Howard Lewis on the art of The Schorr Collection and passion investments in the coronavirus age

The coronavirus outbreak has prompted many families to re-evaluate what is important in life and portfolios, and with lockdowns restricting world views to the immediate four walls, is art collecting due for a renaissance?

The Lewis family formed The Schorr Collection over the past 45 years into one of the largest privately-held fine art collections of its kind in the world. It consists of more than 400 works, from 15th century devotional images to 19th century French Impressionist landscapes. Paintings by such luminaries as Thomas Gainsborough, William Hogarth, Peter Paul Rubens and JMW Turner have been accumulated with care along with rare prints and books. About half the collection is on long-term loan to museums and institutions in the United Kingdom, United States and beyond.

The worldwide art market was experiencing a sea change even before the coronavirus outbreak. The year 2019 was the fourth consecutive year that sales for overall individual artist records fell, while record sums were paid for works by living artists, Art Market Research (AMR) found. The art market was continuing to adapt to a slowing supply of works by Impressionists and Modern Masters, AMR said.

Then came the Covid-19 shock. In March 2020, there was a 45% drop in the number of fine art lots sold at auction compared with the same month in 2019. Small wonder when more than half of March’s 80 fine art sales were shelved. Yet demand still simmers among collectors. AMR reported some smaller auctions did well online, including Sotheby’s 20th century design sale in March, which brought in $4 million—more than 25% above its high estimate.

Then came the Covid-19 shock. In March 2020, there was a 45% drop in the number of fine art lots sold at auction compared with the same month in 2019. Small wonder when more than half of March’s 80 fine art sales were shelved. Yet demand still simmers among collectors. AMR reported some smaller auctions did well online, including Sotheby’s 20th century design sale in March, which brought in $4 million—more than 25% above its high estimate.

In this historically disruptive time for the art market, CampdenFB talks with Howard Lewis, director of The Schorr Collection. Lewis discusses the future of museums in the “new normal”, what he looks for when considering acquisitions, and whether family offices should really invest in art.

What measures has The Schorr Collection taken in response to the coronavirus pandemic?

We liaised very promptly with all borrowers, once it became evident that the virus was escalating. Although many were in touch to advise their imminent closure, we felt it prudent to contact them all to ensure they were engaging in best practice. Since The Schorr Collection lends to more than 30 institutions in the UK and beyond, we maintain regular oversight anyway, but we have been impressed by the rigor and professionalism with which they have handled this difficult situation.

Our lending policy has remained intact and we have continued to monitor security, insurance and indemnities concerning individual museums. Although internal spaces may remain out of bounds in the immediacy, we would hope that venues with accompanying gardens will permit the public access to them so they might at least enjoy the landscape around the buildings themselves. The application of social distancing outside will still need a dose of common sense by all concerned.

Our lending policy has remained intact and we have continued to monitor security, insurance and indemnities concerning individual museums. Although internal spaces may remain out of bounds in the immediacy, we would hope that venues with accompanying gardens will permit the public access to them so they might at least enjoy the landscape around the buildings themselves. The application of social distancing outside will still need a dose of common sense by all concerned.

Should galleries and museums be among the first public venues to reopen once a lockdown is lifted, especially given the mental health and wellbeing benefits?

Unlike other cultural venues, there is no numbered seating at a museum or gallery! This brings a dual benefit. Whichever direction you may follow, you will gain a sense of humanity all around you. A smile, nod, wave or other acknowledgement indicate a shared experience. You may be very stimulated by the exhibits on display, but I believe the craving for physical interaction, even from a distance, will stir the senses even more.

During the Second World War, The National Gallery in London hosted a series of concerts to boost morale, offer sanctuary and enable people, however briefly, to close their eyes and forget the chaos and disruption to their lives. Art can be similarly soothing and restorative, but it can also induce a spiritual awakening. Our recent isolation and separateness will have encouraged a search by many for deeper meaning to their lives and art frequently acts as fuel for the soul.

