Why India's wealthiest families are setting up family offices

Family offices are becoming increasingly popular amongst India’s growing ultra-wealthy population, but while family businesses are deeply entrenched in the country, family offices are still a relatively new phenomenon. Susan Lingeswaran reports

When Uday Kotak, managing director of Kotak Mahindra Bank and the eighth-richest person in India, announced earlier this year that he was setting up a family office to invest his $10.3 billion fortune, it was hard to ignore the sense that a tide had turned.

Traditionally, it was European and American families who dominated the global office space. Yet for observers, Kotak’s headline-hitting foray signalled that the long-predicted boom in India’s family office scene could have started in earnest.

This trend is a move away from the previous generation’s preference for reinvesting any profits back into the family business and avoiding risky ventures. Increasingly India’s rapidly increasing population of ultra-high net worth individuals have started to set up their own family offices to manage and grow their wealth and create a lasting legacy for generations to come.

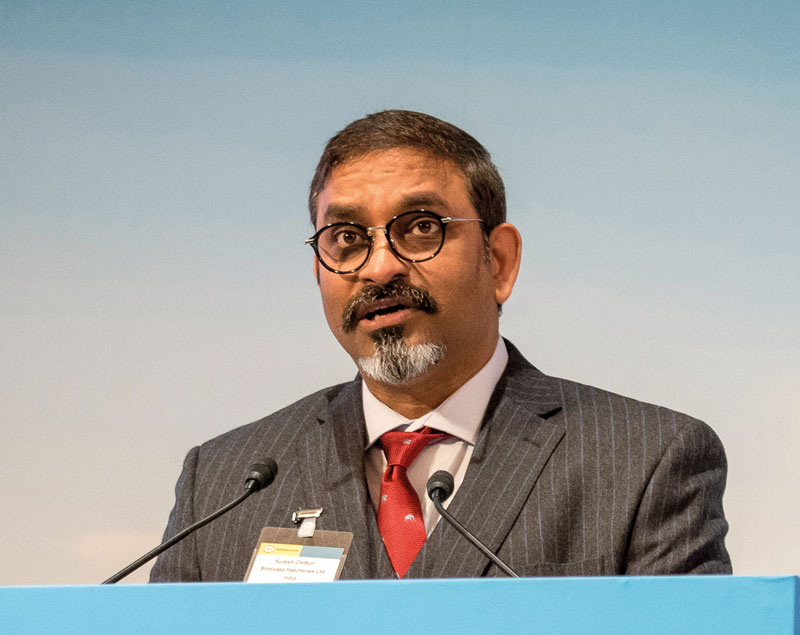

One of these wealth holders is Suresh Chitturi, vice chairman and managing director of Hyderabad-based second-generation poultry giant Srinivasa Farms. He is looking for guidance as he sets up his family office to invest in new asset classes and ensure a smooth transition of wealth to the next generation.

One of these wealth holders is Suresh Chitturi, vice chairman and managing director of Hyderabad-based second-generation poultry giant Srinivasa Farms. He is looking for guidance as he sets up his family office to invest in new asset classes and ensure a smooth transition of wealth to the next generation.

However, the family office space is still quite nascent in the region. There are only about 45 formal family office structures in India compared to an estimated 5,300 single family offices worldwide, according to the Family Wealth Report 2018: A Roadmap for the Indian Family Office by Campden Research in partnership with Edelweiss.

Chitturi says the infancy of India’s family office industry, together with the fact that the majority of wealth management providers are Mumbai-based, means there is a lack of knowledge among him and his peers about best practice.

“We definitely see that setting up a family office is something we have to do because our old ways of doing things and transferring wealth is not appropriate anymore, but we are still trying to understand the different aspects,” he says.

What then are the main things to consider while setting up a family office in India?

Getting started

If a family is considering establishing a family office, the first question its members need to ask themselves, is what size structure is actually right for them, says Dr Rebecca Gooch, director of research at Campden Wealth.

“Running a family office can be a costly enterprise, so it is important to consider the cost implications. Also [consider] the reasons for wanting to set up a family office and if the services desired are best undertaken through this type of structure,” Gooch says.

This is something Nitai Utkarsh, a family office executive based in India, agrees with. To Utkarsh, a family office has to have a purpose that is deeply considered and researched—similar in many ways to the reasons for setting up a business.

“It cannot be a fad, a ‘peer-did-this-so-I-have-to-do-it’ phenomenon,” he says.

“If you are unsure, you can start by using a multi family office to get a sense of what it takes to have a family office and if you know the process and feel you can make the time and effort, then you should look at setting up your own family office.”

“If you are unsure, you can start by using a multi family office to get a sense of what it takes to have a family office and if you know the process and feel you can make the time and effort, then you should look at setting up your own family office.”

