FB Roundup: Joel Glazer, Warren Buffett, Bill Gates

Manchester United owner Joel Glazer promises angry fans investment and consultation

Apologetic co-chairman Joel Glazer has sought to reassure Manchester United fans he and his US billionaire family “care deeply” about the English Premier League football club they own and pledge greater investment and fan consultation.

Glazer (pictured above), 50, one of two second-generation principals, said Old Trafford wanted to work with the supporters’ forum to come up with an ambitious package of measures which will transform its relationship with fans and strengthen the club for the long-term.

The Florida-based businessman appealed to fans in a lengthy open letter last week to answer the backlash against the doomed breakaway European Super League, of which Manchester United was a founding member.

Glazer and his brother Avram Glazer, 60, have been co-executive chairmen of Manchester United since 2005. Their late father Malcolm Glazer (pictured below right), who owned the Tampa Bay Buccaneers since 1995, acquired the football club in a controversial leveraged buyout that year. After Malcolm Glazer’s death by stroke aged 85 in 2014, the family of widow Linda Glazer and their six children have maintained their 75.7% shareholding in the club, which is valued at £3.05 billion ($4.2 billion).

Joel Glazer said in his letter he would personally meet the forum “as soon as possible” after the end of the season in late May. He committed to further strengthening of the team and increased investment in the stadium and training ground.

Joel Glazer said in his letter he would personally meet the forum “as soon as possible” after the end of the season in late May. He committed to further strengthening of the team and increased investment in the stadium and training ground.

Glazer reiterated his apology “for the mistakes that were made” when Manchester United agreed to join 11 other elite European clubs in backing the new tournament, before quickly withdrawing its support.

“I want to reassure you that my family and I care deeply about Manchester United and feel a profound sense of responsibility to protect and enhance its strength for the long-term, while respecting its values and traditions,” he said.

Glazer highlighted Old Trafford’s support for the principle of fans owning shares in the club.

“We have previously engaged with the Manchester United Supporters’ Trust on fan share ownership and we want to continue and accelerate those discussions, together with provisions to enhance associated fan consultation,” he said.

The forum joined the chorus of disapproval when the super league was officially announced on 18 April. Many fans accused the club’s owners of only being interested in maximising their own profits. The forum responded to Glazer’s Mea Culpa by noting the owners’ “silence and disregard for communication over the last 16 years” and sought action rather than words.

Warren Buffett’s heir apparent is deal-maker Greg Abel

Warren Buffett’s heir apparent is deal-maker Greg Abel

Billionaire investor Warren Buffett has anointed his successor, after years of speculation on his succession, but the nonagenarian has not declared when he will step down.

Buffett (pictured left), 90, chairman and chief executive of the sprawling $665 billion conglomerate holding company Berkshire Hathaway, confirmed to CNBC last week “if something were to happen to me tonight, it would be Greg who’d take over tomorrow morning.”

The “Oracle of Omaha”, renowned for his investment acumen, referred to Greg Abel (pictured below), 58, the Canadian chairman and chief executive of Berkshire Hathaway Energy and vice-chairman of non-insurance operations of Berkshire Hathaway since 2018.

Abel earned a reputation as a deal-maker with his involvement in more than a dozen complex utility acquisitions for Berkshire Hathaway over three decades. Deals included $5.1 billion for PacifiCorp in 2005, $10.4 billion for NV Energy in 2013 and $8 billion for the pipeline business of Dominion Energy in 2020.

The hard-working, alternative energy-focused and discreet hockey player was deemed by some commentators as a natural choice for successor, sharing Buffett’s Midwestern patient capital values. Others questioned how effectively Abel would work with other members of the senior team, mentored by Buffett, among them Ajit Jain, 69, who was appointed vice chairman of insurance operations in 2018, the same year Abel was made vice chairman. Jain was also well regarded as a contender for the top job.

The hard-working, alternative energy-focused and discreet hockey player was deemed by some commentators as a natural choice for successor, sharing Buffett’s Midwestern patient capital values. Others questioned how effectively Abel would work with other members of the senior team, mentored by Buffett, among them Ajit Jain, 69, who was appointed vice chairman of insurance operations in 2018, the same year Abel was made vice chairman. Jain was also well regarded as a contender for the top job.

