Schrodinger's bonds

Like many readers, I took advantage of the best snow in years to go sledging with my daughters. As Daddy bombed down the hill like Bowser in Mario Kart my mortality flashed before me and I realised I was simultaneously having fun and in great danger.

I was Schrodinger’s Dad—contemporaneously dead and alive, the die had been cast, only the outcome was unknown. On reflection, I realised this is the perfect metaphor for the corporate bond market.

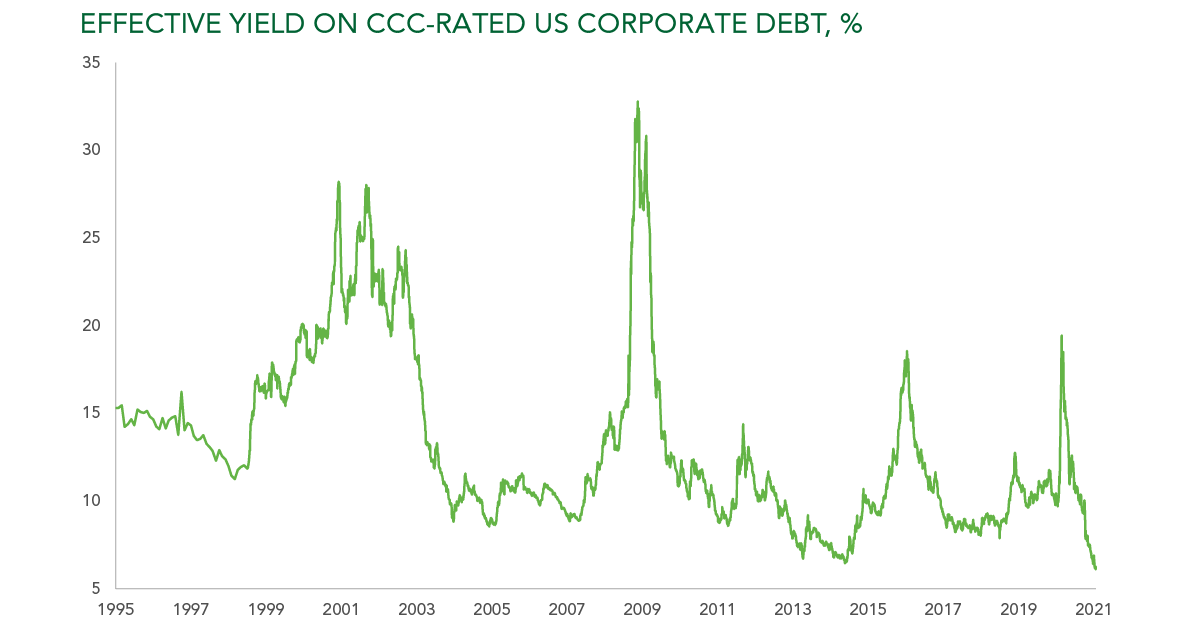

Corporate bonds had a near death experience in 2020. After a decade where credit markets grew to $10 trillion (1) borrowing costs spiked as we stared into the abyss of a global economic shutdown, as can be seen on the chart. We had been warning of this for several years and were positioned accordingly—our unconventional credit protection investments almost doubled in Q1 2020 and this allowed our portfolio to remain flat at the March lows when equities were down 30% (2).

But since the US Federal Reserve drenched the market with its money hosepipe, credit is alive again.

Chart source: BAML/ICE bond index, Bloomberg

Junk gets a makeover

The spiciest end of corporate credit was once known as “junk bonds”. Highly leveraged or structurally challenged companies whose survival was uncertain and where lenders demanded juicy returns. They were rebranded “high yield bonds” in a Wall Street makeover, given a veneer of respectability and somehow have made it into conventional portfolios.

Today the ‘high’ yield on ‘junk bonds’ is just 3.9% (3). Boom times are back with issuance of $140 billion of debt in the first six weeks of 2021 (4). The run rate issuance for the lowest rated CCC-rated bonds is more than double the previous record (5). When was the last record? Just before the global financial crisis (6).

Today the ‘high’ yield on ‘junk bonds’ is just 3.9% (3). Boom times are back with issuance of $140 billion of debt in the first six weeks of 2021 (4). The run rate issuance for the lowest rated CCC-rated bonds is more than double the previous record (5). When was the last record? Just before the global financial crisis (6).

An example of the madness: the retailer Party City (been to many parties recently?) raised $750m for five years in February. A year ago, their bonds were on the edge of default and traded at below 10 cents on the dollar! (7)

Is lending to companies which are one month’s bad trading (or mandatory lockdown) from insolvency appropriate for most investors? What do these bonds add to a portfolio? Attractive income is available in equities and interesting diversifiers are available in gold or bitcoin. Equity has asymmetric upside, junk bonds have asymmetric downside! Who is buying this stuff?

Reaching for yield

We are troubled by investors’ increasing allocation to this risky niche. As Raymond DeVoe once said, “More money has been lost reaching for yield than at the point of a gun”.

But it gets worse… the true return on high yield is the yield minus what is lost on defaulted bonds. Over the last 40 years, the average default rate is 4% (8). Some of this can be reclaimed through the courts and the bankruptcy and recovery process: let us say half. So the average expected outcome for a buyer of junk bonds today is around 2% (3.9% yield, 2% lost to defaults). Even that meagre return is before considering inflation, or that leverage is higher, the economy is recessionary, and technological disruption is challenging more industries than ever.

But it gets worse… the true return on high yield is the yield minus what is lost on defaulted bonds. Over the last 40 years, the average default rate is 4% (8). Some of this can be reclaimed through the courts and the bankruptcy and recovery process: let us say half. So the average expected outcome for a buyer of junk bonds today is around 2% (3.9% yield, 2% lost to defaults). Even that meagre return is before considering inflation, or that leverage is higher, the economy is recessionary, and technological disruption is challenging more industries than ever.

The other side

Frankly, we share the optimism the economy is going to get better due to stimulus and re-opening, but this is not the way to play it. We want to be on the other side of this trade.

We have been adding to our credit protection investments. Central bank liquidity injections have anaesthetised this market to risks. Central bankers can prop up asset prices, but they are less capable of stopping bad businesses from going under and this market is full of zombies.

We have been adding to our credit protection investments. Central bank liquidity injections have anaesthetised this market to risks. Central bankers can prop up asset prices, but they are less capable of stopping bad businesses from going under and this market is full of zombies.

These investments saved our bacon in Q1 2020. The opportunity set today is arguably more distorted and more mis-priced.

So ‘Schrodinger’s bonds’: a lot of these bonds are dead—but until they look inside the box, the owners don’t know it yet.

(1) Bloomberg

(2) Ibid

(3) Financial Times (February 2021)

(4) Ibid

(5) Ibid

(6) Wall Street Journal (Feb 2021)

(7) Financial Times (Feb 2021)

(8) Amundi (Nov 2020)

Past performance is not a guide to future performance. The value of investments and the income derived therefrom can decrease as well as increase and you may not get back the full amount originally invested. Ruffer performance is shown after deduction of all fees and management charges, and on the basis of income being reinvested. The value of overseas investments will be influenced by the rate of exchange.

Past performance is not a guide to future performance. The value of investments and the income derived therefrom can decrease as well as increase and you may not get back the full amount originally invested. Ruffer performance is shown after deduction of all fees and management charges, and on the basis of income being reinvested. The value of overseas investments will be influenced by the rate of exchange.

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. This document does not take account of any potential investor’s investment objectives, particular needs or financial situation. This document reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. Read the full disclaimer.