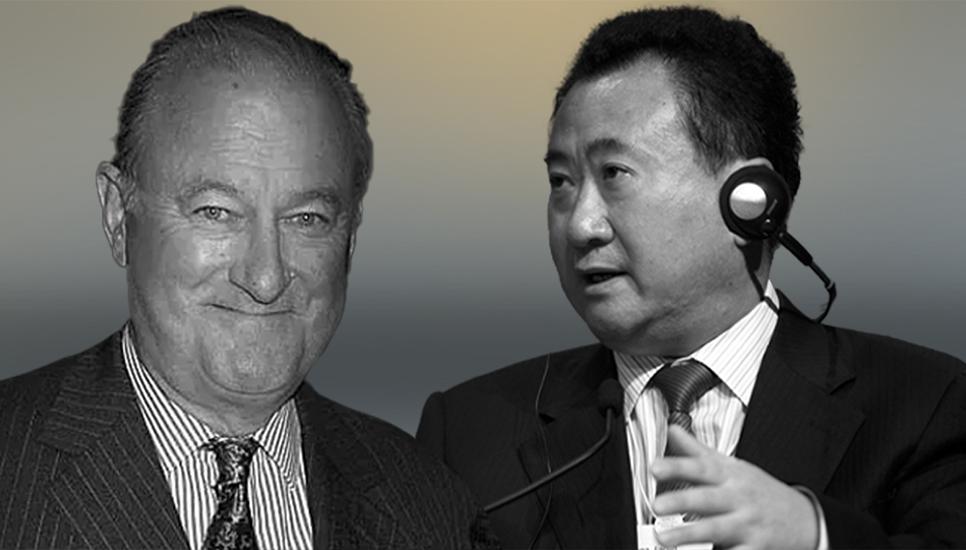

FB Roundup: Charles Cadogan, the Moreira Salles family, Wang Jianlin

Tributes paid to billionaire aristocrat Charles Cadogan

Charles Cadogan, the eighth Earl of Cadogan and the patriarch of one of Britain’s richest families, has passed away at the age of 86 at his home in Chelsea.

“He found enjoyment and amusement readily and was wonderful company, gregarious and voluble,” said the Cadogan Group, his family’s investment company, in a statement. “He described himself as a ‘countryman’ and while his family business has been very successful under his stewardship, he felt most comfortable in the role of philanthropist.”

The UK’s 14th-richest person (according to the Bloomberg Billionaires Index), the Earl was the life president of the family company, Cadogan Estates, the expansive property company which, according to The Daily Mail, “owns nearly 100 acres of Kensington and Chelsea and includes more than 500,000 square feet of office space, five embassies, seven schools and more than 30 restaurants and bars.”

The family, which has owned land in the central London Royal Borough since 1717, controls the assets through a series of trusts and has a portfolio worth £5.1 billion.

“He was ever-present in Chelsea and cared deeply about this very special part of London, the community, the history, the buildings and the environment,” said Conservative Party Chairman and Chelsea and Fulham MP Greg Hands on Twitter.

“Lord Cadogan left an indelible mark on our organisation through his leadership,” said Helen Rowntree, CEO of the charity Blood Cancer UK for whom Lord Cadogan was a trustee for almost 30 years. “During the three decades of his involvement, Blood Cancer UK has been transformed into one of the UK’s leading blood cancer charities. Our research has led to a long line of breakthroughs that have transformed treatments and saved lives.”

Lord Cadogan took over the running of Cadogan Estates in 1974 and, during his tenure, oversaw the purchase of freeholds to the Peter Jones department store in Sloane Square and Harvey Nichols in Knightsbridge. The firm’s highest-profile work was the £150 million redevelopment of the old Duke of York Square barracks on the King’s Road, described at the time as the “largest and arguably most stylish shopping centre to open in London for decades”.

Lord Cadogan retired as chairman of the Cadogan Group in 2012. His eldest son Viscount Chelsea, the company’s chairman, has now been named the 9th Earl Cadogan.

Moreira Salles family aim to increase stake in Havaianas flip-flop brand

The Moreira Salles family, one of Brazil’s wealthiest lines, are aiming to increase their share and become the biggest stakeholder in Alpargatas SA, the maker of Havaianas flip flops.

The family business, which was founded by Walter Moreira Salles (Brazil’s former Minister of Finance and the founder of Unibanco), has offered to buy as many as 32 million preferred shares of Alpargatas through an investment vehicle owned by its private equity firm Cambuhy Investimentos Ltda and family office Brasil Warrant Gestao de Investimentos, according to Bloomberg.

If successful, the family would own 33.3% of Havaianas, up from their current 28.6% stake. Presently, control of the iconic beachwear brand is shared between the Moreira Salles family and holding firm Itausa SA – which oversees the fortune of the Villela and Setúbal families.

Havaianas was sold for £850 million in 2017 by its former owners, the Batista family, after they were forced to pay a £2.5 billion fine relating to a political corruption scandal.

The Moreira Salles family have a fortune of more than $23 billion spread across four brothers, according to the Bloomberg Billionaires Index.

Wang Jianlin loses $40 billion as Dalian Wanda Group faces collapse

Wang Jianlin, the billionaire founder of Dalian Wanda Group known as China’s answer to Walt Disney, has seen his net worth reduced by $40 billion from its peak to $6.6 billion - a drop of more than 85 per cent.

Once Asia’s richest person, the property and entertainment tycoon has now suspended all new business deals as he attempts to save his company which, according to Bloomberg, is facing billions of dollars in debt.

The 35-year-old shopping, entertainment and hotel empire has, again confirmed by Bloomberg citing unnamed sources, been turned away by China’s biggest banks and is now reaching out to smaller lenders for a lifeline.

“For the past ten years, property companies have expanded too fast with too much debt,” said Louis Tse, managing director at brokerage firm Wealthy Securities, to Bloomberg. “The good old days are gone for good, especially for Chinese property billionaires.”

The 68-year-old Wang previously faced a bankruptcy crisis five years ago and was forced to sell a host of hotels and theme parks to his competitors. Bloomberg said: “Tse acknowledged some of the problems at his embattled company during a meeting in April [2023] but maintained that it would recover.”

Due to ongoing economic pressures over the past few years, the number of Chinese billionaires have dropped by around 20 per cent from 1,185 to 946, while their total wealth also fell by 18 per cent, according to The Hurun Rich List.

“The recent Covid outbreak across the country and increased tension with the US combined… to see the steepest drop in value since the 2008 financial crisis, with many of China’s biggest companies shedding up to half their value,” said Hurun Report chairman and chief researcher Rupert Hoogewerf. “Other factors in play include continued anti-monopoly regulations, pressure on real estate borrowings, efforts to stem the falling birth rate, carbon emission targets and the recently introduced common prosperity theme.”