Would a stock, by any other name, rise just as high?

Traditional finance theory tells us that markets are rational. Investors incorporate all public and private information when making their investment decisions. This school of thought is grappling with the field of behavioural finance, which asserts that human psychology and biases also act in an irrational way to influence these same investment decisions.

One well recognised phenomenon in psychology is the fact that individuals show a preference for information that is easy for the brain to process. This characteristic is known as fluency and leads to feelings of familiarity, affinity and a positive impact on our judgement. Rhyming proverbs such as ‘woes unite foes’ are believed to be truer than snippets such as ‘woes unite enemies’.

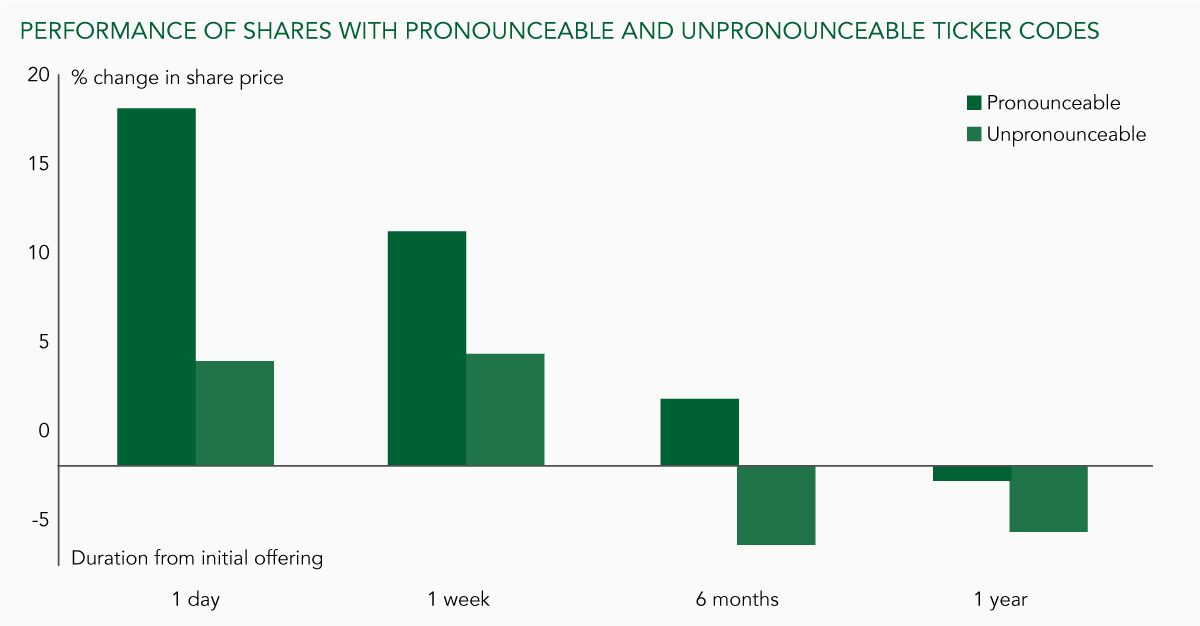

A collection of studies over the last decade has shown that this phenomenon occurs in stock markets. The first of these, in 2006, found that the early performance of a listed share, for example following an initial public offering (IPO), is positively influenced by the pronounceability of the company name and ticker symbol. Those companies with easier-to-process names and tickers performed better over the short term.

A collection of studies over the last decade has shown that this phenomenon occurs in stock markets. The first of these, in 2006, found that the early performance of a listed share, for example following an initial public offering (IPO), is positively influenced by the pronounceability of the company name and ticker symbol. Those companies with easier-to-process names and tickers performed better over the short term.

Fig 1 Actual performance of shares with pronounceable and unpronounceable ticker codes in the AMEX market after entry to the market, from 1990-2004

This finding is particularly telling given the failure of many complex, economic models to determine significant drivers of short-term price movements. The answer may be something as irrational as name fluency.

