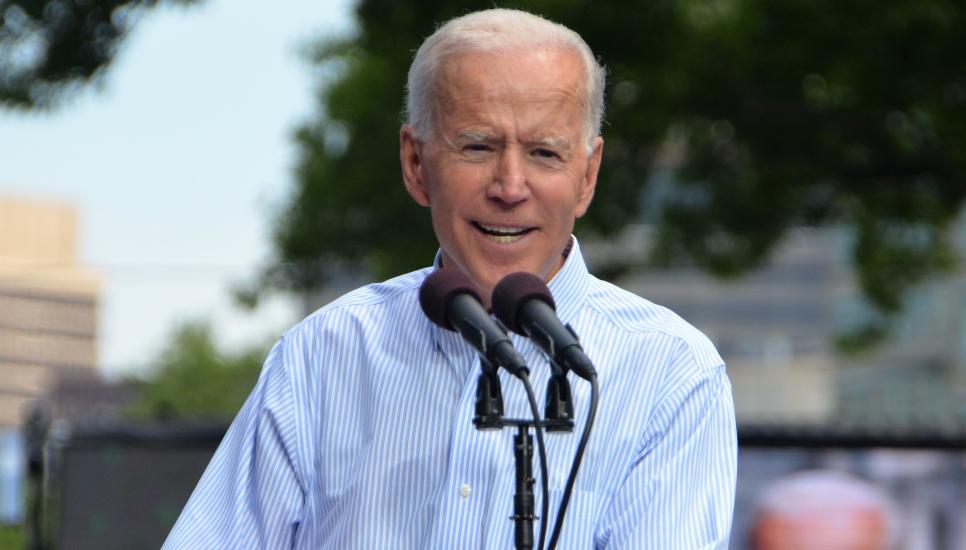

What will the Biden tax plan mean for wealthy business families?

The 2020 election did not result in the massive blue wave that many predicted, but there are definitely still blue ripples reaching shore—especially now that Democrats won both Senate seats in the Georgia runoff elections.

With the Democrats controlling the White House and now both houses of Congress, there are certainly changes in tax policy and other areas that ultra-wealthy families should expect and watch closely.

That said, we believe the pendulum probably will not swing as far left as some people fear. There will be elements of the Democratic party pushing in that direction, but historically, Joe Biden has governed as a centrist. Additionally, a couple of Democratic senators, who already voted against the Green New Deal in 2019, probably will not agree to tax changes as originally espoused by the Biden Tax Plan.

And the midterm elections are only two short years away, so politically speaking, a Biden Administration will tread cautiously on policy decisions when his margin of safety in both chambers of Congress is razor thin.

And the midterm elections are only two short years away, so politically speaking, a Biden Administration will tread cautiously on policy decisions when his margin of safety in both chambers of Congress is razor thin.

The administration will prioritise what’s most important to them while being careful to not overstep in a way that could jeopardize the congressional majority Democrats will have for at least the first two years of the Biden presidency. If Democrats lose that majority, any legislative initiatives they want to accomplish could grind to a halt, if recent history is any guide. Also, after the extreme division the country has experienced, driving towards some semblance of unity will be one of President Biden’s primary goals.

On the tax front, the Democrats are still faced with the threat of filibusters, given they are far short of a 60-seat majority to bypass filibuster delays. While they could always use budget reconciliation, which requires a simple majority to pass tax legislation, even such means have limits and constraints that will prevent unfettered Democratic rein on federal legislation going forward.

For all these reasons, we’re advising clients to be cautious and will closely watch what the new administration sets as its priorities. But we are also advising clients to continue with the plans we put in place in 2020 and to follow the models we created prior to the election, so they can quickly take action on those informed decisions as the new tone in Washington unfolds, and not make decisions based on haste and conjecture.

For all these reasons, we’re advising clients to be cautious and will closely watch what the new administration sets as its priorities. But we are also advising clients to continue with the plans we put in place in 2020 and to follow the models we created prior to the election, so they can quickly take action on those informed decisions as the new tone in Washington unfolds, and not make decisions based on haste and conjecture.

We are reinforcing our advice that no one should be blatantly transferring wealth, through trusts or otherwise, unless it is part of their longer-term multi-generational goals and their balance sheets can support such wealth transfer. All wealth transfers should be made in a manner that the patriarch and matriarch think best so as not to disincentivise the next gen from becoming productive and responsible with wealth.

This said, if families have the desire to move forward with these multigenerational gifts, considering potential statutory changes, we encourage them to do so as there are no drawbacks, if properly structured, to maximising their exemption, so long as their balance sheet allows.

While tax exposure could certainly increase based on evolving regulations and legislation, it will not happen overnight. On the other hand, families should already be looking at how they might adjust their investment strategies, given the macroeconomic realities of this political shift. As we headed into this election, markets had experienced an unprecedented, near parabolic market appreciation off March Covid lows, fuelled by technology-related growth stocks.

While tax exposure could certainly increase based on evolving regulations and legislation, it will not happen overnight. On the other hand, families should already be looking at how they might adjust their investment strategies, given the macroeconomic realities of this political shift. As we headed into this election, markets had experienced an unprecedented, near parabolic market appreciation off March Covid lows, fuelled by technology-related growth stocks.

Against this macro back-drop, we’re recommending allocations to assets with exposure to innovation and that will benefit from the economic recovery with positions to hedge potential short to intermediate-term inflation risk and dollar weakness.

With Democrats controlling the White House and Congress now, it increases the likelihood and potential size of fiscal support for the economic recovery packages, while the Federal Reserve has indicated it will keep very loose monetary policy over the foreseeable future.

