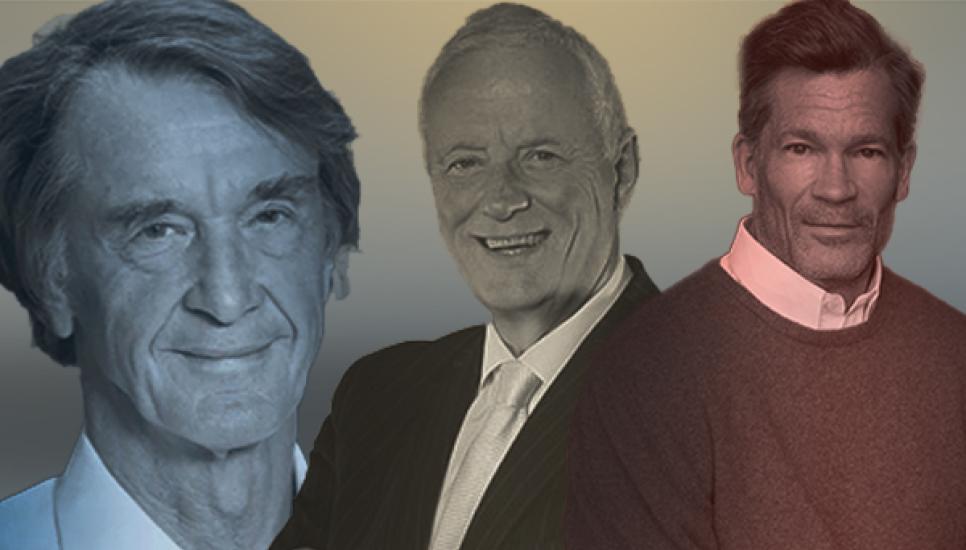

FB Roundup: Sir Jim Ratcliffe, Barry Hearn, Louis Bacon

Sir Jim Ratcliffe proposes £5 billion Manchester United buyout bid

Sir Jim Ratcliffe proposes £5 billion Manchester United buyout bid

After nearly having his dreams of owning Manchester United football club dashed after current owners the Glazer family said the team was not for sale, British petrochemicals billionaire Sir Jim Ratcliffe is proposing a full buyout of the Premiership team after three years if he succeeds with his revised £5 billion bid.

According to Sky News, the proposal from the chairman and chief executive officer (CEO) of INEOS includes “put-and-call arrangements which would become exercisable in 2026, and which would pave the way for the Glazer family’s complete exit as shareholders.”

Bloomberg had reported in August last year that the Glazer family would consider selling a minority stake in the club, they then later declared in October that the Old Trafford-based team wasn’t for sale. Now, a disclosure reports that the Glazers –who have controlled United since 2005, first by patriarch Malcolm Glazer, then by his children, Avram and Joel Glazer, after the American tycoon passed away in 2014 aged 85 – are open to offers for the club.

Sky News reports that Sir Jim's “offer for majority ownership could force the Glazers to sell their remaining shares to him or force him to acquire them at specified future dates”.

The update is expected to be of great interest to Manchester United’s ardent fanbase, many of whom are unhappy with the club’s ownership model and recent poor performance on the pitch –having not won a Premier League title in nine years.

A rival bid from Qatari businessman Sheikh Jassim bin Hamad al-Thani is proposing to buy the entirety of United's share capital, however, Sir Jim’s offer is believed to be higher.

The Glazers have also reportedly received at least four credible offers – from American financial investor Carlyle, American hedge fund Elliott Management, US investment group Ares Management Corporation and global investment firm Sixth Street – for minority stakes or financing investment in the club.

Merchant bank The Raine Group, which also oversaw last year's £2.5 billion takeover of Chelsea by Todd Boehly and Clearlake Capital’s consortium, is handling the sale which is expected to fetch up to £5 billion, making it the biggest sports club deal in history.

A decision about a preferred bidder is expected to be made later this month.

Barry Hearn and son’s Matchroom Sport sale falls down

Barry Hearn and son’s Matchroom Sport sale falls down

The proposed sale of global promotion company Matchroom Sport, owned and operated by British father-and-son sports promoter duo Barry and Eddie Hearn, to CVC Capital Partners has ended after a price was failed to be agreed upon.

The Hearns were circling an expected £175 million windfall from a 25% minority stake sale in a deal that saw the firm valued at up to £700 million. However, according to Sky News, CVC Capital Partners, the buyout firm which backs Six Nations Rugby, has concluded its approach after the two sides were unable to agree on a price.

In a recent Sunday Times interview, Eddie Hearn said: “It's such a difficult conversation over Sunday lunch, because my dad has always said to me: ‘Whatever you do, do not sell this business, do not let people into the business, do not let people affect your decisions. This is our company –we will make all the decisions, and that's how it will always be.’

“But I recognise that through our growth, there is another level. We are already operating at a level that no one ever expected us to, but there's so much more potential for growth.”

The Hearns remain in control of the company, which was formed in 1982 and has since evolved into a heavyweight player in professional boxing, darts and snooker.

In 2018, Matchroom scored the biggest deal in boxing promotion history after signing a $1 billion agreement with streaming giants Dazn to stage 16 American shows per year and to exclusively broadcast Matchroom’s fights in the US.

Hedge fund billionaire Louis Bacon wins $203 million in defamation case

Hedge fund billionaire Louis Bacon wins $203 million in defamation case

American investor Louis Bacon, the founder and chairman of Moore Capital Management, has been awarded more than $203 million in damages following a defamation case against his former neighbour, the Canadian fashion tycoon Peter Nygard.

According to The Financial Times, the award, which is a record for a defamation case in New York state, was given by former federal judge Layn Phillips due to the “truly stunning” nature of the evidence.

The feud began more than ten years ago after the two men clashed over issues “ranging from the loud parties at Nygard’s Robinson Crusoe-themed property in the exclusive Lyford Cay community on Clifton Bay in the Bahamas, to whether Bacon had frustrated Nygard’s redevelopment plans after a fire.”

Nygard is said to have conducted “a global smear campaign over almost a decade, falsely asserting that Bacon was a Ku Klux Klan member; that he was guilty of insider trading; that he was implicated in the death of an employee; and that he was implicated in arson.”

“Any one of these would have been a significant assault on his character; the combination of all four depicted him as an evildoer of the highest order,” said Phillips. “[It was] a deliberate plan by Nygard to personally and professionally destroy Bacon.”

The award, which is subject to appeal, covers court and legal fees, $50 million in compensatory damages, $100 million in punitive damages and $53 million to cover Bacon’s legal costs.

Nygard, the Finnish-Canadian fashion founder of Nygård International, is currently in jail in Canada awaiting trial on charges of sexual assault in Toronto and Montreal. He has also been charged in the US with racketeering and sex trafficking.

“With this verdict, Mr Bacon is vindicated from the vicious lies and disgusting smear campaign against him, and Mr Nygard has finally been held accountable for at least some of his actions,” said a spokesperson for Louis Bacon.