What will curators need to consider when exhibition spaces re-open?

The pressing issue for me is determining how museums reconfigure the viewing experience in a post coronavirus society. Although they permit a freedom to move, unlike theatre and concert venues, they encourage visitors to linger too. Bookshops and cafes within are often significant revenue generators in their own right. This will require some delicacy and tact on the part of the management team whereby they do not squeeze the life out of each visit.

Do you see fashions emerging around certain themes or artists from institutions seeking works to borrow?

Do you see fashions emerging around certain themes or artists from institutions seeking works to borrow?

Taste in art ebbs and flows, as it does in music, literature, design and other creative endeavours. I would anticipate an increased emphasis on themes such as gender, disability and the home. The craft movement is witnessing a resurgence too and deserves closer inspection. However, blockbuster shows will be a real act of faith, given the constraints imposed by travel and social distancing, and exhibitions may be more focused on local rather than global aspirations in the short term.

What factors do you consider when acquiring art and what is the most recent addition to the collection?

My father has always advocated that the three guiding principles behind any acquisition are that it should inspire you aesthetically, emotionally and intellectually—preferably all three should apply but any two will do! Condition per se is less important. We have occasionally purchased paintings that were filthy or neglected, but where we believed there was an underlying quality to the work. Our judgement has generally proved correct, albeit there has also been the odd mistake!

One of the most recent additions is a cassone panel that features on an Italian marriage chest dating from c 1390. It depicts scenes from The Rape of Lucretia which frequently acts as a morality tale in Renaissance Art. This cassone is a rare survival from its era and offers an apt reminder of the craftsmanship and subtlety prevalent over 600 years ago. The past all too often provides a road map to the future if only we remember where to look.

