Harshit Agrawal: ‘Innovation has been a fundamental part of what we do from day one’

As a second-generation entrepreneur and family office executive, Harshit Agrawal is constantly pushing towards a vision based on equity and sustainability.

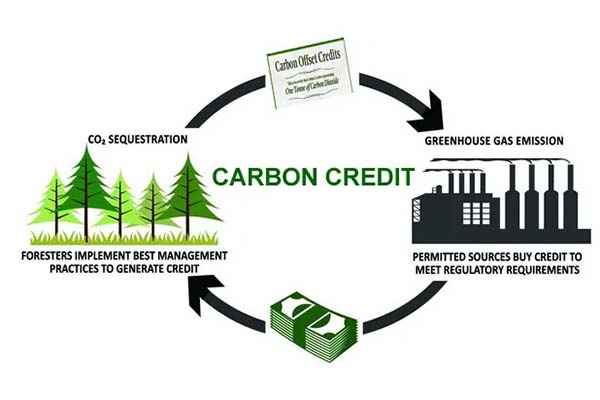

Following in the footsteps of his family’s Shanti Group, a collection of companies spanning a wide variety of industries, Harshit (who is based in Raipur Chhattisgarh, India) is building on his father’s legacy of innovation while pursuing his own passions, including running a venture capital fund and spearheading a carbon footprint and carbon credit advisory called Blue Earth.

“Our formula for ‘A Better World’ is an infinite community of like-minded people,” says Harshit. “We aim to make a global impact to transform the carbon credit and climate investment landscape while paving the way for a healthier, greener planet. We are ready to lead the charge. As the saying goes, “Where there is a will, there is a way.”

Here, Harshit Agrawal talks about this origins of his family business, how he’s pushed it forwards into new and diverse arenas and what we can do better to address issues of carbon responsibility…

Can you talk a little about the origins of Shanti Group and how it got to where it is today?

Shanti Group was initially started by my father. He began his journey around 1997 by launching into PVC pipe manufacturing. From there, he diversified into mining, oil and gas, renewable power generation, schools and hospitals, and warehousing and logistic parks. He also diversified into various other ventures, including commodity trading, real estate and construction.

Ever since he established the group, we have seen growth trajectory into many different ventures. This led us into starting a family office, which invests into various other startups around private and public equity or acquiring companies which are going bankrupt.

I, as the second generation, joined Shanthi Group in 2019 and have been actively involved in business operations across sectors and handling family office interests since then, which has helped me to hone my investment interest and acumen. I've also started my own venture inside Shanti Group called Blue Earth, an end-to-end sustainability ‘matchmaker’ which helps companies to define and report their sustainable activities and also generate carbon credits as a commodity from those sustainable activities.

We have always aimed for an innovative approach rather than a cost-effective approach because we believe that is the key to success.

As a director of Shanti Group, you’ve seen it grow and diversify. How have you been inspired by your family firm’s approach to innovation in your own work?

Innovation has been a fundamental part of what we do from day one. We have always aimed for an innovative approach rather than a cost-effective approach because we believe that is the key to success. Innovation is the reason my family ventured into startup investments at a very early age and at a point when very few other Indian business families were doing the same.

As a serial founder and angel investor, can you talk us through what piques your interest and if your investments share similar goals?

We see startups as an R&D industry where they do much of the research and development that would usually have been done directly inside our group. We are very well connected with all the startups we have invested in. There are synergies which we align with our own business model and network to help them to grow. We are open and ready to deliver to these startups and to give them the best possible support they can get.

Your latest venture is as founder of carbon footprint and carbon credit advisory Blue Earth, why did you chose to focus on this?

I was traveling to meet a couple of venture equity players in Delhi and I received a deck on my WhatsApp pretty late in the evening. I was scrolling through the PDF and there were some financial numbers which did not add up, so I couldn’t sleep. Around 5am in the morning, I called my father and said, ‘I have an Excel sheet in front of me, and the numbers don't add up’. He was like, ‘Why are you are wide awake so early in the morning?’

This is where I got attracted towards the sustainable sector and the seeds of Blue Earth were born. We started building a team and got talking to the people around the industry in and outside India. Once we got a better understanding and clarity about the state of the sustainability industry, it was a no brainer for us to go ahead.

As a new generation to the group, I wanted to do something beyond the family business. It just felt that, with the market opportunity and global network, it was the right opportunity to be a part of.

It’s vital that companies understand their responsibility towards the environment.

How have you seen Indian SMEs and family businesses addressing the issues of carbon responsibility? What can be done better?

All SMEs today are aware about sustainability and what is required for it to be done right. Companies need to start take taking actions and focus on a long-term vision. No one can achieve sustainability in day one.

It’s vital that companies understand their responsibility towards the environment. And they need to start taking small actions towards it from today, rather than just focusing on making profits and saving as much as they can.

Following the agreements at COP28, do you see an urgent uptick in focus on carbon credits?

International policy makers need to realise that it's not just about bringing in burden to the corporates. Every nation is ready to commit towards sustainability, what actually needs to happen now is to give corporates a mandate, to show them this is the path we need to follow. Once that path is laid out, things will ease out for corporates and start shaping up in a positive manner for a sustainable future.

International policies need to align with individual government policies. Unless these policies work hand in hand, outcomes will not arrive in a positive manner. A more stringent and target-driven approach should be taken with clear objectives for corporate to meet.

How important is what do you do from a corporate and social responsibility (CSR) point of view?

CSR is a very broad term in today's world and it is a very important factor which needs to be kept in mind when policies are being made. CSR is used for individual welfare development programmes, such as education or hunger, but we see CSR being more effective and impactful if they are divided into multiple layers. For example, if each corporation gave, say 2% of their CSR allowance to human welfare, 2% to education, 5% for sustainability activity, etc… then CSR can play a much more important role than it being purely focussed on one particular area of need.

If we have committed to something, we do not go back onto it. That's the biggest differentiator for us.

As a family business owner working with SMEs and family businesses, how do you feel your perspective and background differs from other carbon credit advisory services?

Where we stand differently is that we come with our own goodwill. If we have committed to something, we do not go back onto it. That's the biggest differentiator for us.

We also come with financial bandwidth and have the capacity to take financial risks. We can build the team around us because it’s a very new market. And while employee cost is very high because of the lack of availability of qualified expert employees, our financial capability is where we bring on board the best people.

Finally, being part of the Shanti Group, our network is what gives us the clear competitive advantage.

According to a 2022 Next Generation report from Campden Wealth, 64% of those surveyed confess that they have an increased awareness of the importance of sustainability, while 56% want to demonstrate that family wealth can be used for positive outcomes. Is this the generation to help turn a corner towards a truly sustainable society?

Absolutely. This determination to work towards sustainable businesses, especially from families with family offices, comes from a desire see things done better through our day-to-day corporate activity.