The Bank of England's inflation forecast looks like a triumph of hope over reality

Who’d be a central banker today? Once, they were the masters of the universe, bravely slaying the dragon of inflation and slashing interest rates to save the economy in times of peril.

Today, they seem powerless to control inflation. Fearful of raising interest rates too far, they issue hollow calls for wage restraint. No wonder Andrew Bailey, Governor of the Bank of England, admitted to MPs recently that “It’s a very, very difficult place for us to be in.”

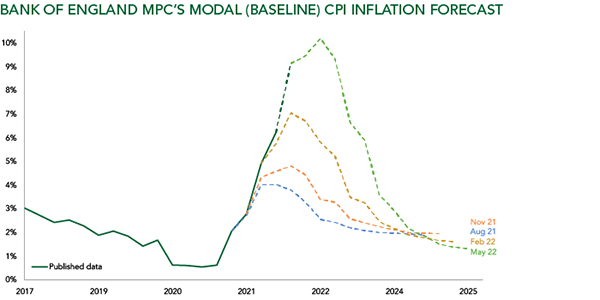

Just 12 months ago, as the chart below shows, the Bank of England was predicting inflation would be less than 2.5% today. In fact, it has just hit 9%, and the Bank expects it to exceed 10% by the year end. That is some forecasting error.

Of course, the war in Ukraine, soaring energy and food prices, supply chain disruption and the covid lockdowns in China were all – to a greater or lesser extent – not easily predictable.

But what really puzzles us is their forecast that inflation will miraculously fall back to the official 2% target by early 2024. It seems central bankers are still addicted to the notion of ‘transitory’ inflation.

There are really only two ways for that target to be met. Either the Bank intends to raise rates high enough to plunge the economy into recession. Or it is desperately hoping energy and food prices stabilise, supply chains are unblocked, deglobalisation is reversed and, most importantly, wages don’t rise.

Back in the real world, average earnings (as measured by the Bank of England itself) are already rising at 4-5%. If you include bonuses and other payments, the latest number is more like double that.

The good news is that unemployment is now just 3.7%, the lowest since 1974, and job vacancies are at all-time highs. For the first time since records began, there are more job vacancies than unemployed workers.

The bad news is that such a tight labour market points to rising wages. If earnings rise to offset the ‘cost of living’ crisis, then inflation will become embedded in the system. Government payments to offset soaring energy costs, though welcome to those struggling to pay soaring energy costs, can have much the same effect.

We expect central banks to conclude that inflation may be the lesser of these two evils, especially given the high levels of debt in the economy. But investors should be in no doubt about the threat it poses to both equities and bonds. After all, as John Maynard Keynes wrote in 1924: ‘inflation is unjust and deflation inexpedient. Of the two perhaps deflation is the worse; because it is worse, in an impoverished world, to provoke unemployment than to disappoint the rentier.’

Sources: Bank of England, Office of National Statistics

Chart source: Bank of England, modal projections based on market pricing for Bank Rate over the forecast horizon, MPC’s modal (baseline) CPI inflation forecast

Past performance is not a guide to future performance. The value of investments and the income derived therefrom can decrease as well as increase and you may not get back the full amount originally invested. Ruffer performance is shown after deduction of all fees and management charges, and on the basis of income being reinvested. The value of overseas investments will be influenced by the rate of exchange.

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. This document does not take account of any potential investor’s investment objectives, particular needs or financial situation. This document reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. Read the full disclaimer.