Charlie Munger, 97, Buffett’s long-time consigliere and a vice chairman of Berkshire Hathaway, may have let slip the succession plan to investors during the group’s annual meeting on the previous weekend. The successor was said to have been chosen internally in 2012, but not announced publicly.

Asked about the company's decentralised business model, Munger underlined its importance and said: “Greg will keep the culture.”

Omaha-born financier Buffett began buying stocks in Berkshire Hathaway in 1962. He continued the struggling company’s trade in textiles until he expanded into insurance in 1967. Berkshire Hathaway and its subsidiaries now hold a diverse portfolio of interests including insurance and reinsurance, utilities and energy, freight rail transportation, manufacturing, retailing and services.

Businessman, author and former Republican politician Howard Graham Buffett, 66, middle child of Warren and the late Susan Buffett, is the chairman and chief executive of the family’s philanthropic Howard G Buffett Foundation.

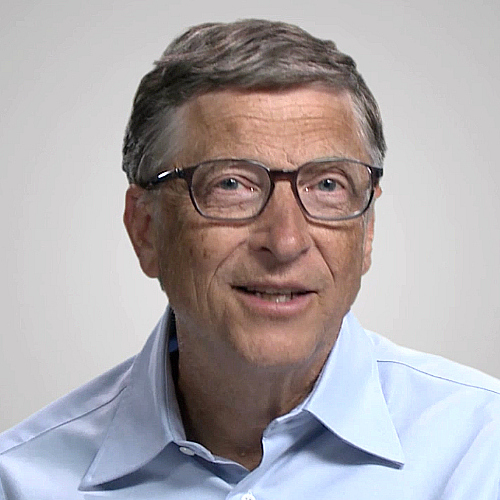

Bill and Melinda Gates to divorce but continue charitable foundation

Billionaire philanthropists Bill and Melinda French Gates say they will continue to work together at the world’s largest private charity they founded, despite their surprise divorce after almost three decades of marriage.

The split prompted speculation on the fate of their foundation, his $130.5 billion fortune and their three children’s inheritance.

“After a great deal of thought and a lot of work on our relationship, we have made the decision to end our marriage,” the former couple said on their individual Twitter accounts on 3 May.

“Over the last 27 years, we have raised three incredible children and built a foundation that works all over the world to enable all people to lead healthy, productive lives. We continue to share a belief in that mission and will continue our work together at the foundation, but we no longer believe we can grow together as a couple in the next phase of our lives.”

Bill Gates (pictured above), 65, transferred almost $2.4 billion in securities from his holding company, Cascade Investment, to Melinda Gates (pictured below), 56, on the same day of their announcement, presumably as part of a settlement.

The Gates reportedly did not sign a prenuptial agreement. Neither did Jeff Bezos, 57, billionaire Amazon chief executive, and wife MacKenzie Bezos, 51, who also announced their intention to amicably divorce after 25 years of marriage via Twitter in 2019.

Gates, the fourth richest person in the world, made his fortune with Microsoft, the computer software company he co-founded with childhood friend Paul Allen in Albuquerque, New Mexico in 1975. Gates became the world’s youngest billionaire, aged 31-years, in 1987, the year after the company went public. The mogul stepped down from Microsoft’s board in 2020 after selling or giving away most of his stake, to retain 1% of shares and focus on his philanthropic efforts.

The couple launched their Bill and Melinda Gates Foundation in 2000 in aid of public health, education and environmental causes. The $43 billion foundation committed more than $1.75 billion in response to the Covid-19 pandemic, including more than $300 million towards the development, production and procurement of vaccines.

Based in Seattle, the foundation is led by Mark Suzman, 51, who was appointed chief executive in 2020, under the direction of the Gates namesakes and investor Warren Buffett. The three billionaires also founded The Giving Pledge to encourage fellow wealthy individuals and families to give most of their fortunes to philanthropy or charitable causes, either during their lifetimes or in their wills.