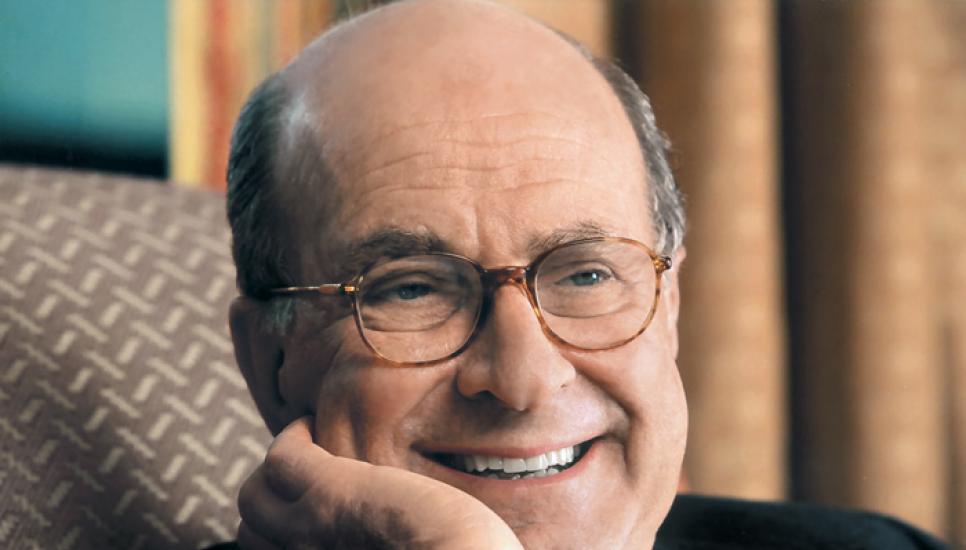

Icon: Edgar de Picciotto

Edgar de Picciotto was a pioneer to hedge fund investors, “the smartest man in Europe” to his disciples, and the patriarch of a dynasty that upholds his legacy of astute, innovative, and independent wealth management.

De Picciotto founded Geneva-based Union Bancaire Privée (UBP) in 1969 and turned it into one of the world's biggest family-owned banks.

UBP remains the only continuous family banking group out of the trio set up by the three hugely influential sephardic Jewish bankers of the late 20th century, alongside Gilbert de Botton, founder of Global Asset Management, and Edmond Safra, founder of the Republic National Bank of New York.

Ethical business acumen was instilled in de Picciotto as a child in lively family dinner table discussions in Lebanon. After studying, he settled in Switzerland in 1954 where his father-in-law organised internships for him at investment houses in Geneva.

Inspired by the growth of mergers and acquisitions while working in London and the US, he joined Société Bancaire de Genève two years later. He earned a reputation as a sharp financier and helped boost turnover to unequalled levels.

He created his own bank, Compagnie de Banque et d'Investissements (CBI), with a capitalisation of CHF8 million ($8.27 million) in 1969. At the end of the first financial year, earnings were substantial and he employed 20 people.

The renamed UBP never stopped growing under his stewardship, with a string of major acquisitions, more than $100 billion in assets under management and almost 1,500 multinational staff by the time he died.

The UBP annual report of March 2016, the month of de Picciotto's death, hailed its founder as a “creative visionary and pioneer” in banking who ensured early on the group's longevity by integrating the second generation of his family into the business.

The family controls the bank through CBI Holding SA. Eldest son Daniel de Picciotto, a board member since 2010, succeeded his late father as chairman.

Edgar's daughter, Anne Rotman de Picciotto, has sat on the board since 2002 while another of his sons and chief executive, Guy de Picciotto, has steered the bank's operational management since 1998.

Byron Wien, American vice chairman of Blackstone Advisory Partners, described the Bordeaux and cigar aficionado as “the smartest man in Europe”.

De Picciotto knew a good investment had three phases, Wien said.

“The period when you are waiting for an offbeat, but promising, idea to work; the period when everyone agrees with you and the stock or asset performs well; and the final period when the asset may still be appreciating but it is time to look for something else because the additional gains will be small.”

Wien was “forever grateful” for what the rule-breaking de Picciotto taught him.

“He sought high rewards and was willing to tolerate high risk in the process.”