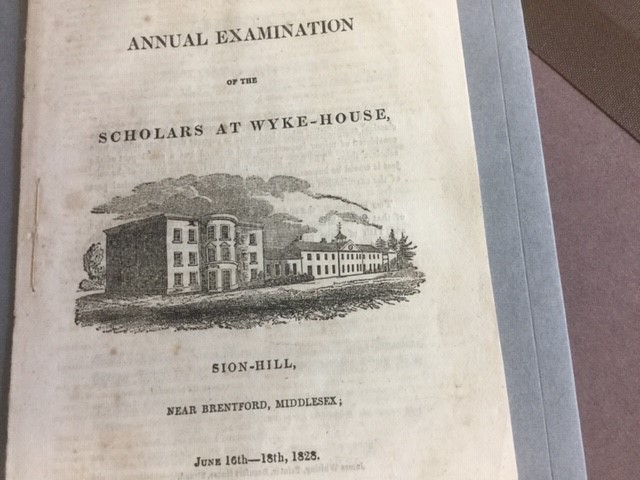

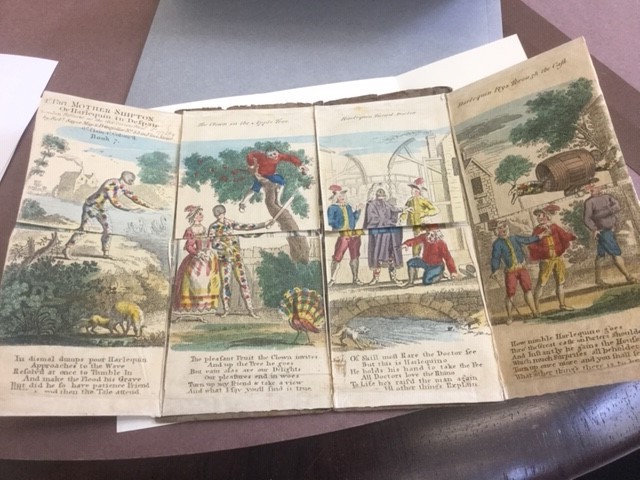

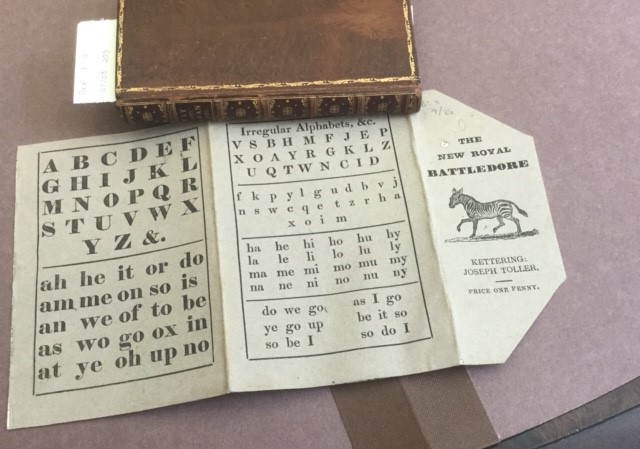

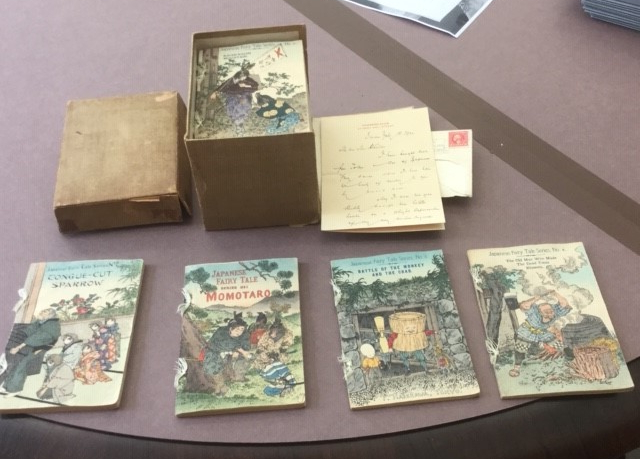

Another example of our interest in preserving the lessons of the past extends to the acquisition of three 19th century children’s games to augment existing holdings. Although the focus of this collection is primarily educational books, it also comprises toys and artefacts that have been lovingly enjoyed, maintained and passed down the generations, a stark contrast to the throwaway habits of today in which such objects are routinely discarded in pursuit of a better version.

Which work in The Schorr Collection do you find most rewarding on repeated viewing?

As roughly half the Old Master collection is on long-term loan, that is quite a challenging question. However, two images of exceptional quality, which are consistently rewarding, are The Portrait of St John the Evangelist by El Greco (pictured above) and The Pass at St Gotthard by JMW Turner (pictured below). As a boy, I also remember I was always captivated by Christ Before Pilate, an etching by Rembrandt. My father used to say that every time I viewed it, I would notice something different and he was right!

The painting by El Greco possesses a haunting, almost ethereal quality. St John is caught at a moment in time, seemingly poised between thought and action, the softness of the palette magnified by the dark background. The Turner complements the power and grandeur of nature with the fragility of the travellers crossing an Alpine pass, a vanishing abyss beneath. It is a remarkable accomplishment, executed while he was still in his late twenties.

On a more modest scale, I have an affection for a small group of 16/17th century paintings on copper. At a time when most jobbing artists were binding planks of wood into a panel, copper was an expensive and coveted medium. The hardness of the surface invites great precision and luminosity of colour and these little treasures are a delight. I am also very partial to an informal sketch of the Scottish collector Munro of Novar, who was the one of the earliest patrons of Turner.

Do you believe that art has no place as a passion investment in a family office portfolio?

Art certainly has a place in a family office portfolio, since it is an asset class in its own right. Every work has a value, but we do not believe that financial returns should be the major motivation and we treat any rise in values as a bonus not an expectation. Our principal desire has always been to develop our collection as a source of pride and pleasure and share our good fortune with as wide an audience as possible through loans to museums and libraries, both large and small.

