FB Roundup: Porsche, Inditex, Selfridges

Porsche family joins billionaire space race with rocket investment

The Porsche family is backing the European rocket launch startup Isar Aerospace Technologies with an eye on the spin-off innovations from easier access to space.

The family’s holding company Porsche SE announced it acquired a “low single-digit percentage stake” in the latest $75 million financing round for the three-year-old Munich-based startup. Isar Aerospace develops and manufactures launch vehicles for satellites and has raised more than $180 million from investors including Lakestar, HV Capital, Earlybird and Airbus Ventures.

Porsche SE said Isar Aerospace plans its debut launch in 2022 and offers a more cost-efficient and flexible launch capacity for satellites with Spectrum, the first launch vehicle developed by the company. Demand for the launch of small satellites was expected to grow significantly in the coming years.

Lutz Meschke (pictured right), the investment manager on the Porsche board, said the rapid development of Isar Aerospace was impressive.

“As an investor with a focus on mobility and industrial technology, we are convinced that cost-efficient and flexible access to space will be an enabler of innovation in many industry sectors,” Meschke said.

Dr Wolfgang Porsche (pictured above), 78, is the influential chairman of the supervisory board of Porsche SE and Porsche AG. He has served on the supervisory board of the sports car manufacturer since 1978. Born in Stuttgart, the youngest son of Ferry and Dorothea Porsche is also the grandson of Ferdinand Porsche Sr, the auto engineer and founder of Volkswagen and Porsche.

Wolfgang Porsche serves on the 10-person supervisory board with members of the Piech and Porsche families. The fourth generation Austrian-German dynasty is estimated to have a $52.8 billion fortune.

The listed Porsche SE company they supervise was founded in 2007 and holds 53.3 % of shares in Volkswagen Group. The group comprises of Volkswagen Passenger Cars, Audi, SEAT, Skoda, Bentley, Bugatti, Lamborghini, Porsche, Ducati, Volkswagen Commercial Vehicles, Scania and MAN.

Porsche SE owns entirely PTV Group, a provider of software for traffic planning and transport logistics, plus minority stakes in several technology companies in the United States and Israel.

Amancio Ortega’s Inditex fortunes fall and rise with Covid-19 restrictions

Amancio Ortega’s Inditex fortunes fall and rise with Covid-19 restrictions

Fashion retail king Amancio Ortega saw his family office profits plummet as pandemic restrictions hit his stores, but Inditex, the world’s biggest clothing retailer he founded, has made a rapid recovery in 2021.

Pontegadea Inversiones, the Ortega family office, holds a 59.29% stake in his retail empire Inditex. Pontegadea this week reported its net profit for 2020 was $792 million, down a significant 62.5% from $2.1 billion in 2019.

Inditex has suffered alongside other family retail businesses, like the Persson family-owned Hennes & Mauritz, as lockdowns impacted consumer spending in high street stores. Inditex’s eight brands include Zara, Massimo Dutti and Stradivarius, selling clothes and accessories through its 6,829 stores in 96 markets or online in 216 markets.

However, Inditex reported in June its sales shot up 50% in the first quarter of 2021 to $5.8 billion, with May sales above 2019 levels. Online sales in local currencies grew by 67%. Sales were higher across all geographies and every brand despite 24% of trading hours being unavailable due to lockdowns. Some 16% of the group’s stores were still closed by the end of the quarter.

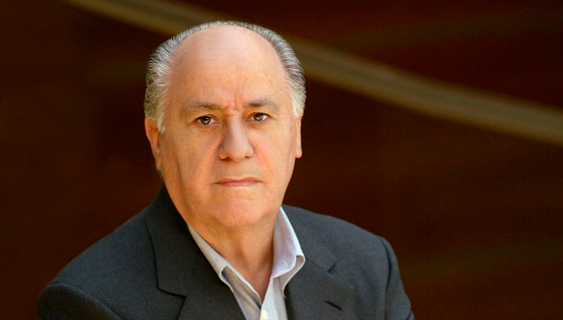

Amancio Ortega (pictured above), 85, founder of Inditex and a member of the board, remains the controlling shareholder of the company through Pontegadea. His self-made fortune is said to be $77 billion.

Ortega began his business career in the textile manufacturing sector in 1963. In 1972 he founded Confecciones Goa, the first garment-making factory of Inditex. He launched Zara three years later, the first retailing company of the group.

He was Inditex’s chairman from the date of incorporation until 2011. He chairs the board of directors of Pontegadea and his real estate business Partler, as well as the board of trustees of the Amancio Ortega Foundation, which he created in 2001.