We are recommending investments in areas including:

• Technology: Tech sector returns have been strong, as the positive long-term trend in digitisation was accelerated by the coronavirus pandemic, while regulatory risks and higher interest rates may weigh on prices over the short-term. We recommend buying on weakness as we expect the focus of the administration will be economic recovery and the digitisation trend still appears to be in its early stages of this secular movement.

• Technology: Tech sector returns have been strong, as the positive long-term trend in digitisation was accelerated by the coronavirus pandemic, while regulatory risks and higher interest rates may weigh on prices over the short-term. We recommend buying on weakness as we expect the focus of the administration will be economic recovery and the digitisation trend still appears to be in its early stages of this secular movement.

• Healthcare/biotechnology: Healthcare and biotechnology companies are expected to benefit from the continuing positive trends in scientific innovation. We recommend buying on weakness with the risk that higher interest rates weigh on valuations. Long-term we expect the sector to be supported by continuing innovation, notably in oncology, and an aging population with the pandemic highlighting systemic weaknesses, eg, the need for quick and scalable medical testing and improved diagnostic capabilities.

• Climate: Joe Biden vigorously campaigned for a "Green New Deal" package, which entails trillions of fiscal spending to "rebuild America.” Our view was that even without a Green New Deal, policy was likely to skew away from fossil fuels to renewable energy sources. We recommended strategies with a focus on energy efficiency and renewable energy. Our belief is that money will continue to flow to renewable energy, electrification, and various green projects.

Longer-term, we expect renewables to become an increasingly important energy source, driven by improving technologies and economics. The potential election outcome reinforces this trend, increasing the likelihood that green infrastructure spending will be part of new stimulus programs.

Longer-term, we expect renewables to become an increasingly important energy source, driven by improving technologies and economics. The potential election outcome reinforces this trend, increasing the likelihood that green infrastructure spending will be part of new stimulus programs.

• Inflation: The potential for greater inflation increases if additional stimulus along with the distribution of vaccines translates into greater demand and an increased velocity of money, against weaker labor productivity trends and increased global demand from overseas markets, particularly China. We have recommended allocations to short duration TIPS as a direct inflation hedge while mitigating interest rate risk as well as utilities and basic materials, which stand to benefit from greater potential infrastructure spending. Inflation and a focus on alternative energy also supports demand for precious metals as an inflation hedge and basic materials as the necessary raw materials for renewable batteries. With monetary policy pinning short rates, inflation would result in a steeper yield curve which would benefit value relative to growth stocks, as future cash flows are discounted at a higher rate, and financial services. This said, we are not predicting long-term endemic inflation, as the global monetary system that was put in place over seven decades ago, does not support sustained higher inflation. As such, we view this inflation trade as an 18-to-24-month trade.

• Investment real estate: Consistent with the inflation theme, we believe that income-producing real estate, particularly with prudent amounts of fixed-rate leverage is a very effective inflation hedge with enhanced, after-tax return potential for every ultra-high net worth portfolio. We are particularly interested in the multi-family sector in secondary and tertiary geographies that are in growth phases in states with favourable income tax regimes. We also like specialty lab/office and industrial/warehouse segments that are experiencing strong secular demand trends in states with favourable income tax regimes.

• Investment real estate: Consistent with the inflation theme, we believe that income-producing real estate, particularly with prudent amounts of fixed-rate leverage is a very effective inflation hedge with enhanced, after-tax return potential for every ultra-high net worth portfolio. We are particularly interested in the multi-family sector in secondary and tertiary geographies that are in growth phases in states with favourable income tax regimes. We also like specialty lab/office and industrial/warehouse segments that are experiencing strong secular demand trends in states with favourable income tax regimes.

As part of our investment real estate strategy, we are aggressive allocators to development real estate located in Qualified Opportunity Zones to benefit from the significant federal income tax, as well as gift/estate tax benefits afforded to investors participating in this program. The QOZ Program is particularly well suited for private investors who are professional fund managers (ie, hedge fund, private equity, and venture capital) that receive a significant part of their income via carried interests in the form capital gains.

• Distressed credit: We allocated to European stressed and distressed credit strategies in 2017 and 2019, and recommended allocations to US distressed strategies earlier this year. While credit markets dislocated, the recovery was equally sharp. However, the liquidity facilities did not address all securities and may have deferred rather than resolved credit issues, particularly given the high levels of corporate debt against the potential for rising rates. Within distressed debt, we particularly like managers who can conduct deep legal due diligence and identify diamonds in the rough in the hallways of bankruptcy courts around the world.

• Foreign currencies: Against the potential threat of higher inflation and a depreciation of the U.S. dollar, we believe credit strategies, particularly Emerging Markets credits, that are in local currencies, can provide enhanced levels of returns over the next 18 to 24 months, as Biden’s fiscal and monetary policies are likely to send the U.S. dollar lower.

• Foreign currencies: Against the potential threat of higher inflation and a depreciation of the U.S. dollar, we believe credit strategies, particularly Emerging Markets credits, that are in local currencies, can provide enhanced levels of returns over the next 18 to 24 months, as Biden’s fiscal and monetary policies are likely to send the U.S. dollar lower.

• Digital assets: We are bullish on an allocation to Bitcoin as a broader expression of digital currencies and the perception around money printing worldwide. While the price has run up significantly as of recent, we believe the long-term outlook remains bullish and feel that the fundamentals are too compelling to not at least own a small allocation that could become a meaningful contributor to performance and an inflation hedge over the intermediate- to longer-term.

To summarise, we believe that this relative low interest rate environment, coupled with the threat of estate/gift tax legal changes and a positive investment environment with select pockets of high growth strategies and sectors that can provide outsized returns, makes the current environment very favourable for effective wealth structuring for families with strong balance sheets and complex investment portfolios. There are many different tools that well-seasoned wealth planners can utilise to address families’ multi-generational, philanthropic and investment objectives simultaneously.