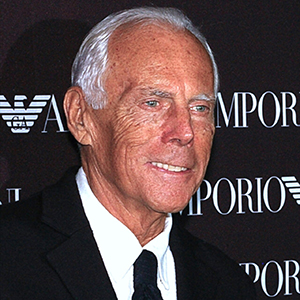

FB Roundup: Giorgio Armani, Gina Rinehart, Daniel Kretinsky

Giorgio Armani hints at new leadership once he steps down from fashion empire

Ahead of his 90th birthday, iconic Italian designer Giorgio Armani has dropped hints about a change of leadership at his fashion empire once he’s no longer in charge.

Having famously fought for decades to keep the Giorgio Armani label independent, the billionaire designer has now said he won’t rule out his company someday combining with a bigger rival or listing on a stock exchange.

“Independence is one of the founding values of everything I have created and certainly the one I have guarded most tenaciously, to the point of obstinacy,” he said in a rare interview with Bloomberg. “I think independence from large groups could still be a driving value for the Armani Group in the future, but I don’t feel I can rule anything out. What has always characterised the success of my work is an ability to adapt to changing times.

“I don’t currently envisage a takeover by a large luxury conglomerate,” he continued. “But as I said, I don’t want to exclude anything a priori because that would be an ‘unentrepreneurial’ course of action… Listing is something we have not yet discussed, but it is an option that may be considered, hopefully in the distant future.”

Armani, who rose from Milan window dresser to creator of one of the world’s most prominent luxury houses, has to date been reticent about discussing succession but the subject has long surrounded the child-free, unmarried designer.

Currently, Armani himself controls most of the brand, contributing to his $6.6 billion net worth, according to the Bloomberg Billionaires Index.

While Armani doesn’t have any children to take over the company once he steps down, he told Bloomberg that he would like to leave it to some of his relatives and close advisers. The Armani foundation is already overseen by some of those people, and Armani views that group as the one that will determine the future of the overall company.

“The foundation will decide and govern the future of the Armani Group because the people closest to me are at the helm of it,” he said. “The foundation’s role is essentially to guarantee and guard my work and the values I hold most dear and on which I founded my company. My intention was to establish a framework within which my group could operate even in my absence.”

Gina Rinehart confirms six percent stake in Lynas Rare Earths

Australian mining magnate Gina Rinehart has further added to her portfolio of mineral producers vital to the energy transition, with the acquisition of an almost six per cent stake in Lynas Rare Earths.

Rinehart’s private company, Hancock Prospecting, added 6.6 million shares in the Sydney-listed company for more than A$40 million ($25.7 million), according to a filing.

As reported by The National, “Lynas is one of the only rare earths producers outside China – which dominates the supply chain – with a mine and processing plant in Western Australia and a refinery in Malaysia.”

Give the nickname ‘Australia’s Iron Lady’, Rineheart, who inherited her privately owned mineral exploration and extraction company from her late father, Lang Hancock, is at the forefront of the lithium rush following increased demand for use in rechargeable batteries for mobile phones, laptops, digital cameras and electric vehicles. Recently, she has become involved in lithium takeover deals and took stakes in a handful of companies with large footprints across Australia, including Arafura Rare Earths, Liontown Resources and Vulcan Energy Resources.

She also joined forces with Sociedad Química y Minera de Chile, the world’s second-largest lithium producer, for the takeover of Azure Minerals, which was approved by shareholders this month.

Daniel Kretinsky’s bid to buy Royal Mail rejected

Billionaire Daniel Kretinsky – known as the Czech Sphinx – has seen a bid to buy Royal Mail rejected by its current owner, International Distributions Services (IDS), saying the £3.1 billion “significantly undervalues” the company.

“The board believes the timing of the proposal is opportunistic,” IDS said in a statement. “It does not reflect the growth potential and prospects of the company under a new management team, a significant modernisation programme under way at Royal Mail and the potential for regulatory easing.”

Kretinsky’s EP Group, which already holds a 27.5 per cent stake in Royal Mail, had said that it is considering its options and wants to “engage constructively” with IDS.

“Weak financial performance, poor service delivery and a slow transformation, in the face of a market going through structural change, have put the business under unsustainable pressure,” said a spokesperson for EP Group, adding that private investment was crucial for the company which has struggled to cope with changing trends in the delivery sector.

According to The National, “Under the UK’s takeover rules, EP Group has until 5pm on May 15 to either announce a firm intention to make an offer for IDS or walk away.”

Royal Mail was privatised in 2013. The government sold its remaining stake in 2015.