Why you should not ignore two billion millennial consumers

The rise of the millennial consumer may well be the most profound demographic shift in history. Yet with daily news on crises, technology and politics, a longer-term trend like generational change is easily overlooked.

When investors do focus on demographics as an investment theme, they concentrate on the 'silver dollar' of aging populations. And where they focus on millennial consumers, we see three key areas of misperception around millennials:

? Ignoring the generational shift altogether, believing that changes in consumer spending are cyclical and short-lived

? Failing to grasp the magnitude of generational change

? Misunderstanding values and behaviours of young consumers

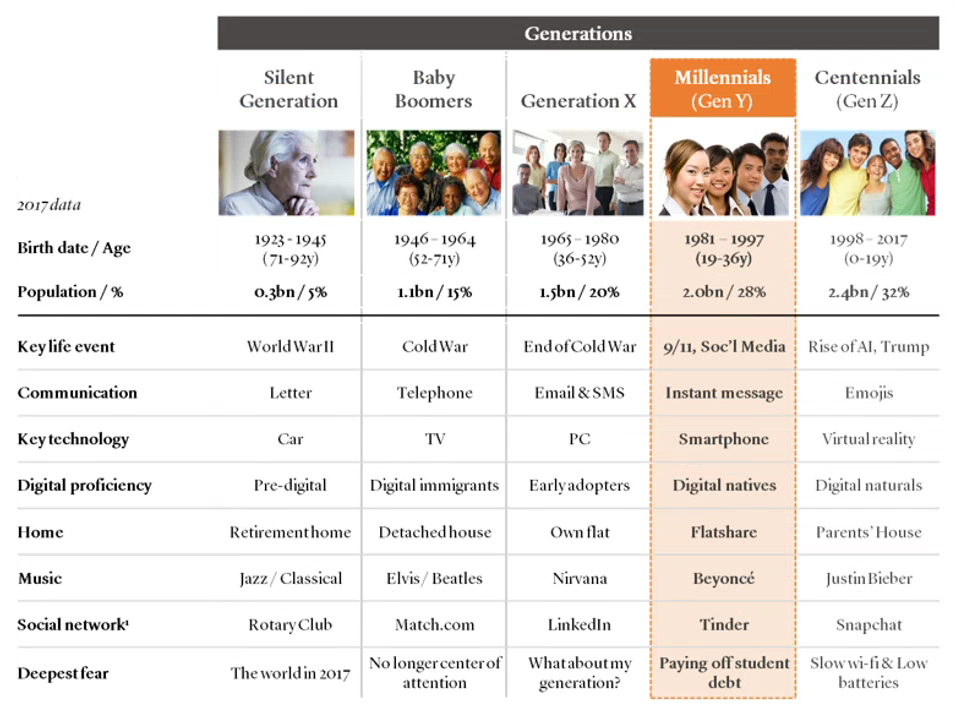

Every week, more than one million millennials (born between 1981 and 1997) replace retiring baby boomers (born between 1946 and 1964) in the global workforce. The world's biggest cohort of their time is passing the baton to the biggest generation of today—2 billion millennials and 2.4 billion centennials (born 1998 and after) already make up a combined 60% of the global population today. They will provide 75% of the world's workforce as early as 2025.

Millennials: Transforming the global economy for the decades to come

Millennials: Transforming the global economy for the decades to come

Baby boomers transformed the global economy as they grew up. For investors, a 'boomer consumer' portfolio of say cars, suburban real estate and home improvement generated double-digit annual returns over the 25 years from 1985 to 2010.

The demographic dividend created and enjoyed by baby boomers was remarkably resilient during the 1987 equity markets crash, the savings and loan crisis of the early 1990s, the burst of the dotcom bubble and the global financial crisis of the late 2000s.

Similarly, as millennials come of age, their impact on consumer markets, company performance and thus investor portfolios will be substantial. The rise of millennials creates a major investment opportunity: a long-term secular growth trend driven by demographic fundamentals. Companies that cater successfully to the millennial zeitgeist of experience, authenticity and wellbeing are bound to deliver long streaks of growth and investor returns. Conversely, ignore or underestimate two billion millennials at your own peril: the steadiness of the trend should not take away from the magnitude of the change. The world in 2027 will look very different from today.

Millennials grew up in the most peaceful time in history—with the Berlin Wall, the Cold War and the price of air travel falling in rapid succession. The world became a global village, driving a boom in consumerism and cheap manufacturing.

Millennials grew up in the most peaceful time in history—with the Berlin Wall, the Cold War and the price of air travel falling in rapid succession. The world became a global village, driving a boom in consumerism and cheap manufacturing.