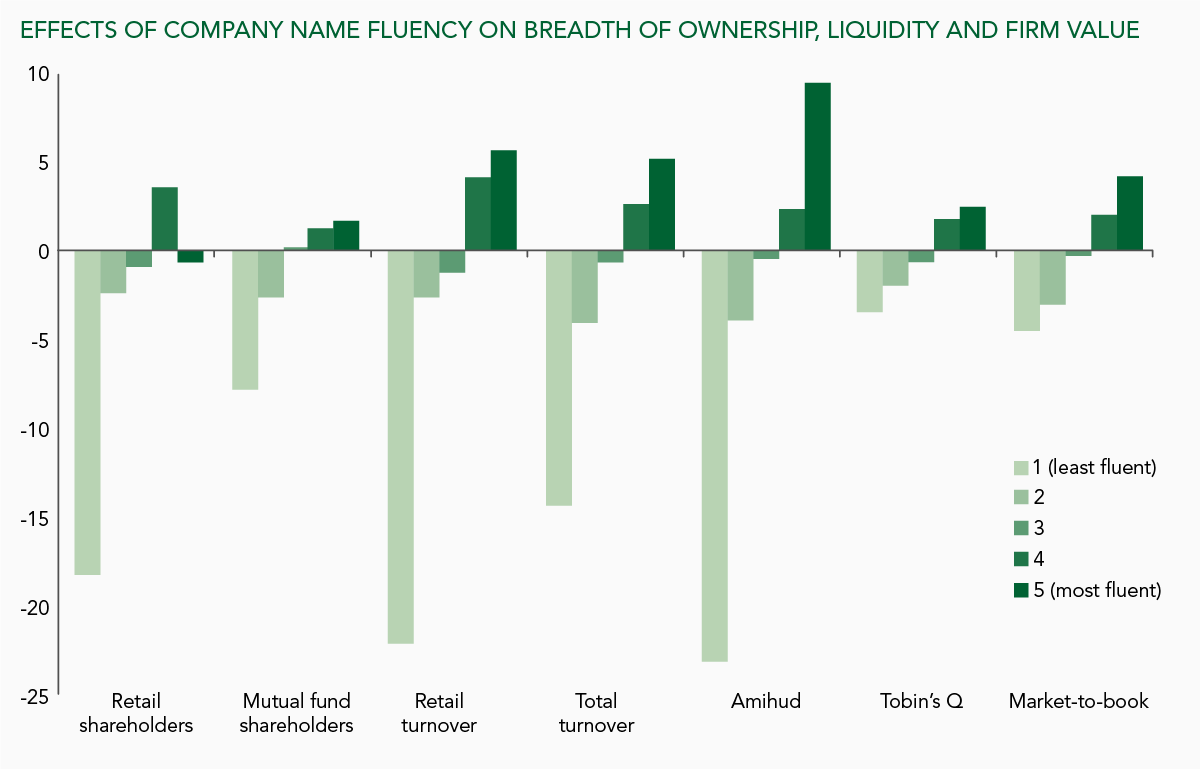

Since then, studies have expanded on these results. In 2013 a pair of researchers identified that those companies with fluent names tend to have a broader shareholder base, greater levels of share turnover and better liquidity profiles. Fluency in this case was defined using metrics such as length, Englishness and performance in a standard spell checker. More fluent names led to higher valuations (price-to-book ratio) and greater firm value. Amongst smaller firms, the results were particularly robust, perhaps since investors are less familiar with the company’s underlying fundamentals and must resort to the simplicity of the name. They go further. The fluency effect is also seen within firms. A change in company name to a more fluent option also translated into an uplift in firm value, implying that fluency is not a proxy for a company that is larger, better run and more familiar.

Fig 2. The effects of company name fluency on breadth of ownership, liquidity (Amihund score) and firm value

This phenomenon is not confined to the western markets and languages. A 2018 study on A-share listed Chinese companies found that those with simple ticker symbols, based on length and number of strokes, also traded with higher liquidity and superior performance following an IPO. Once again the effect is more pronounced where there are higher levels of information asymmetry.

In sum, the evidence implies that investors respond positively to more fluent stock market stimuli. Elements unrelated to company fundamentals are impacting investor evaluation. And what’s more—this is a global occurrence. Such an effect predicts that companies with names like ‘Apple’ will be afforded more preferential trading characteristics than companies with names like ‘Bristol Myers Squibb’, at least initially. If so, it is an obvious method for a management team to improve investor recognition, company trustworthiness and firm value.

Fig 3. Fluency scores from Green & Jame (2013) that are publicly available for Ruffer’s equity holdings

In the field of psychology, it has been known for some time that individuals rely on heuristics and mental shortcuts when evaluating information. It seems that in today’s world of excessive information and data, this is also apparent in financial markets. Cognitive constraints force individuals to be selective about processing information and ultimately prefer that which is fluent.

On reflection, this phenomenon occurs time and again in different forms. A variety of the fluency effect was at work when public companies experienced a significant boost in value after changing their name to include ‘.com’ or ‘blockchain’ during both the dotcom and bitcoin booms. Evidence suggests that theme park rides with more complicated names are deemed to be more risky and less popular. The same is true for drugs and food additives. The cognitive ease with which stimuli can be processed has a positive impact on its evaluation, in all walks of life. This has wide reaching implications. Information is not cognitively equal and we should consider the fluency and simplicity of any that we choose to present. It may have a profound effect on how it is valued.

[1] Alter & Oppenheimer 2006: ncbi.nlm.nih.gov/pubmed/16754871

[2] By including data on ticker symbols the method removes words such as ‘technologies’ or ‘bank’, from which investors could derive useful information.

[3] Green & Jame 2013: pdfs.semanticscholar.org/2fc7/8dae0193311e2e13dbfda4d212f430e7ea91.pdf

[4] Englishness is based on a linguistic algorithm developed in 1978 which assesses the pronounceability of a word by determining the probability of three letter strings in the English language.

[5] Fang and Zhu 2018: onlinelibrary.wiley.com/doi/epdf/10.1002/rfe.1050

Chart 1 Performance of shares with pronounceable and unpronounceable ticker codes in the AMEX market after entry to the market, from 1990-2004. Source: Alter & Oppenheimer 2006: ncbi.nlm.nih.gov/pubmed/16754871

Chart 2 source: Green & Jame 2013: pdfs.semanticscholar.org/2fc7/8dae0193311e2e13dbfda4d212f430e7ea91.pdf

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument. The information is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. References to specific securities should not be construed as a recommendation to buy or sell these securities. This document reflects Ruffer’s opinions at the date of publication only, and the opinions are subject to change without notice.

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument. The information is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. References to specific securities should not be construed as a recommendation to buy or sell these securities. This document reflects Ruffer’s opinions at the date of publication only, and the opinions are subject to change without notice.

Ruffer LLP is authorised and regulated by the Financial Conduct Authority. © Ruffer LLP 2020