FB Roundup: Hyundai, Bacardi, Associated British Foods

Chung family driving Hyundai make $2 billion on Apple tie-up reports

The Chung family in control of Hyundai became almost $2 billion better off when South Korean media reported the automaker was in early talks of a partnership with Apple, Inc.

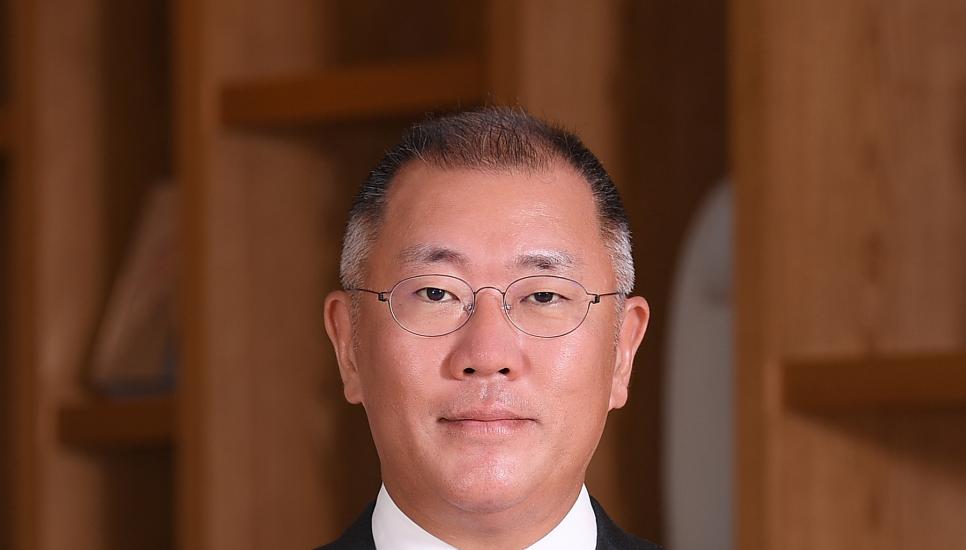

Share prices in Hyundai Motor Co soared by up to 25% in Seoul last week, which boosted the family fortunes of Euisun Chung (picture), 50, chairman, and his father, Mong-Koo, 82. Together they hold about 8% of stock in the group, but maintain influence through complex governance arrangements.

Hyundai confirmed it was in early discussions with Apple, but quickly revised its statement to avoid any mention of the US tech giant. It broadened its potential technological co-operation on the development of driverless electric vehicles to a number of “diverse companies” and said no decisions had been made. Industry commentators put the u-turn down to Apple’s strict insistence on discretion from its potential partners.

Euisun Chung, the only son of Mong-Koo Chung (pictured right in 2005), was appointed by board members of the $96 billion group of Hyundai Motor, Kia Motors and Hyundai Mobis in October 2020. Mong-Koo Chung, the eldest surviving son of group founder Chung Ju-yung's eight sons, was inaugurated as honorary chairman after announcing his wish to transfer control to his son earlier last year.

The proposed Apple deal would fit the ambitions of Euisun Chung to steer the world's fifth largest automaker into the development of autonomous driving, renewable fuels and flying cars.

In his new year address to employees, Chung said 2021 will be a decisive year for Hyundai Motor Group as a catalyst for long-term sustainable investments and innovations.

“We have to therefore think of 2021 as an inflection point for shaping our future growth and prepare ourselves to become the first mover in a new era,” he said.

“In the post-pandemic era, social values and lifestyles different from the past will prevail. And as a result, only those companies prepared for continuous transformations will survive and grow.”

Bacardi raises the bar on post-Covid ‘mindful drinking’ trend

The Bacardi family which owns the world’s largest privately held spirits company is getting ahead of the predicted growth of the “no and low” spirits market by launching new products and a campaign this month.

The fifth-generation family business said the ‘mindful drinking’ trend accelerated in 2020, especially in western Europe under coronavirus lockdowns and restrictions.

There were 30% more Google searches in the United Kingdom and 25% more in Germany for non-alcoholic beverages, compared to 2019. In both countries. Google searches for “Aperitivo” saw a rise from March 2020 as people began researching NoLo cocktails to enjoy at home.

One in three (36%) consumers in the UK, France and Germany said they were taking to non-alcoholic cocktails or a ‘less but better’ shift in attitude to alcohol over the festive holidays. Almost half (48%) of UK consumers surveyed and a quarter (24%) of German consumers said they planned to participate in “Dry-ish January”.

Bacardi, known for its flagship white rum among more than 200 brands and labels, predicted the NoLo category to grow in sales from $100 million in 2020 to $500 million in western Europe by 2024.

Bacardi, known for its flagship white rum among more than 200 brands and labels, predicted the NoLo category to grow in sales from $100 million in 2020 to $500 million in western Europe by 2024.

In response, the new Bacardi marketing initiative was designed to focus on visibility and education. It aimed to raise awareness of its mindful drinking line-up of premium drinks and signpost NoLo options for cocktail-lovers, bartenders and store owners. The campaign was backed with dedicated ‘Less is More’ Amazon gift stores in the UK, Germany and Spain to inspire at-home bartenders with recipes and interactive content. Samplings will be hosted across retail outlets and bars, when they reopen.

Facundo L Bacardi (pictured), 53, has been chairman of the board of Bacardi Ltd since 2005 and a director since 1993. He is the great-great grandson of company founder Don Facundo Bacardí Masso and a fifth-generation family member.

Founded 159 years ago in Santiago de Cuba, Bacardi employs more than 7,000 people, operates production facilities in 11 countries and sells its brands in more than 170 countries.

Associated British Foods stares at $1.4 billion sales loss but rules out Primark e-commerce

Associated British Foods stares at $1.4 billion sales loss but rules out Primark e-commerce

The Weston family-controlled food and retail giant Associated British Foods (ABF) says it expects to miss out on more than $1.4 billion in sales if all of its Primark fashion retail stores stay closed until the end of February.

However, the UK high street brand again rebuffed some irate customers this week by confirming via Twitter it was not planning to open an online store.

George Weston (pictured), 56, is the third-generation chief executive of ABF. The family business said in its update this week on trading across its grocery, sugar, agriculture, ingredients and retail divisions that group revenue for the 16 weeks ended 2 January, 2021 was 13% lower than the same period last year. Performance in all but retail had been “very strong” so far and profit was expected to be “well ahead of last year.”

Retail performance again took the biggest hit due to government lockdown restrictions.

“Our estimate for the loss of sales in the periods of closure during these 16 weeks is £540 million [$733 million],” ABF said.

“Our estimate for the loss of sales in the periods of closure during these 16 weeks is £540 million [$733 million],” ABF said.

“While stores were open, trading was strong given the circumstances, with sales at -14% on a like-for-like basis compared to last year. We opened five new stores in this period with a very positive customer reaction.”

However, 305 of Primark's 389 stores around the world, including all 190 UK outlets, were closed. ABF said assuming all 305 stores stayed shut until the financial half year, on 27 February 2021, the loss of sales would reach £1.05 billion ($1.4 billion), up from the £650 million ($883 million) loss estimated on 31 December.

The family business said it expected to help mitigate the loss by saving 25% of the operating costs of the 305 stores shuttered. It still planned to open 15 new stores in its financial year—five in Spain, three in the US, two in Italy, one in each of the UK, France and the Netherlands, plus another store in Poland and its first store in Czechia, Prague.