The advantages of master global custody for today's family office

Despite the many differences among family offices, they all need flexible, cost-effective management of their financial assets. Choosing the right custody model is key to meeting this need.

Family offices should consider the importance of choosing a custody model that best meets its needs. A common mistake made by some fledgling family offices is focusing on the appointment of investment managers without considering how to properly structure a custody model. This can result in a structure that sees securities spread across firms of varying safety. Further down the road, as family offices evolve and complexities increase, having a mismatched custodial selection can have long-term repercussions, and the costs of unwinding an unwieldy structure can be high, but not out of reach. Even established family offices can re-evaluate and move to a new custodian platform.

Choosing the right structure for a family office is key to efficient operation. It’s important to understand the role that the right custodian can play in helping ultra-high net worth families build, maintain, and protect their wealth.

WHAT IS THE ROLE OF A CUSTODIAN?

The primary responsibilities of a custodian are:

- Giving clients the ability to invest around the world, across multiple asset classes.

- Safekeeping client assets and providing clients with immediate access to their assets.

- Providing holistic reporting across the portfolio that enables the investor to compare managers in a consistent manner.

CHOOSING THE RIGHT TYPE OF CUSTODIAN

Family offices that have experienced a recent liquidity event may find that they have outgrown their private bank. Private banks provide a high level of service, but they may lack the resources to support an expanding portfolio. They may also be unwilling to work with multiple investment managers, may not offer flexibility in reporting, and may not have the resources to support a global investment portfolio with multiple asset classes. In some instances, family offices may appoint many investment managers who provide their own separate in-house custody and reporting, creating a chaotic structure for the family office to manage.

Family offices usually require the combination of:

- The resources of a global custodian to bring together a global portfolio with multiple managers and asset classes.

- The personalized service model of a boutique firm.

THE CHALLENGES OF WORKING WITH MULTIPLE CUSTODIANS

On the surface, working with multiple custodians may seem like a good way to mitigate risk by diversifying where the family’s assets are held. However, the best way to protect a family’s assets is to select a custodian that has strong fundamentals and the financial resilience to withstand challenging market conditions.

The complexity of recordkeeping and consolidated reporting is a serious challenge for family offices that work with multiple custodians. A substantial amount of effort is involved in reconciling the various inputs to produce consolidated reports. For example, staff should not be manually combining data in Excel spreadsheets to create a consolidated report. Not investing in proper technology can lead to expensive mistakes, which could permanently undermine the confidence of the family in their staff.

Working with multiple custodians may also create a greater potential risk of financial loss. The more custodians a family office works with means the office must use different procedures for each transaction, increasing the potential for errors. More custodians also mean a greater number of cash transactions to move money between banks, which increases the risk of theft by cyber criminals or internal staff. While it can be difficult to ensure that basic controls are applied consistently across multiple custodians, a high-quality master custodian can offer more control and security over the movement of assets.

Finally, the increased volume of administrative work that comes with managing multiple custodians can distract family office staff from their core responsibilities, which might lead the family to question how much value the family office is delivering.

In most cases, a single custodian with a good reputation, superior credit ratings, and a strong balance sheet will be a safer bet than spreading assets among several custodians. Ironically, adding more custodians may just be adding more opportunities for risk by placing assets in firms of varying quality.

THE ADVANTAGES OF A MASTER GLOBAL CUSTODIAN

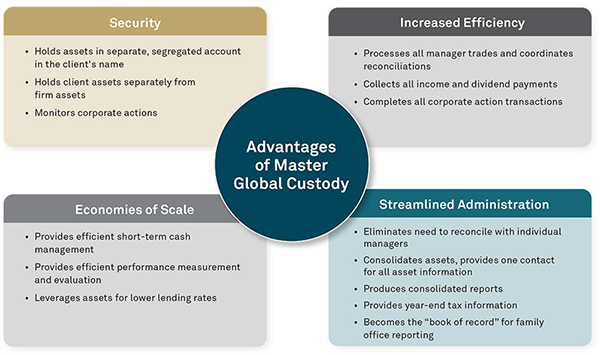

Working within the Master Global Custodian model offers family offices in all global markets the opportunity to make the choice of custodian up front and take advantage of additional benefits — security, consolidated reporting, transparency, and administrative efficiency.

STRUCTURING AN INVESTMENT PORTFOLIO WITHIN MASTER GLOBAL CUSTODY

Another advantage of a Master Global Custodian is that family offices can maintain their relationships with their investment managers, as the custodian provides the underlying structure that supports these managers. The way it works is that the client sets up accounts at the custodian, and then appoints each investment manager to transact directly with the custodian on its respective account or set of accounts within the portfolio. This means the family office can easily appoint and replace managers without upsetting the overall structure and reporting. The managers instruct trades either themselves or via third-party brokers, and then instruct the custodian to settle the trades to the investor accounts, usually via automatic SWIFT messaging that can be tied to the accounts. The custodian safekeeps the assets and gives the family office a consistent set of reports across the portfolio, consolidated at the total portfolio level and across each manager. The family office can then analyze the manager performance and monitor the concentrations of securities, countries and industries across each manager, and across the entire portfolio.

Master Global Custodians also serve as a shield against issues that could undermine a family office’s ability to protect the family’s wealth, such as bookkeeping errors or fraud. Custodians use a consistent valuation methodology across the portfolio.

WORKING WITH BNY MELLON GLOBAL FAMILY OFFICE

The BNY Mellon Global Family Office team understands the unique challenges faced by family offices. We’ve been serving clients for over 230 years, and family offices for over 50 years. We have the resources of the world’s largest global custodian at our disposal, and we make these resources accessible to family offices via our dedicated Relationship Management teams who specialize only in serving global family offices. We have been vetted by the world’s wealthiest families, pension funds, banks, Fortune 500 companies, and sovereign wealth funds. Our custody and reporting services are at the center of everything that we do.

|To learn more about working with BNY Mellon Global Family Office, visit bnymellonwealth.com/globalfamilyoffice.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorized Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorized Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K., a number of the services associated with BNY Mellon Wealth Management’s Family Office Services – International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorized and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland.

Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation

The information in this paper is as of June 2022 and is based on sources believed to be reliable but content accuracy is not guaranteed.

©2022 The Bank of New York Mellon Corporation. All rights reserved.