Millennials experienced abundance of choice in almost everything from shampoos to cars. Choices in education led to a generation with more college degrees than their parents could have dreamt of. Environmental concerns—most notably climate change—have been on the curriculum since primary school. Most crucially, millennials grew up in the age of the internet—and that changed everything.

Where baby boomers bought the same products from the same stores for years, millennials search and shop online: for food, movies, clothes—and relationships. They travel by phone via Uber, pick their accommodation at Airbnb, and find their next date on Tinder. Where baby boomers kept up with the Joneses by buying a home in the suburbs, station wagons and record players, millennials rent, swap and share—and stream their music on Spotify.

Young global consumers: Myth and reality

Young global consumers: Myth and reality

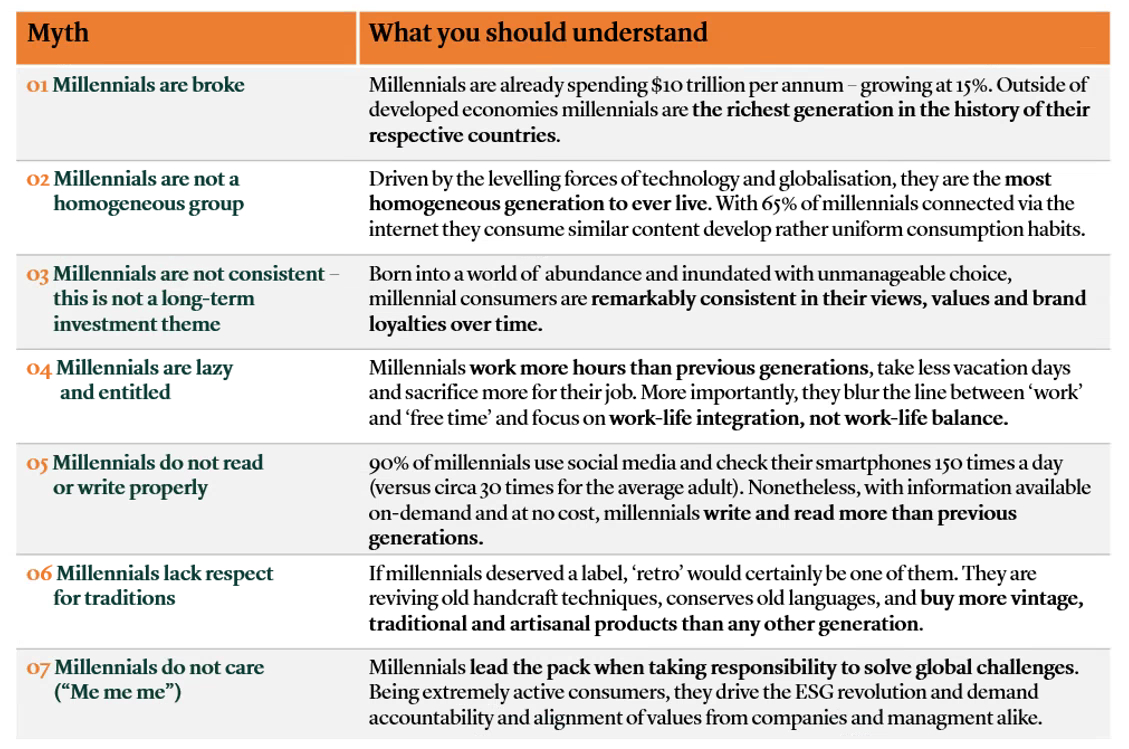

When thinking about millennials, investors often look at their own children and grandchildren as case studies. Nonetheless, we find the young generation quite poorly understood. We believe that investors fail to grasp the magnitude and speed of generational change and do not understand the values and behaviours of young consumers. We have summarized these misunderstandings in what we call The Seven Millennial Myths (right).

We believe demographic change matters hugely. As they come of age, two billion millennials will have a significant impact on cultural mainstream, consumer spend and financial markets. Millennial incomes are poised to grow 15% per annum over the next decade. For investors, millennials offer a compelling long-term growth theme similar to the baby boomer wave that started in the late 1970s.

To invest successfully behind millennials, investors need to go beyond the The Seven Millennial Myths of common misconceptions. Millennials are not poor. They are more homogeneous, more cause-driven and more conscious than they get credit for. Their attitude towards work and career is grind rather than entitlement. And the vast majority cares about much more than selfies and self-actualisation—about family, about roots and traditions and ultimately politics and the environment.