Isio Private Capital: Re-thinking private equity

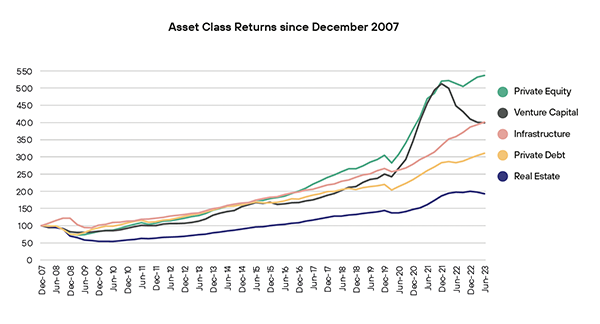

If asked to disclose the most successful investment type in their portfolio, we expect many family office investors would mention private equity (PE). This is borne out in the numbers, with the asset class significantly outperforming most others since 2007 [1] (and a June 2023 Preqin report finding that PE had met or exceeded expectations for more than 80% of institutional investors [2]):

This is a simplistic assessment, which doesn’t account for risk or dispersion of performance; however, it’s clear that PE has largely delivered for investors over the past 15 years.

As we enter 2024, these investors face an important, but not straightforward, decision: how should my PE allocation look going forwards?

A recent survey found that the average family office allocation sat at 26% - a close second to the average 28% allocation to public equities [3]; meanwhile, Campden Wealth also note that 38% of European family offices plan to increase their allocation to direct PE investments, with only 10% planning to reduce exposure [4]. When considering whether this makes sense, it’s important to look back before we can look forward.

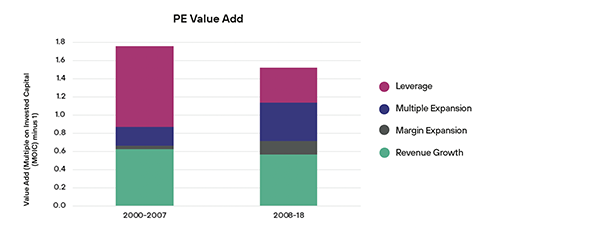

Post-2008, economic conditions provided an optimal environment for PE, with low interest rates driving investors towards riskier assets and underpinning a surge in demand for equity. Against this backdrop, and with exit opportunities aplenty, PE firms were able to place ever increasing valuations on assets. In a recent article, Morgan Stanley cite a study which found that in the post-2008 world, expansion in valuation multiples drove a significant proportion of PE returns [5]. Although we acknowledge that there are cases where investment managers have added value through origination and scaling, we believe that much of this improvement has been driven by general market factors.

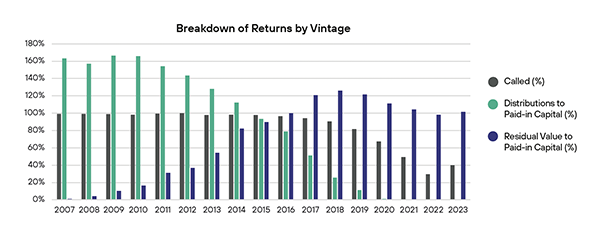

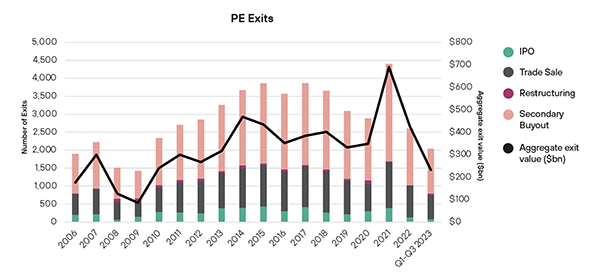

Hamilton Lane have also found that PE funds also currently hold a higher proportion of fund value in unrealised NAV than the historical average [6], and are therefore particularly reliant on exit performance to support returns. There is currently a gap between PE firms’ valuations of their own assets and the market’s own expectations, driving increased holding periods and negative net cashflow for investors. Against this backdrop, we think Distributions to Paid-In (DPI) will be an increasingly important focus for investors over the short term.

What does this mean looking forward?

We can break down prospective PE returns into the same components outlined above:

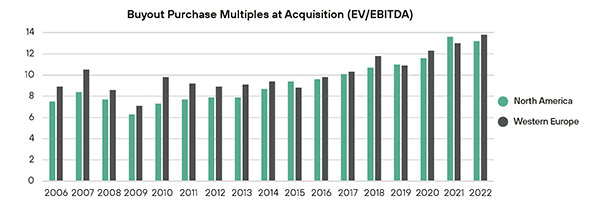

Multiple Expansion: Despite rising interest rates and a de-rating in large swathes of public markets, PE entry valuation multiples have remained resilient, hovering around record highs at a headline level, despite dispersion amongst sectors [1].