For Jai Rupani, chief investment officer of Bangalore-based Dinesh Hinduja single family office, knowledge sharing with other established family offices was the key when he was setting up his father-in-law’s family office.

After Rupani’s father-in-law Dinesh Hinduja’s exit from second-generation manufacturing giant Gokaldas Exports in 2007, Rupani was tasked with setting up a single family office to manage the wealth of the family and its transition to the next generation.

Not knowing where to start, Rupani spent a year attending conferences around the world, gathering knowledge and meeting families that had already established family offices.

“The first thing I did was go and meet other family offices in India—however, in India it is still a very nascent space,” he says.

“The first thing I did was go and meet other family offices in India—however, in India it is still a very nascent space,” he says.

“I went to meet families in Europe and London to learn about their journey.

“If you are contemplating setting one up, go and meet the guys who are ahead of you in the pack and you can ask questions about how they started, what worked for them, and what didn’t work.”

Setting up

There is no standard to follow since every family has a unique set of circumstances. In addition to taking into account the size and diversity of the family portfolio, it is critical to consider the family’s investment objectives, risk appetite, and the objectives of different generations.

“The only way to find out what your family office needs to oversee, is to ask yourself a lot of tough questions about the future and the answers will give you a better picture of how to build your family office,” says Rupani.

“We have the whole package—investment, succession, governance—but we want to tackle them one by one, starting with the investment piece because for us, it is an iterative process.”

Asking tough questions was something Leena Dandekar, principal of the Raintree family office, also did with her two children when she decided to set up her single family office after selling her stake in the larger fourth-generation Dandekar family office, Camlin Group, in 2017.

“We sat down together and came up with a list of what we wanted to do and quite a large list of what we did not want to do, and that gave us something solid to work on with professionals,” she explains.

“Our family office was set up to help facilitate our impact investing and our philanthropic ventures, but we are involved in all aspects of activities, including tax planning, governance, and succession planning.”

But while Rupani and Dandekar have set up their single family offices to manage the full spectrum of family office activities, Utkarsh says most others have focused solely on the investment aspect of family office activity.

“That is because today you do not really have a family office space in India—it is full of people with private banking or asset management backgrounds and they need to understand there are other aspects of family offices, not just the numbers,” he says.

“The industry is really nascent right now, but over the next two to three years, I think the other aspects, like governance, will come to the front.”

Governance and best practice

Family office decision making can sometimes be complex, requiring collaborative decision making on a variety of initiatives, from philanthropic and investment endeavours to goals of various generations.

Best practice entails drafting mission statements, appointing a board of directors for the family office, and creating oversight committees for specific aspects of the office’s operations. In addition to family members, the board should include external professionals with appropriate expertise.

However, the Family Wealth Report 2018 found just a quarter (26%) of the Indian family offices surveyed had documented mission statements in place, which is lower than the global average of 32% reported in Campden Research’s Global Family Office Report 2018.

“People [in India] are used to being flexible and so there is a bit of caution in formalising everything too early,” says Rupani.

“People [in India] are used to being flexible and so there is a bit of caution in formalising everything too early,” says Rupani.

“There is a feeling that it can go the wrong way where it is restricting and then the children do not have the chance to follow their own pursuits.”

But Utkarsh believes once the family office space in India matures, more families will understand the benefits of governance structures.

“This is a work in progress for Indian family offices right now—they understand they need a family board, investment policy and maybe an advising board and they are working towards that,” he says.

Taking a bold step is Dandekar’s Raintree family office, who believes that far from stifling her children’s pursuits, the many governance structures in place gives them the freedom to pursue their own interests.

Taking a bold step is Dandekar’s Raintree family office, who believes that far from stifling her children’s pursuits, the many governance structures in place gives them the freedom to pursue their own interests.

Working with multi family office Waterfield Advisors, which manages 30 families with $2 billion assets under management, Dandekar has installed advisory councils for the philanthropy and impacting investing arms of her family office and an investment committee to evaluate their investments into the alternative asset space.

“Because we have all these structures and teams in place looking after all the activities, it allows my children to have another day job doing things that they really like to do instead of just looking after the family wealth.”

Handing over the baton

Succession planning can be a difficult subject to broach in most countries, but it is even harder in India, where dialogue between the generations is not as free and flexible as it is in the West. Those who have not been able to manage a smooth transition to the next generation have found themselves wasting time and resources on family squabbles.

“Succession planning in India is difficult—very few patriarchs want to talk about it,” Rupani says.

“There is a fear of losing control, since historically controlling the economic purse strings meant you controlled the direction of family members.”

