Worried about inflation' Why not?

In the world of investment, there are few things everyone can agree on. You’re either a bull or a bear, a dove or a hawk, for or against.

If there’s one thing investors do know for sure—it’s that bonds and equities can be used in combination to achieve a ‘balanced portfolio’.

At the simplest level, this means building portfolios with some equities for the good times, and bonds for the bad. Typically, in a 60/40 split.

The traditional balanced portfolio is based on a certainty—bonds and equities are offsetting assets. This emerged from a world of falling interest rates, low volatility and low inflation. And disciples of the traditional balanced portfolio have been well rewarded over the past 40 years.

But the return of inflation changes everything and calls into question the certainty upon which the entire investment system is based. Inflation could spell disaster for ‘balanced’ portfolios.

But the return of inflation changes everything and calls into question the certainty upon which the entire investment system is based. Inflation could spell disaster for ‘balanced’ portfolios.

This presents an asymmetric opportunity for investors—whereby avoiding catastrophe, comes at relatively little cost.

Here we’ll look at why we’re worrying about inflation and positioning portfolios for a new status quo.

Returns from bonds are bounded

Bonds are the bedrock of the balanced portfolio—the 40% of the classic 60/40.

The case for owning them is twofold

— as an offset to falling equities

— for the income, or yield

But in an inflationary environment, neither of these stands to reason.

First, let’s look at the ability of bonds to act as an offset to falling equities—as they have done in previous market crises.

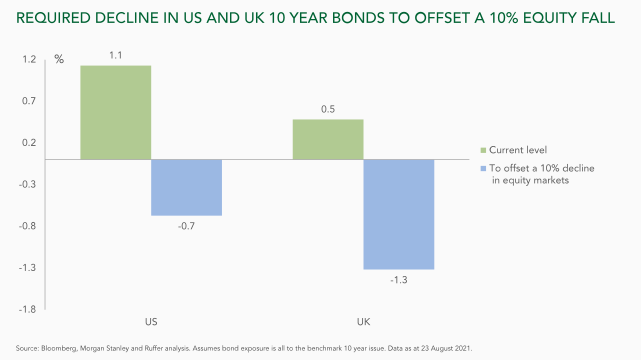

The chart below demonstrates that bonds are very unlikely to do this job in the future. The blue bars illustrate how far yields must fall to offset a 10% decline in equity markets for a 60/40 portfolio.

From this point, with yields as depressed as they are, bonds have run out of the road required to effectively defend portfolios in the event of a sell-off.

Income is rare, and expensive

For 40 years, investors have been able to rely on bonds as a source of a steady, reliable income. Yields today, however, are at historic lows.

The yield offered by conventional government bonds is paltry. There are $16 trillion of negative yielding bonds globally. The German sovereign 10-year bond yields -0.3% per annum. Who is the rational buyer of any bond that guarantees a loss?

Factoring in even moderate inflation, makes the picture even worse. For the first time ever even investment grade and high yield bonds offer negative real (after inflation) returns.

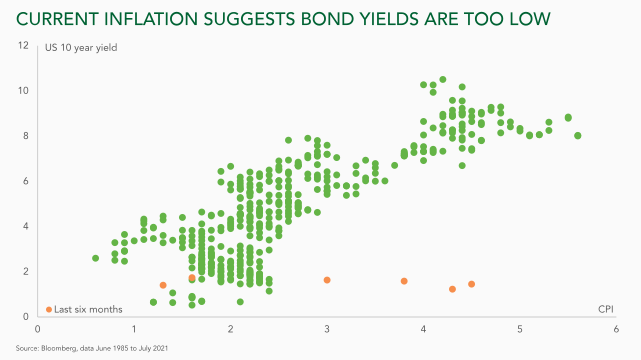

Current inflation readings (the orange dots) correlate to a US 10-year bond yield of 5-6%—not the current 1.3%. The present situation looks deeply anomalous and reveals a market that doesn’t believe inflation will persist.

