European unicorn growth outpaces US and Asia

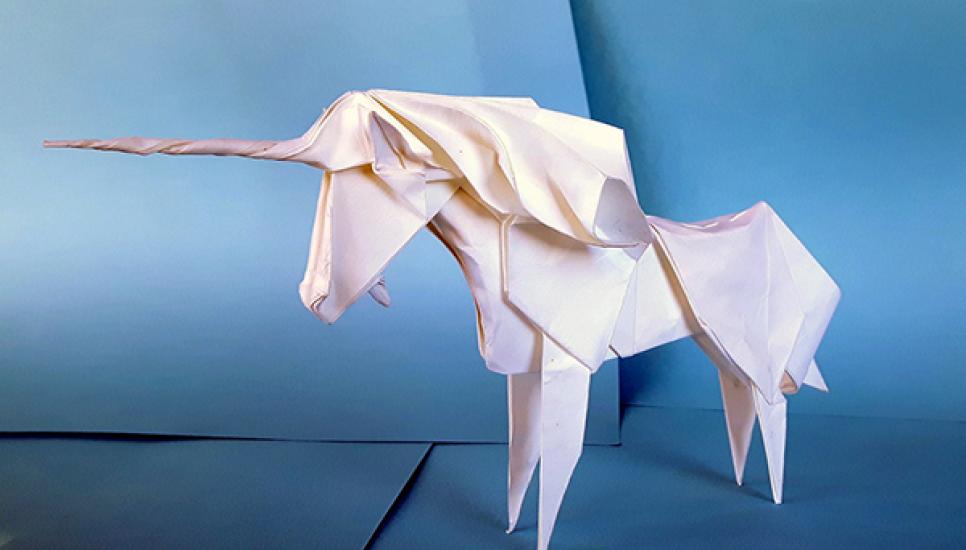

Unicorns are being created at a faster rate in Europe than anywhere else in the world. Private markets investment platform Titanbay takes a look at the structural changes driving this acceleration.

Europe has been breeding unicorns at a record pace. The number of startups valued at $1 billion or more hit at least 78 last year, up from 17 in 2020, according to PitchBook data [1]. That pace of growth was higher than in the US and Asia, where the venture capital ecosystem is more established.

In total, Europe had 128 unicorns at the start of this year, worth roughly €330 billion combined. Pitchbook data shows that’s almost triple the value of Europe’s unicorns at the end of 2020.

The same data shows that by the end of June this year, 30 more European startups had become newly minted unicorns – still outpacing growth rates in the US and Asia (even though the US and Asia have both minted more new unicorns in total) [2].

What’s behind the surge?

McKinsey says there are a range of explanations as to why Europe’s unicorn growth rate has lagged the US and Asia in the past. These included regulatory constraints, a risk-averse culture and a less developed VC ecosystem [3].

The evolution of the European VC ecosystem has been spectacular, fed by a virtuous cycle of rapid growth, high-visibility company success stories that have encouraged risk-taking, repeat entrepreneurs and a developing VC financing network. Inflows from outside the region (predominantly from the US) have helped improve the capital available to support assets.

According to i5invest’s European Unicorn and Soonicorn report, almost half of investors (48%) backing European unicorns are from outside Europe. US investors make up more than three-quarters of those (76%), followed by investors in China and Russia, with roughly a 3% stake each [4].

Among the European startups that reached unicorn status last year were UK insurtech firm Marshmallow, French biotech firm Owkin and UK peer-to-peer lender Zopa. Joining them this year include the likes of UK edtech company Multiverse and payments platform GoCardless.

Where are Europe’s unicorns hiding?

At a tally of 41, i5invest data shows the UK is home to the highest number of European unicorns, i5invest data shows. However, Germany has been responsible for creating some of the fastest-growing unicorns to date. Four of the top-five fastest unicorns – those that grew from $0 to $1 billion+ valuations in the shortest space of time – came from Berlin. Grocery delivery service Gorillas, for example, took just ten months from its inception to achieve unicorn status.

The top-five sectors for European unicorns (by volume and valuation) are IT, media and telecoms; fintech and ecommerce; future mobility and supply chain; AI and big data; and life sciences, healthtech and beauty, according to i5invest data.

Happy hunting ground

While the current macroeconomic backdrop might dampen funding rounds during the remainder of this year, PitchBook says Europe held up better than the US and Asia in the first half of 2022. By mid-June, capital invested in European startups had reached €54.4 billion, more than 50% of last year’s total and on course to exceed €100 billion for the second year in a row. By contrast, the US was at 42% of last year’s total deal value, with Asia languishing at just 30%.

So for investors seeking to find the next batch of unicorns, Europe is likely to remain their fastest-growing breeding ground.

Footnotes

[1] Pitchbook

[2] Pitchbook

[3] McKinsey

[4] European Unicorn Map

Disclaimer

This material is provided for information and educational purposes only. Titanbay does not provide investment advice or make investment recommendations and nothing in this material should be construed as legal, tax, investment advice or an invitation, general solicitation, recommendation, or offer to buy, sell, or hold any investments or securities offered on or off the Titanbay investment platform, or to engage in any other transaction in any jurisdiction.

All information presented herein is considered to be accurate at the time of production unless otherwise stated and has been prepared from sources we believe to be reliable. No representation or warranty or guarantee, express or implied, is given as to the truth, accuracy or completeness of the information or opinions contained herein. No reliance may be placed for any purposes on the information or opinions contained in this material and material aspects of descriptions contained in this material are subject to change without notice. Non-affiliated entities mentioned are for informational purposes only and should not be construed as an endorsement or sponsorship of Titanbay. This material in no way constitutes Titanbay research and should not be treated as such.

Investments in private placements and private equity investments via feeder funds in particular, are complex, highly illiquid and speculative in nature and involve a high degree of risk. The value of an investment may go down as well as up, and investors may not get back their money originally invested. Investors who cannot afford to lose their entire investment should not invest. Past performance is not indicative of future performance. For private equity investments via feeder funds, investors will typically receive illiquid and/or restricted membership interests that may be subject to holding period requirements and/or liquidity concerns. Investors who cannot hold an investment for the long term (at least 10 years) should not invest.

This material is confidential and may not be disclosed, reproduced, copied, distributed, or published (in whole or in part) by the recipient without the prior written consent of Titanbay.