We do not consider art to be an investment in conventional terms. It is certainly a speculation, but that is not the same thing at all. There is no yield attached to a work of art so you can not define its future worth using a discounted cash flow model or similar. The market does not work that way. It is opaque and unregulated and the value of any work is broadly determined by agreement between a willing buyer and a willing seller on a given day.

We do not consider art to be an investment in conventional terms. It is certainly a speculation, but that is not the same thing at all. There is no yield attached to a work of art so you can not define its future worth using a discounted cash flow model or similar. The market does not work that way. It is opaque and unregulated and the value of any work is broadly determined by agreement between a willing buyer and a willing seller on a given day.

If you are in any doubt about the pitfalls of buying art for investment, look no further than the seminal study, The Economics of Taste: The Rise and Fall of Picture Prices 1700-1960 by Gerald Reitlinger. One can observe how masters like Vermeer and El Greco fell into relative obscurity, due to the vagaries of taste and opinion, or Frith, one of the dominant artists of the Victorian age, saw chromolithographic reproductions of his works completely eclipse any demand for his paintings.

What is the likely response from ultra-high net worth (UHNW) investors in art to the effect of coronavirus?

I would anticipate the vast majority of investors in art will exercise due restraint. No doubt a few financial opportunists will seek out distressed assets, regardless of circumstances, but this is a time to take stock. The personal economic damage wrought in America may increase the supply of goods in the secondary market as owners seek to liquidate art and other passion holdings. An illiquid, uncertain environment might appeal to some, but we shall be watching from the sidelines.

Equally, I do recognise that some art buyers will take solace in the permanence of more personal objects in such an impermanent world. It was instructive to note how online demand at Sotheby’s recent jewellery sale far exceeded expectations. Various accessories might be construed as a relatively inexpensive treat for some UHNW investors while bigger ticket items are becalmed. Similar criteria may apply to couture and vintage design.

Do you anticipate a more conservative approach, as prospective buyers seek a sense of reassurance from deeper values? Will the excesses of the contemporary market start to decline accordingly?

Do you anticipate a more conservative approach, as prospective buyers seek a sense of reassurance from deeper values? Will the excesses of the contemporary market start to decline accordingly?

Yes, I believe the speed and breadth of the pandemic will cause many to recalibrate their value system. Circumstances can influence fashion and taste in surprising ways. A pandemic or a revolution, for example, have the capacity to sharply accelerate and decelerate the pace of change. Conservative and deep seated values are very reassuring, as they offer a sense of continuity with the past, and it is likely that the frothiness of the contemporary market will deflate.

This does not infer that emerging artists or ideas should be discouraged. Indeed, innovation and experimentation may flourish during this paralysis, but the conspicuous consumption that has so characterised the contemporary end of the market will probably diminish. Collecting with purpose, rather than as a mere vehicle for status and showmanship, will witness a gradual revival and will be akin to tasting, chewing and savouring delicious food rather than just wolfing it down!

Is the market likely to rebound as it did after the global financial crisis? What should passion investors be seeking under that scenario?

Is the market likely to rebound as it did after the global financial crisis? What should passion investors be seeking under that scenario?

I don’t believe you can directly compare the global financial crisis with the impact of the coronavirus epidemic. The former presaged significant value destruction, but policy makers were dealing with a known quantity and possessed the tools to right the ship. That was a squall, whereas we are confronted now by a storm, both invisible and unpredictable. There is an understandable caution everywhere across all asset classes and art will not be immune to that.

Passion investors should use this hiatus in regular business activity to learn in greater depth about subjects in which they have an interest. The major auctioneers host online seminars with experts in their field, as does The Courtauld Institute. If you only seek a brief snapshot, institutions such as the Frick Museum in New York invite you to spend a leisurely hour listening to one of the curators talk about aspects of the collection. All these activities are recommended, as is reading widely!

St John the Evangelist by El Greco and The Devil’s Bridge, St Gotthard Pass by JMW Turner (Copyright The Schorr Collection 2020). The four photos relate to children's eduation materials in the collection.