Bonds appear mispriced—offering neither the income nor protection that investors have come to expect.

Balance to imbalance

The implicit assumption of the balanced portfolio is that stocks and bonds are negatively correlated; they move in opposite directions.

This assumption is wholly reliant on the economic policy of recent decades: when stocks go down central banks cut interest rates in response. In turn, pushing yields down and bond prices up thereby ‘balancing’ your portfolio.

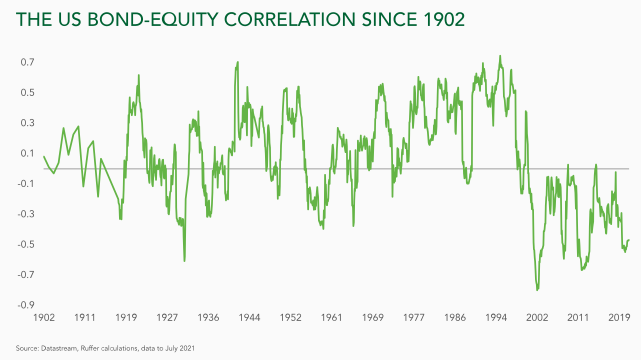

As the chart below shows, this negative bond equity correlation is a modern phenomenon. The relationship only holds since the 1990s. For most of the time before that, the correlation was positive or, at best, unpredictable.

Inflation upends the negative correlation between bonds and equities. And in an inflationary environment, bonds turn from principal offset to principal liability.

And if bonds and equities cease to move in opposite directions, the concept of the balanced portfolio becomes a fallacy.

Inflation risk is mispriced

A generation of investors have never had to conceive of a world in which inflation is anything but low and stable.

And even as inflation looks to be on the turn, few portfolios have changed to reflect this new environment. Conventional bonds remain the bedrock of supposedly balanced portfolios.

Inflation taking hold is as much a psychological phenomenon as an economic one. If people worry their money will be worth less tomorrow, they will spend it today. This rush of activity exacerbates the problem of rising prices and a reflexive process is born.

Investors turning a blind eye to inflation risk presents an opportunity.

From today’s valuations there is limited downside to preparing your portfolio for inflation. What you’re giving up on is zero or slightly negative returns from bonds. What you’re risking if you’re wrong is a crushing destruction of the real value of your capital.

Heads you don’t win much, tails you lose a lot.

It could pay to be prudent

It could pay to be prudent

It is this asymmetry of outcomes that suggests to us the importance of building genuine inflationary protection into portfolios.

Hedging a portfolio against inflation is relatively cheap; yet in our view it is the single biggest risk in the coming decade.

In this sense you don’t even need to agree with our inflationary thesis, hedging against inflation is just prudent risk management. The US 10 year yield moving to just 3% (where it was in 2018) would cause a loss of about 15% to bond holders.

Do all investors with balanced portfolios possess the bravery and conviction required to dismiss the possibility of such a move?

We expect not. Rather, investors seem to be sticking to the status quo—trusting a portfolio structure which has seen them through thick and thin for almost half a century.

But the return of inflation poses a new threat. And the old ways of balancing portfolios may soon be found wanting.

Past performance is not a guide to future performance. The value of investments and the income derived therefrom can decrease as well as increase and you may not get back the full amount originally invested. Ruffer performance is shown after deduction of all fees and management charges, and on the basis of income being reinvested. The value of overseas investments will be influenced by the rate of exchange.

Past performance is not a guide to future performance. The value of investments and the income derived therefrom can decrease as well as increase and you may not get back the full amount originally invested. Ruffer performance is shown after deduction of all fees and management charges, and on the basis of income being reinvested. The value of overseas investments will be influenced by the rate of exchange.

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. This document does not take account of any potential investor’s investment objectives, particular needs or financial situation. This document reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. Read the full disclaimer.