Despite a recent slowdown in fundraising, dry powder continues to expand, hitting $1.4 trillon in 2022, and projected to reach $2 trillion by 2028 [1]. Even if we assume a rebound in the dealmaking environment, growing demand for private assets should continue to support entry valuations. With entry multiples remaining elevated, and a slowdown in public market and industry demand for assets via PE-backed exits [1], we believe it could be increasingly challenging for managers to drive multiple expansion in the short to medium term.

Earnings Growth: Hamilton Lane find that over the past two decades, higher deal entry multiples have typically capped available upside, while also increasing reliance on future profit expansion for returns [6]. This emphasises how important we believe profit growth will be going forward. There is a positive correlation between economic growth and corporate profitability [7]. With muted GDP growth predicted for 2024 and beyond [8,9], and profit margins already sitting above historical averages [10], there are headwinds to achieving the earnings growth required to support such strong returns. We expect the companies hardest hit will likely be those which have greater sensitivity to GDP growth, as opposed to those which can benefit from less cyclical secular growth trends.

Leverage: Interest rates have surged since 2021, bringing the era of cheap financing to an abrupt end. While leverage levels have remained stable [1], we believe that the interest rate environment could continue to slow dealmaking, and put downward pressure on returns. We have also seen a shift in debt financing from public to private markets, and with a trend towards covenanted loans, managers face increased financing headwinds going forward.

To summarise, we believe that, of the four key return levers, top line revenue growth and margin expansion will be the key future value drivers. This could prove challenging as economic growth slows and monetary policies remain relatively tight. We expect there will be greater manager dispersion, with selecting the right partner becoming increasingly important. Managers who are selective with deals through proprietary sourcing channels, and have the expertise to generate operational improvements, will be well placed.

What does all this mean for you?

Whilst PE can still generate strong returns in absolute terms, we believe investors should consider how PE currently sits on a relative value basis. Additionally, when implementing in today’s environment, there are key aspects investors should consider:

Portfolio construction: building a well-structured portfolio has become ever more important, given the challenging landscape. Investors should ensure that they are getting the right advice to enable them to do this. Some key themes we have been engaged with our clients on are:

Identifying parts of the market to focus on: in particular, mid-market PE is attractive on a relative basis, given its greater scope for managers to add value through sourcing and operational improvements, and potentially a wider range of exit opportunities.

Minimising the J-curve and enhancing entry points via secondaries: with deal and exit markets subdued, secondaries can provide fast access to a known asset pool, at attractive pricing levels relative to history.

Prioritising income: by implementing an allocation to something like General Partner Stakes, investors can partially mitigate the risk of difficult exit environments.

Value for money: in a lower return environment, fees grow in importance. One way which investors can blend down average costs is by implementing co-investments where available. Ensuring that you are receiving value for money from your investment managers is key. There needs to be a focus on finding managers who can justify the high fees within the industry, by being operationally involved with portfolio companies and by demonstrating an ability to consistently drive earnings growth.

Within the wider illiquid assets space, we believe private credit continues to offer attractive risk-adjusted returns and income profiles, with bank disintermediation and lack of public capital representing the thematic tailwinds which underpin a strong medium-term investment case. This shift in relative value has been reflected in practice by many of our largest institutional clients, who have focussed on new illiquid allocations to both performing credit strategies (producing mid-teen IRRs) and infrastructure equity.

Contact Rob Agnew, Partner, isio Private Capital on rob.agnew@isio.com for more information.

Sources

[1] Preqin 2024 Global Private Equity Report

[2] Preqin Investor Outlook: Alternative Assets H2 2023

[3] Goldman Sachs - Eyes on the Horizon

[4] Campden Wealth European Family Office Report 2023

[5] Earnings Era: Future Performance in Private Equity (Morgan Stanley) / “Performance Analysis and Attribution with Alternative Investments.” Institute for Private Capital. 12 February 2022.

[6] Hamilton Lane - State of the Private Markets November 2023

[7] Schroders - How much does a fall in GDP growth matter to corporate earnings?

[8] IMF - World Economic Outlook (October 2023)

[9] Oxford Economics, via 2024 Preqin Global Private Equity Report

[10] Bureau of Economic Analysis, via https://www.gurufocus.com/economic_indicators/62/corporate-profit-margin-after-tax-

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

This document is issued by Isio Services Limited who are authorised and regulated by the Financial Conduct Authority (FCA), Firm Registration Number: 922376. This document is intended solely for distribution to Professional Clients for the purposes of the FCA’s Handbook of Rules and Guidance and should not be relied upon by any other person.