Are we nearing the end of Yield Curve Control (YCC) in Japan?

So far in 2022, the Bank of Japan (BoJ) has resolutely stuck to its policy of negative interest rates and yield curve control (YCC), despite the dramatic hawkish shift from the US Federal Reserve (the Fed) and, more recently, the yen’s nosedive. Might the BoJ be about to change course?

Its reluctance to act reflects the apparent quiescence of CPI inflation in Japan, which is currently running at only 1.6% on a core (excluding fresh food & energy) basis. I say ‘apparent’ because inflation may soon move sharply higher. Surveys suggest companies’ pricing intentions are as strong as they have been in decades. The sharp depreciation of the yen – 25% so far in 2022 – strengthens these impulses. Most strikingly, Japanese consumers know the inflationary surge is coming: 60% of Japanese adults now expect inflation to be 5% or higher a year from now.

What holds the BoJ back? Those who promoted YCC are loath to end it before securing an unequivocal victory in the battle against deflation. And for now, the BoJ judges that the inflation spike will prove transitory.

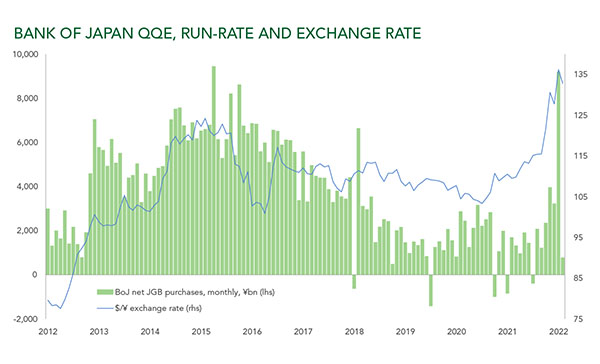

The consensus is that the BoJ will hold the line well into next year – and that, when it eventually moves, it will only tinker with its yield curve target, rather than abolish it. On both counts, we are not convinced. Nor, it seems, are other investors: the blue line in this month’s chart shows just how far the yen has fallen out of favour.

The yen is now at a 24 year low against the US dollar. Even more notable, BoJ purchases of Japanese government bonds (JGBs) have surged to defend the 10 year yield target in the face of intense selling pressure.

So the writing may be on the wall for YCC. Partly, this is for economic reasons: the ‘transitory’ inflation narrative has proved, well, transitory in country after country, as consumer-facing sectors have reopened after the pandemic. Unlike the US or the UK, Japan’s consumer economy is only now exiting its covid-induced stasis.

But it is primarily for political reasons: electorally, inflation is deeply unpopular in Japan. Yet the BoJ remains committed to deliberate action that de facto worsens the cost-of-living crisis. Still heavily influenced by its political masters, the BoJ may soon be pressured into a course correction.

It hopes to be bailed out by the coming global downturn: lower energy prices and a Fed loosening cycle would bolster the yen and undermine current imported inflationary impulses. But this may not come soon enough. The Fed is hell-bent on pushing dollar interest rates dramatically higher; and further relief on imported energy costs seems unlikely before domestically generated inflation rises. Yen dynamics already indicate that investors are sceptical of the BoJ’s strategy. In the months ahead, FX markets may leave the BoJ no option but to change course.

If it does, the repercussions could be material for financial markets. Japan’s central bank is a big source of global demand for interest rate-sensitive assets, and the nation’s domestic investor base is highly active overseas. Releasing the YCC pressure valve would not only reverse the yen’s slide but also suck liquidity from fixed income markets outside Japan.

With sentiment already undermined by rampant inflation, aggressive Fed tightening and persistent dollar appreciation, the demise of YCC may well be enough to trigger the next phase of the bear market.

Sources: Bank of Japan, Bloomberg

Past performance is not a guide to future performance. The value of investments and the income derived therefrom can decrease as well as increase and you may not get back the full amount originally invested. Ruffer performance is shown after deduction of all fees and management charges, and on the basis of income being reinvested. The value of overseas investments will be influenced by the rate of exchange.

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. This article does not take account of any potential investor’s investment objectives, particular needs or financial situation. This article reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. This financial promotion is issued by Ruffer LLP. Read the full disclaimer.