This hesitancy among Indian family offices to plan succession is widespread. Less than a fifth (19%) of the Indian respondents in the Family Wealth Report 2018 said they had a formal plan, 29% said theirs was simply verbally agreed, and 15% said they had no plan at all.

This hesitancy among Indian family offices to plan succession is widespread. Less than a fifth (19%) of the Indian respondents in the Family Wealth Report 2018 said they had a formal plan, 29% said theirs was simply verbally agreed, and 15% said they had no plan at all.

“What I am seeing across the board in India is that the first generation wealth owners are grappling with transition issues,” says Utkarsh.

“What a lot of families need to do now is just learn to talk to each other about what they want for the future. If they cannot, then the family office can step in and help that situation by asking the tough questions and being that buffer.”

Rupani agrees: “Often there is a different reason than the one being stated for the lack of action on a topic like succession. It often needs an external neutral adviser to help navigate so finding a few such advisers will make your journey a lot more fruitful.”

Rupani agrees: “Often there is a different reason than the one being stated for the lack of action on a topic like succession. It often needs an external neutral adviser to help navigate so finding a few such advisers will make your journey a lot more fruitful.”

Encouragingly, more than half (56%) of those surveyed in the Family Wealth Report 2018 said next-generation family members hold family office or wealth management roles, while a fifth (20%) sit on the board. Close to two-thirds (64%) said they have a strong influence over the family business, while 57% said they have a strong influence over long-term investment decisions.

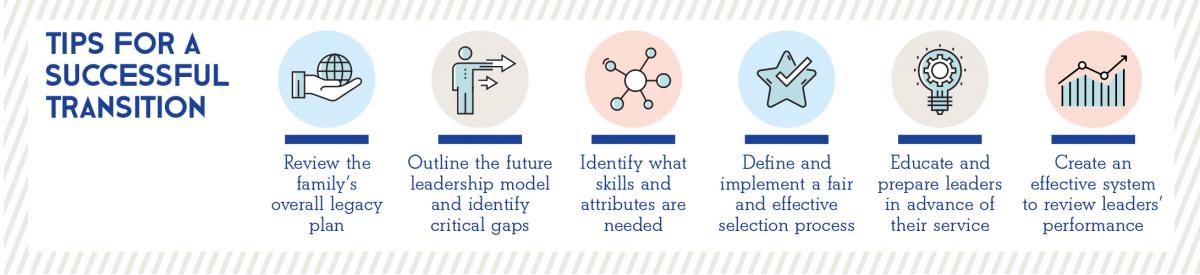

Gooch says while this is a good start, there are a number of ways that families can better prepare the next generation for succession.

“Formal education at top universities and business schools, and gaining experience both outside and within the family office or foundation, are just a few,” she says.

“Some families even hire external wealth management advisers to train their children how to manage their finances before they reach adulthood. Beyond this, a great deal of learning starts at home and family communication and parental nurturing are key.”

Getting it right, the first time ‘round

Like most decisions, there are benefits and challenges to creating a family office. When implemented and structured properly, it can enable families to grow their wealth and perpetuate their legacy for the benefit of generations to come.

But it is not an easy undertaking and setting one up without gathering sufficient knowledge and consulting the right professionals can lead to wasting valuable time and funds.

If one traces the family office concept back through history, from medieval royalty to John D. Rockefeller, one aspect remains constant—the presence of the best and brightest to manage what families of wealth could not and teach family members how to preserve a legacy.

If one traces the family office concept back through history, from medieval royalty to John D. Rockefeller, one aspect remains constant—the presence of the best and brightest to manage what families of wealth could not and teach family members how to preserve a legacy.

And this is where families should start, advises Gooch.

“There are professionals with expertise in this area that can help families understand the intricacies of the family office space and how best to set one up that is right for them,” she says.

“Family offices are as unique as the families themselves, so it is important to take the time to get it right.”

Family offices explained

In its simplest form, a family office is a private office for families of significant wealth, which manages the family’s assets, investments, tax consolidation and estate management. It also acts as a vehicle to preserve the family’s legacy through philanthropic ventures, next-generation education, succession planning and governance.

The number of staff working within a family office can vary considerably, from one or two employees to 100 or more, depending on the breadth of services it provides.

There are different types of family offices, the most popular being hybrid family offices, multi family offices, single family offices and virtual family offices.

Hybrid family offices keep functions strategic to the family’s objectives embedded in a family business, employing experts in tax, legal, and asset allocation. Multi family offices are firms which manage the affairs of multiple wealthy families. Single family offices are set up independently of the family business and retain full-time, in-house professionals to meet the needs and aspirations of the family. While virtual family offices outsource the large majority of the work to service providers, thus only needing one or two internal staff.