Making the case for cash

Cash is trash. Cash is a melting ice cube. Going to cash is giving up.

Ruffer currently has the highest weighting to cash or cash-like assets in our history. We are concerned that liquidity is the new leverage and that a degradation of liquidity conditions poses an imminent danger to investor portfolios.

So why, unlike other investment managers, are we comfortable owning cash today?

First a story. The author of the famous novel Catch 22, Joseph Heller, attended a cocktail party hosted by a Wall Street tycoon with his friend, the writer Kurt Vonnegut, who said: “What do you think, Joe? That man earned more last month than you’ve made from all your books.”

Heller: "Maybe. But I have one thing he’ll never have."

Kurt: “What’s that?”

Heller: “Enough.”

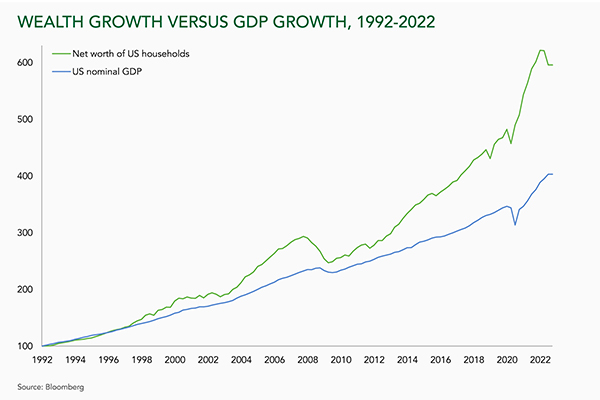

Despite recent market travails, there are a lot more people out there who have ‘enough’. Asset price inflation has made a lot of investors wealthy in the last decade.

‘Enough’ – that’s the moment, or the number, when you move from trying to get rich, to trying to stay rich. The mindset shifts from capital accumulation to capital preservation.

Our job at Ruffer is to assess the economic and market landscape, and then decide how much risk to take. We have a preoccupation with identifying the major downside threats and avoiding them. Today, our assessment is that this is a very poor time to take risk. So, we don’t. Patience and preparation are our watch words.

“We are paid to invest, not to hold cash” is a common push back. I would counter that cash is one of the bravest and most client-centric asset allocation decisions.

“Cash is losing money in real terms” is another. How are other so-called inflation hedges like cryptocurrency, gold and property funds performing in real terms?

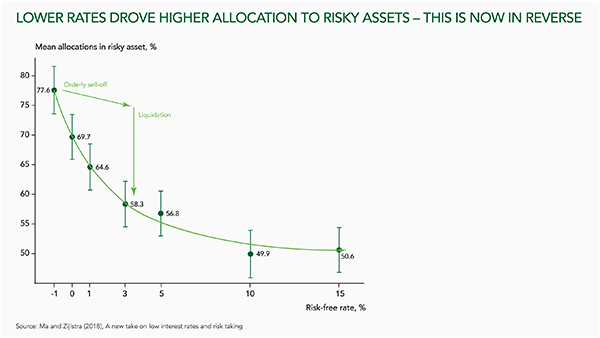

Since the financial crisis an oft-repeated mantra has been ‘TINA’ – There Is No Alternative. The slogan, borrowed from Margaret Thatcher, summarised the phenomenon whereby in a zero interest rate world investors are forced up the risk curve. Investors leapt from sovereign bonds to credit to high yield and finally to equities in pursuit of income. A whole industry of ‘alternative income’ and ‘private credit’ blossomed. Some are now wilting.

Today, TINA has been replaced by PATTY. An alternative exists, you just need to Pay Attention To The Yield. The yield on the risk-free asset – cash.

The Federal Reserve and the Bank of England are expected to have rates at 4.5% in time for Christmas. Two and five year bond yields on both sides of the Atlantic are also in that 4% to 4.5% range [1].

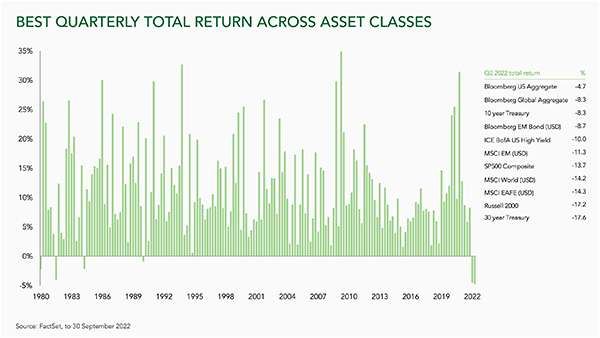

2022 has been a year where there has been nowhere to hide. Diversification has failed, cross asset correlations have been high. Balanced, multi-asset portfolios have been badly damaged.

