family’s business tradition through their own entrepreneurial endeavors. In this case, giving due consideration to the future success of family members need not conflict with new ambitions. An understanding of the family values can help ensure continuity within a family enterprise and can unfold in parallel with the development of the Next Gen’s goals, ideas, and desire to make their own mark on the world. For example, a family whose wealth comes from an historically carbon-intensive industry, such as petrochemicals or mining, may see the Next Gen adopting a more ESG (environmental, social, governance) or sustainable and impact investing (SII) lens as they look to further develop the direction of the family’s capital.

Relatedly, many Next Gen investors take active involvement in their family’s efforts to give back to society with the intention of positively influencing their communities and the world. Many families use philanthropic endeavors as another way to give Next Gen investors hands-on experience with wealth management and develop their sense of agency, beginning as early as pre-college. For example, some families opt to enlist next gen members as resources for a specific investment or project area, including impact investing, venture capital, or Web 3.0 strategy allocations. As they undertake such projects, families should remain mindful of certain risks, including nearness bias and adverse selection. They should also remain cognizant of the key distinctions between SII and philanthropy.

Where SII investing seeks a return, philanthropy seeks to support a specific organisation or address a specific issue. Notably, philanthropy isn’t just about grant-making alone - the Next Gen are leveraging these pools of capital to develop social venture programs to deliver impact in a more creative, business-oriented, and sustainable way. Recognizing the difference between SII and philanthropy is important to the successful implementation of both. Each can provide the next generation of investors with opportunities to effect change and follow a passion as they make their own contribution to what is often a long-standing family commitment to creating a positive impact.

Wealth Management and Investment Governance: Points of Order

Strong and transparent wealth management and investment governance systems are essential to a family’s ability to put their values into action and use capital to accomplish their objectives. Wealth management refers to the ways a family manages issues such as estate planning and intergenerational wealth transfer, accounting, retirement, and tax services. Investment governance refers to how a family establishes the principles, objectives, execution, and oversight of its portfolio, and evaluates the results.

When it comes to intergenerational wealth transfer, practical considerations should be considered first. Families whose next generation work and live across the world, for example, may face additional challenges in implementing a wealth management framework or creating one where none exists. What’s more, basic preferences around the pace and degree of capital transitions also differ from family to family.

As families think about investment goals and portfolio construction, many opt to organize their investment governance framework around a family office. The structure and purpose of each family office is wide-ranging - no two are exactly alike. Broadly speaking, the job of a family office is to protect and grow intergenerational capital and maintain oversight of any philanthropic work the family may elect to undertake.

It is often the next generation of wealth owners that is responsible for establishing a family office by spearheading an effort to create a more formalized, institutional approach to wealth management. The family’s principal wealth owner(s) may still be fully dedicated to running the family business and may not have the time to fully consider wealth governance, investment management operations, and diversification options. Usually, the structure and make-up of newly established family offices are relatively simple - incorporating the insights and participation of the principal wealth owner(s), Next Gen wealth owners, and the investment professionals who can direct their capital beyond their own concentrated knowledge of the industry from which their wealth is derived. The most effective governance systems are those that can evolve, adapting to calibrations in the family’s investment goals, new complexities in the portfolio, and increases or decreases in the number of wealth owners and beneficiaries.

Investment Policy: Putting the Family’s Success Into Motion

Families who know their value priorities and have articulated a vision around broader wealth management and investment governance are best positioned to focus on the pursuit of both their short- and long-term goals via their investment policy. In cases where an existing investment policy is not in place, it is often the responsibility of a family’s subsequent generation of wealth owners to create one. Enhancing the professionalization of a family’s investment management can be a complex task, but thinking about it as a sum of component parts can help.

Broadly defined, a family’s investment policy sets investment targets for the family portfolio and helps to ensure its management is well aligned with larger financial planning goals. It dictates how a family will deploy its capital to meet its objectives. While Next Gen investors and their families should aim to craft an investment policy tailored to their needs, all programs should account for risk management, diversification, long-term growth goals, and protection against capital loss.

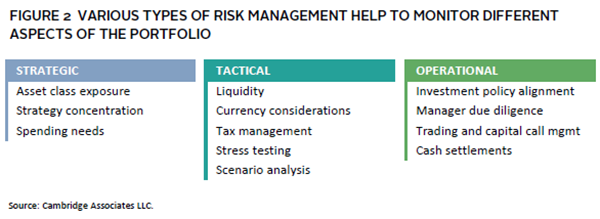

Proper risk management means aligning allocations with a family’s preferred risk tolerance and undertaking regular portfolio maintenance work to ensure that alignment with the family’s objectives is maintained over time (Figure 2). Strategic risk management entails controlling the portfolio’s exposure and concentrations, while accounting for spending needs. Tactical risk management includes addressing issues such as monitoring liquidity, currency considerations, tax management, stress testing, and scenario analysis. Lastly, families should remember the significance of operational risk management. This comprises all the necessary work involved in maintaining alignment to the larger investment policy, including manager due diligence, monitoring for trading errors, capital call management, and confirming cash settlements.