His second wife, Flora Perez Marcote, 69, is the scholarship foundation’s first vice chairwoman and a director of Pontegadea. The couple’s daughter, Marta Ortega Perez, 37, has been a trustee of the foundation since 2015. The next-gen European Business School graduate works in product design and development at Zara Woman.

Pablo Isla (pictured above right), 57, replaced Ortega as Inditex’s non-family chairman in 2019. He previously served as chief executive from 2005 and chairman and chief executive from 2011.

Weston family puts Selfridges on the auction block for $5.5 billion

Weston family puts Selfridges on the auction block for $5.5 billion

The Weston family has reportedly put its luxury department store group Selfridges up for sale by auction for $5.5 billion and one mystery buyer is already interested.

Selfridges reportedly received an unsolicited offer from an undisclosed party earlier in 2021. The group may have appointed Credit Suisse as an adviser. The deal could close by the end of the year. Selfridges and Credit Suisse declined to comment on reports of the auction this week.

Selfridges was founded in London by US entrepreneur Harry Gordon Selfridge, the “Earl of Oxford Street”, in 1909 as an example of the first modern department store. Selfridges Group now comprises 25 stores worldwide across five high-end brands.

The group was acquired almost two decades ago by the Canadian side of the Weston family via its privately owned Toronto-based holding company, Wittington Investments, Ltd. The family’s fortune is worth an estimated $8.7 billion, according to Forbes.

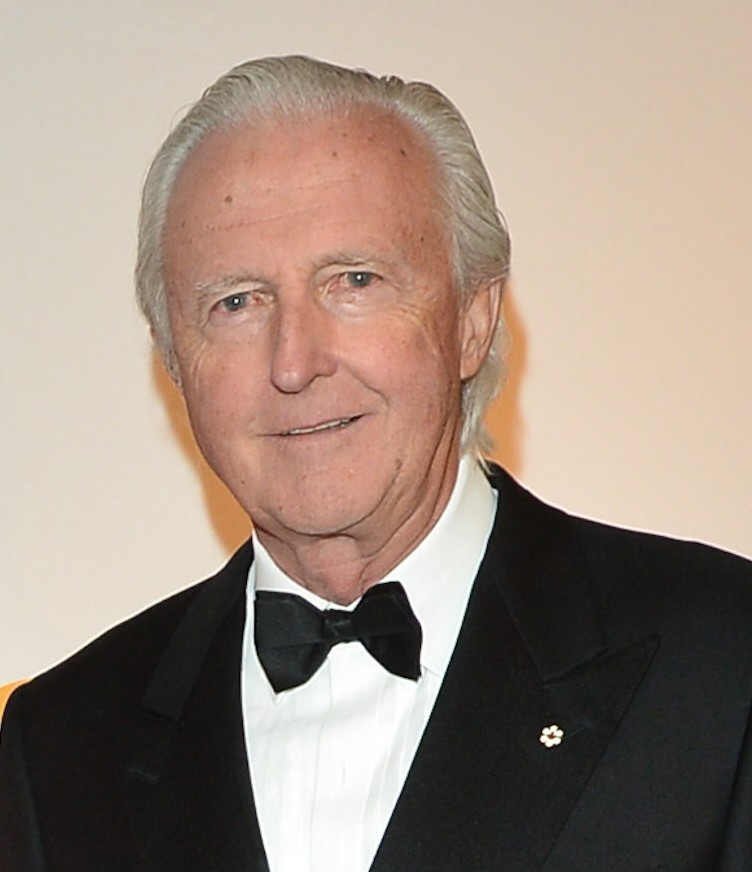

British-Canadian tycoon W Galen Weston (pictured above left) bought the historic upmarket chain for $833 million in 2003. The patriarch died aged 80 in April 2021. Some media speculated the former chairman would not have approved of the sale.

Dublin-born Alannah Weston (pictured), 49, daughter of Weston and Hilary Weston, has chaired the group since 2019. She became the creative director of Selfridges in 2003.

Dublin-born Alannah Weston (pictured), 49, daughter of Weston and Hilary Weston, has chaired the group since 2019. She became the creative director of Selfridges in 2003.

Paul Kelly, the managing director of Selfridges since 2003, departed to become managing director of Wittington Property Investments in the UK and Europe in early 2019.

Anne Pitcher, the latest managing director, told The Times in January 2021 the success of the business in 2019 “allowed us to be so resilient in 2020” during the height of pandemic restrictions.

Selfridges reported a 7% rise in sales to $2.7 billion in the year to February 2020 while operating profits fell by 10% to $122 million.