FB Roundup: Andrew Forrest, Tom Ford, Masayoshi Son

Billionaire Andrew Forrest launches $25 billion Ukraine reconstruction fund

Billionaire Andrew Forrest launches $25 billion Ukraine reconstruction fund

Andrew Forrest, the Australian mining billionaire best known as the former chief executive officer of Fortescue Metals Group (FMG), has committed $740 million of his own fortune to the Ukraine Green Growth Initiative.

Forrest launched the global Ukraine Green Growth Initiative, which is focussed on reconstructing the war-torn country and hopes to raise at least $25 billion (growing to $100 billion) in seeding investment in energy and communications infrastructure, to help transform the nation into a “Digital green economy”.

Ukrainian President, Volodymyr Zelenskiy, welcomed the initiative saying in a statement: “Andrew and I have agreed we will not replace communist-era rubbish Russian infrastructure, instead we will leapfrog to the latest technology.

“We will take advantage of the fact that what the Russians have destroyed can readily be replaced with the latest, most modern green and digital infrastructure.”

Forrest has been working alongside governments from Ukraine, Australia, United States and Britain, as well as members of the international business community, including Larry Fink the chairman of investment giant BlackRock, in a hope to secure further philanthropic giving from other business leaders.

“I invite professional investors, fund managers and sovereign funds and all who believe invading another country should now be forever consigned to the historical garbage bin of humanity’s worst mistakes, to join us,” said Forrest in a statement.

“The president [Zelensky] sees that as an opportunity to completely replace old coal-fired [and] nuclear power stations with brand-new green energy," Forrest told the BBC. “That capital would be available the instant that the Russian forces have been removed from the homelands of Ukraine,” he added.

While Forrest made his fortune in Australia's mining industry, he has latterly focussed on sustainable technology, including initiatives to decarbonise mining operations and mass produce green hydrogen.

Forrest spent a week in Ukraine earlier this year, meeting Zelinskiy in person.

“You will remember the German and Japanese economic miracle after World War II, Ukraine will have it faster,” Forrest said in an interview with ABC’s Radio National. “From sovereign funds to professional investors, institutions all over the world and in Australia, this would be a good investment.”

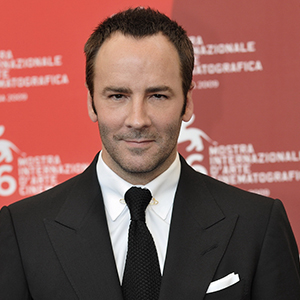

Tom Ford becomes a billionaire after selling fashion brand to Estée Lauder

Tom Ford becomes a billionaire after selling fashion brand to Estée Lauder

In a deal worth $2.8 billion, fashion designer Tom Ford has sold his eponymous fashion, beauty, fragrance and accessories company to Estée Lauder.

The global beauty brand – co-founded by American businesswoman Josephine Esther Mentzer and her husband Joseph Lauder in 1946 – is now the sole owner of the popular Tom Ford brand after purchasing it for $2.3 billion in cash and debt, $300 million in deferred payments (to be paid out in 2025) and $250 million to Marcolin, the Italian eyewear brand which holds the license for Tom Ford’s eyewear line.

Ford himself is expected to receive $1.1 billion from the sale after taxes, according to Forbes.

“I could not be happier with this acquisition as The Estée Lauder Companies is the ideal home for the brand,” Ford said in a statement. “They have been an extraordinary partner from the first day of my creation of the company and I am thrilled to see them become the luxury stewards in this next chapter of the Tom Ford brand.”

Ford, who became creative director of Gucci in 1994 and then creative director of Yves Saint Laurent when it was purchased by Gucci in 2000, will continue to stay on as the brand’s “Creative visionary” until the end of 2023.

Masayoshi Son faces $4.7 billion SoftBank bill

Korean-Japanese technology entrepreneur Masayoshi Son personally owes SoftBank close to $4.7 billion due to growing losses on the Japanese multinational conglomerate’s technology plays.

The 65-year-old’s personal liability comes as the investment management giant has suffered plunging tech stocks and valuations across its private companies.

Having agreed to step back from running day-to-day operations at the group, the chief executive and SoftBank founder said his main focus going forward would be on the company’s British semiconductor designer firm Arm.

“For the next few years, I would like to devote myself to Arm’s next phase of explosive growth,” Son said. “I would like to delegate financial earnings and other daily management operations to other executives.”

Son’s multi-billion bill comes after SoftBank fronted him the money to invest in its technology-related funds. Son’s growing liabilities to his own company emerged as SoftBank shareholders questioned the decision to quicken share buybacks, resulting in pushing the company’s share price to a 12-month high earlier this month.