A well-diversified portfolio is essential to a family’s ability to withstand and exploit market dislocations and anomalies if and when they occur. Family portfolios should maintain adequate diversification across regions and sectors to help dampen the risk of dramatic underperformance. Many families opt to blend a risk-aware, growth-oriented endowment model with a thematic approach that seeks to capture ever-evolving opportunities such as those created by ongoing technological disruptions in tech and healthcare.

Meeting long-term growth goals can be best accomplished by melding equity-oriented growth and hedging strategies with a capacity to consider more entrepreneurial, higher-risk growth opportunities as they become available. In fact, families are often able to source investment ideas and direct deals through their own networks and established reputation for business acumen. A robust investment policy, coupled with requisite oversight, will help determine when and where those ideas can be pursued within the context of the overall portfolio. Families should seek to balance core holdings while remaining nimble enough to adapt to new strategies that seek growth through market dislocations and innovation.

Protection against capital loss is not limited to investment selection and portfolio maintenance. Cost management is crucial, as families can incur substantial custodial and trading fees from entities such as private banks and fund managers. Portfolio administration - the regular monitoring of asset purchases and sales, tax management, accounting, and other clerical tasks - is another important defence against incurring unnecessary costs. Although rare, seemingly minor transgressions such as rounding errors or missed deadlines on subscription documents or capital calls can have significant and widespread negative consequences. Keeping a watchful eye on these risks is just as important as monitoring those related to assets and strategies within a portfolio.

Moving Forward With Confidence

The work of managing and building family wealth is a big project - one that many families of wealth in Asia have begun from their position at the centre of the world’s future economic growth engine. Creating a dynastic family portfolio requires building a bridge between generations. Families who can lean on a long-standing value system while remaining open and adaptable to change put themselves in the best position to build a lasting legacy. From there, a clear governance framework can be instituted to enact an investment policy that is customized to help assure the family continues to flourish. However, no family does this on their own. Such work requires that families develop relationships and knowledge sharing capacity with a network of partners in the APAC region and beyond. It is by learning from established best practices that families of today can make their mark, both in the present day and over the decades to come.

To learn more about Cambridge Associates, click here.

Copyright © 2024 by Cambridge Associates LLC. All rights reserved.

This report may not be displayed, reproduced, distributed, transmitted, or used to create derivative works in any form, in whole or in portion, by any means, without written permission from Cambridge Associates LLC (“CA”). Copying of this publication is a violation of US and global copyright laws (e.g., 17 U.S.C. 101 et seq.). Violators of this copyright may be subject to liability for substantial monetary damages.

This report is provided for informational purposes only. The information does not represent investment advice or recommendations, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities. Any references to specific investments are for illustrative purposes only. The information herein does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Information in this report or on which the information is based may be based on publicly available data. CA considers such data reliable but does not represent it as accurate, complete, or independently verified, and it should not be relied on as such. Nothing contained in this report should be construed as the provision of tax, accounting, or legal advice. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE PERFORMANCE. Broad-based securities indexes are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment funds. Investments cannot be made directly in an index. Any information or opinions provided in this report are as of the date of the report, and CA is under no obligation to update the information or communicate that any updates have been made. Information contained herein may have been provided by third parties, including investment firms providing information on returns and assets under management, and may not have been independently verified.

The terms "CA" or "Cambridge Associates" may refer to any one or more CA entity including: Cambridge Associates, LLC (a registered investment adviser with the US Securities and Exchange Commission, a Commodity Trading Adviser registered with the US Commodity Futures Trading Commission and National Futures Association, and a Massachusetts limited liability company with offices in Arlington, VA; Boston, MA; Dallas, TX; Menlo Park, CA, New York, NY; and San Francisco, CA), Cambridge Associates Limited (a registered limited company in England and Wales, No. 06135829, that is authorized and regulated by the UK Financial Conduct Authority in the conduct of Investment Business, reference number: 474331); Cambridge Associates GmbH (authorized and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (‘BaFin’), Identification Number: 155510), Cambridge Associates Asia Pte Ltd (a Singapore corporation, registration No. 200101063G, which holds a Capital Market.

Services License to conduct Fund Management for Accredited and/or Institutional Investors only by the Monetary Authority of Singapore), Cambridge Associates Limited, LLC (a registered investment adviser with the US Securities and Exchange Commission, an Exempt Market Dealer and Portfolio Manager in the Canadian provinces of Alberta, British Columbia, Manitoba, Newfoundland and Labrador, Nova Scotia, Ontario, Québec, and Saskatchewan, and a Massachusetts limited liability company with a branch office in Sydney, Australia, ARBN 109 366 654), Cambridge Associates Investment Consultancy (Beijing) Ltd (a wholly owned subsidiary of Cambridge Associates, LLC which is registered with the Beijing Administration for Industry and Commerce, registration No. 110000450174972), and Cambridge Associates (Hong Kong) Private Limited (a Hong Kong Private Limited Company licensed by the Securities and Futures Commission of Hong Kong to conduct the regulated activity of advising on securities to professional investors).