Despite three consecutive quarters of losses in both equities and bonds, investors may not be out of the woods. So far, it has been a painful, but orderly repricing of risky assets. Now, we fear something worse – a liquidation. A dash to cash – but a disorderly one, where investors sell what they can, not what they want to. The liability driven investment (LDI) panic was the template.

Everyone knows that rates are going up and quantitative tightening is sputtering into life, but there is a further, less widely discussed, drain on system-wide liquidity: the entirely rational decision to ditch risk assets and hold cash and cash proxies that are now paying a certain yield in a deeply uncertain world.

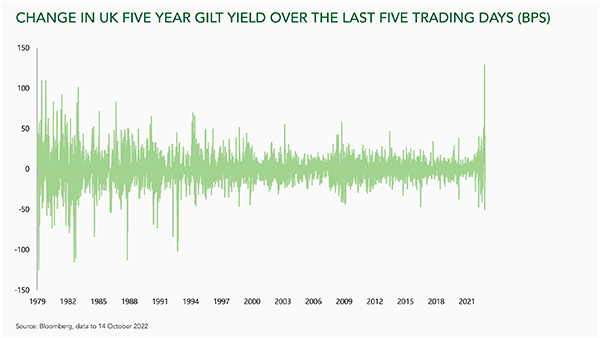

But before we all go and fire our asset managers, there is a twist. One of the biggest advantages of cash is that it gives you optionality, the option to move quickly and pounce on opportunities. Cash is a call option with no expiration date on every asset in the world. The expected return on cash isn’t the yield it gives you, it’s the return you will earn by being able to buy distressed or dislocated assets. For example, during the record-breaking volatility we saw in gilt markets a few weeks ago, it paid to be active when others weren’t.

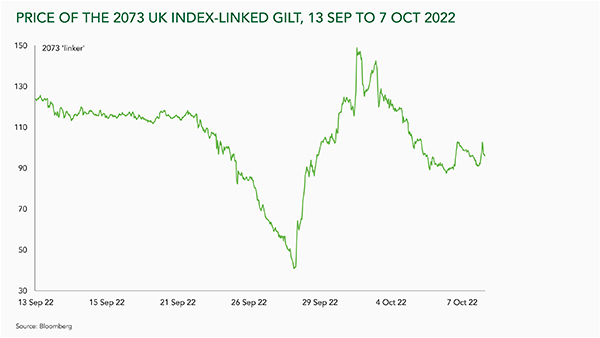

At the end of September, we were buying long dated index-linked gilts at extraordinarily distressed prices, just before the Bank of England stepped in to restore order.

These gilts rallied 115% on the day. This was an opportunity that lasted not weeks, or days, but hours.

There are lessons here that show the power of holding cash and being able to deploy it opportunistically.

Firstly, in a behavioural sense. Being able to make decisions unencumbered by the pain of nursing hefty losses.

Secondly, the ability to act as the market maker or buyer of last resort. If you show up to an auction and you are the only bidder, the chances of getting a good deal are much improved.

Thirdly, holding cash is an acknowledgement that tomorrow’s opportunity set could be more fertile than today’s. When attractive situations appear, you can allocate in size. As Warren Buffett said, “when it’s raining gold, reach for a bucket, not a thimble.”

After a spectacular couple of decades for asset owners, markets are undergoing a regime change. Part of this is a vicious reappraisal of discount rates and term premia. There are times when it pays to be greedy, and there are times when it pays to know when you have ‘enough’.

copy.jpg)

[1] Bloomberg

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. This document does not take account of any potential investor’s investment objectives, particular needs or financial situation. This document reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. More information: ruffer.co.uk/disclaimer

This financial promotion issued by Ruffer LLP, which is authorised and regulated by the Financial Conduct Authority in the UK and is registered as an investment adviser with the US Securities and Exchange Commission (SEC). Registration with the SEC does not imply a certain level of skill or training. © Ruffer LLP 2022. 80 Victoria Street, London SW1E 5JL ruffer.co.uk