FB Roundup: Walmart, H&M, Lotte Group

Walton family’s Walmart sells Asda to British billionaire brothers

Walmart, the world’s largest family business, has sold most of its ownership of the Asda supermarket chain in the UK after 21 years to a fledgling British family business owned by the billionaire Issa brothers for £6.8 billion ($8.7 billion).

The Waltons’ $524 billion retail giant Walmart acquired Asda for £6.7 billion ($8.6 billion) in 1999. However, speculation its subsidiary’s sales performance had not met expectations was buoyed when Walmart attempted to sell a majority stake to rival supermarket chain J Sainsbury in 2019, only to be blocked by regulators.

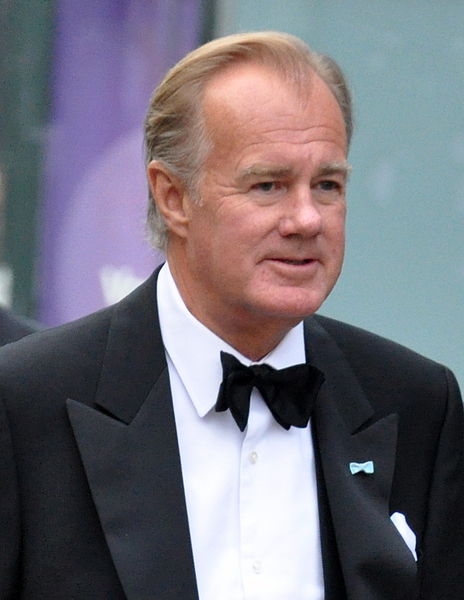

The surge in Asda sales during the UK’s coronavirus lockdown suggested the Walton family had paused its plans to offload the grocer. However, Walmart, chaired by family member Greg Penner (pictured), announced this week brothers Mohsin and Zuber Issa (pictured) and the London-based $9.3 billion private equity firm TDR Capital were acquiring a majority ownership stake in the UK’s third largest supermarket chain. The stake ratio and cost share between the two buyers was not disclosed.

The Bentonville, Arkansas-based Walmart said it will keep an equity investment in Asda with an ongoing commercial relationship and a seat on the board. The new owners and their retained management team will “enjoy the continued support and involvement” of Walmart as an investor and partner, allowing Asda access to global innovation and buying power.

The brothers said they will invest more than £1 billion ($1.3 billion) in the next three years in Asda to strengthen the business and its supply chain. In perhaps a tacit acknowledgement of concern among some British consumers over food quality standards post-Brexit, the new owners pledged to increase the volume of products such as chicken, dairy, wheat and potatoes purchased from UK suppliers each year and committed to sourcing 100% British beef.

Entrepreneurs and philanthropists Mohsin and Zuber Issa started their careers working at their father’s petrol station in Blackburn, Lancashire. The founders of Blackburn-based Euro Garages, later rebranded EG Group, went from acquiring one petrol station in 2001 to more than 6,000 sites across three continents. Their non-fuel convenience retail sales, in partnerships with the likes of Starbucks and Spar, soon outstripped sales of fuel on the forecourt, but the Asda acquisition will be the brothers’ first foray into national supermarkets. Germany’s Albrecht family-owned discount supermarket chain Aldi is among their new competitors.

Persson family’s H&M closes 250 stores and ramps up online investment

Persson family’s H&M closes 250 stores and ramps up online investment

The Persson family-owned fast-fashion retailer Hennes & Mauritz will close a record 250 bricks and mortar stores in 2021 in another blow to the high street as it steps up its digital transformation and integration to recover from coronavirus lockdown closures.

Chaired by second generation Stefan Persson (pictured), 72, Sweden’s H&M is the world’s second largest retailer after the Ortega family-owned Spanish fashion giant Inditex, best known for its largest apparel chain Zara. In its new quarterly report, H&M group said sales slumped especially in the second quarter when 80% of stores were closed during lockdowns. In its second quarter, H&M posted a net loss of SEK 5 billion ($561 million), compared to a net profit of SEK 4.6 billion ($516 million) a year earlier, while revenue halved to SEK 28.7 billion ($3.2 billion).

However, H&M’s online sales, which so far comprised only a quarter of total sales, shot up by 28% during the third quarter. The family business was back in the black by the end of the third quarter with a net profit of SEK 1.8 billion ($202 million).

H&M said rapid changes in customer behaviour had been accelerated by the coronavirus pandemic. About 250 stores out of 5,000 worldwide were planned to close next year as leases came up for renewal.

“We are increasing digital investments, accelerating store consolidation and making the channels further integrated,” said Helena Helmersson, who was the first woman and non-member of the Persson family to assume the role of chief executive in January 2020.

“To ensure that our offerings are relevant to customers and improve availability in all channels, speed and flexibility will be even more important in the future, particularly in the supply chain.”

Adam Vettese, analyst at multi-asset investment platform eToro, said the second quarter was dire for H&M, as it was for most retail fashion firms, but it made an impressively strong recovery in the third quarter.

“H&M has reaped the rewards of tight costs control and its drive to boost online sales, which will undoubtedly become even more important post-pandemic than it is now,” Vettese said.

“Encouragingly for investors, there is probably a decent amount of mileage left in H&M’s recovery, with 166 stores still to reopen and many others operating under limiting opening hours.

“I say this tentatively, but H&M seems to be over the worst of this crisis. But like all retailers, the threat of a second lockdown looms like a dark and menacing cloud over the entire sector.”

Lotte Group prepares for the hands-free “untact” future today

The Shin family-controlled Lotte Group is making the marketing buzzword “untact” a cornerstone of how it rethinks its entire retail domain in the post-pandemic world.

Chaired by second-generation Shin Dong-bin (pictured), 65, the $6.6 billion South Korean multinational said a contact-free society was a consequence of the coronavirus pandemic. The shift was seen most notably in the increase in online instead of offline shopping. But the nascent untact trend Lotte identified was expected to have an “absolute impact” on its retail and food and beverage markets, and the group was preparing to take the initiative.

Lotte Academy summed up its research in late April in BC and AC (Before Corona and After Corona) and circulated the book to all the c-suite executives of its affiliates. The intention was to give executives insights on the expected changes and to help them find out the risks and countermeasures for their businesses in the “new normal”.

The group officially launched Lotte On, an online mall integration app, at the same time as the book release. Lotte On platformed all seven of its separately-run online malls and analysed the purchase data of 360 million members of Lotte Members, the group’s loyalty scheme, with artificial intelligence to give personalised customer recommendations to enhance the user experience while they shopped.

The group officially launched Lotte On, an online mall integration app, at the same time as the book release. Lotte On platformed all seven of its separately-run online malls and analysed the purchase data of 360 million members of Lotte Members, the group’s loyalty scheme, with artificial intelligence to give personalised customer recommendations to enhance the user experience while they shopped.

Fast delivery services, along with online shopping, were signalled as a key competitive advantage in the new untact era. Lotte Auto Fresh Centre (pictured) opened in Uiwang in March, an automated logistics hub where fast-moving robots took orders via the shopping app then found stock and packed products within seven minutes. Lotte Mart will expand the model to major cities across South Korea.