Coronavirus recession?who's most at risk?

February saw concerns over coronavirus truly go global, as cases emerged across Europe and the US, shattering the illusion that this was an infection limited to China.

Whilst public safety and containment of the outbreak must clearly be the primary concern, for financial markets the key question is will the virus cause a recession?

It is no longer a question of whether coronavirus will have an economic impact—you only need to watch the news of school closures, cancelled flights and public events to see this. What matters now is will the impact be short-lived and can lower interest rates encourage a rapid recovery in confidence and business activity?

Alternatively, the impact could be more severe as global supply chains break down and business and consumer activity grinds to a halt—China’s economic survey data for February crashing to a record low, eclipsing even the financial crisis, is not a good omen.

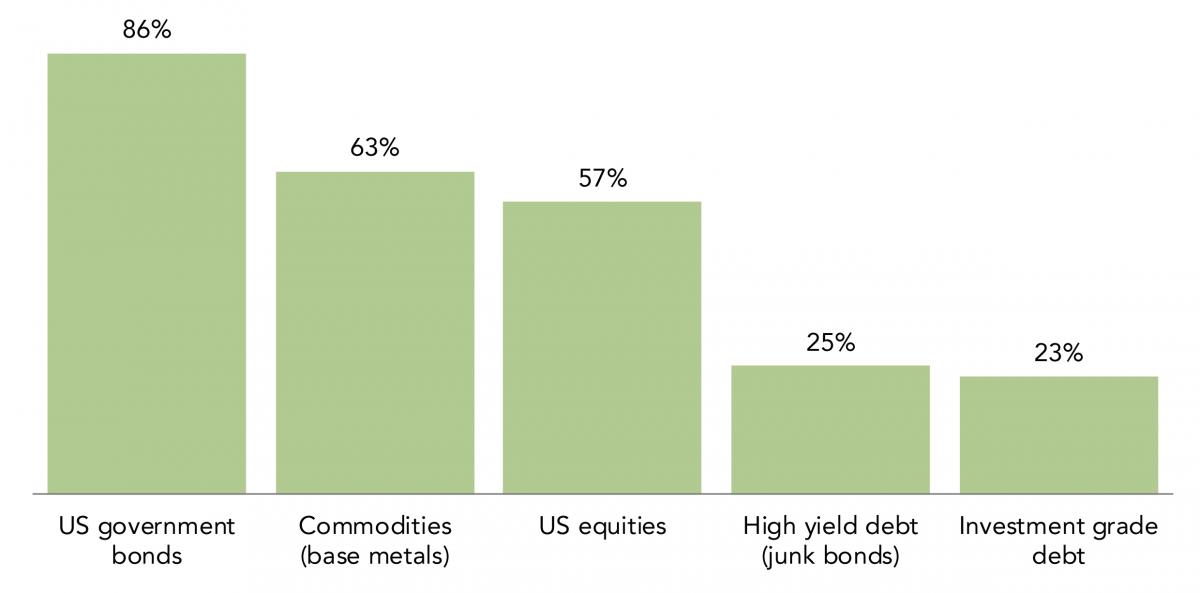

With uncertainty rife, perhaps the best approach is to look at which markets are already pricing in some sort of recession. This month’s chart shows recent estimates (using asset prices at the end of February) of just how much recession risk is priced into different asset classes.

Probability of recession priced into asset classes at end of February

Source: JPMorgan, prices at 29 February, 2020

Source: JPMorgan, prices at 29 February, 2020

The message from government bonds is clear: record low yields already assume weak economies and rate cuts. In fact, if the economic impact is short-lived, then these bonds are likely to lose money.

Equities are less certain—after one of the fastest 10% declines on record, they are at least pricing in some risk of a recession.

Corporate debt markets however seem totally unprepared—be it higher quality (investment grade) bonds or the riskier high yield end of the market—formerly known as ‘junk bonds’, until they changed the name. If economies move into recession it is always the most indebted businesses that fare the worst. They just don’t have the cash cushion to last through a downturn.

Low, zero, or even negative, interest rates have pushed ordinary savers in their droves to buy riskier corporate debt seeking higher yields. The companies on the other side of this trade have been only too happy to help. Witness the recent enormous rise in corporate debt, typically executed to fund share buybacks rather than investment in productive assets.

Low, zero, or even negative, interest rates have pushed ordinary savers in their droves to buy riskier corporate debt seeking higher yields. The companies on the other side of this trade have been only too happy to help. Witness the recent enormous rise in corporate debt, typically executed to fund share buybacks rather than investment in productive assets.

If economic growth slows, let alone a recession, then profits go into reverse, and questions will be asked of the more indebted companies. Investors in corporate bonds are simply not being paid enough for the risks. This seemed true before coronavirus, and now looks certain. Ultimately, it is the credit market that central banks (and investors) should be fearful of.

It goes without saying that Ruffer did not in any way predict the onset of COVID-19. However, we have been concerned for some time that equity and credit markets were priced for perfection, and that a material change in economic direction could expose their underlying fragilities. That is why we hold powerful credit protections across our portfolios. ‘Fear’ assets that are now making money as stock markets fret.

Past performance is not a guide to future performance, investments can go down as well as up and you may get back less than you originally invested. The information contained in this document does not constitute investment advice or research and should not be used as the basis of any investment decision. Ruffer LLP is authorised and regulated by the Financial Conduct Authority.