FB roundup: Rothschild, Berkshire, and family firm management

Rothschild makes way for son

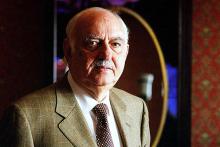

David de Rothschild, chairman of Rothschild & Co, is expected to set aside this year, to make way for his son and successor Alexandre.

The elder de Rothschild, pictured, has run the UK part of the investment group back since 2004, oversaw its merger with its French arm, and has run the joint effort since 2012.

The Financial Times reported the change in leadership without attribution, and the bank declined to comment. The FT said Alexandre, executive deputy chairman, had been “groomed” for the chairmanship since he joined the bank in 2008. The leadership change was expected to take place in June.

The seventh-generation Rothschild dynasty originally made its fortune in banking, though is arguably better known today for its fine wines. The family is notoriously private making it difficult to put a credible figure on their wealth. The investment bank turned over €852m ($1.04 billion) between April and September 2017.

Buffett’s $29 billion tax cut

Warren Buffett has revealed that half the $65 billion gain made by his family’s investment office Berkshire Hathaway came as a result of Republican tax reforms.

In his annual letter to shareholders, Buffet wrote “a large portion of our gain did not come from anything we accomplished at Berkshire”.

In his annual letter to shareholders, Buffet wrote “a large portion of our gain did not come from anything we accomplished at Berkshire”.

“The $65 billion gain is nonetheless real—rest assured of that. But only $36 billion came from Berkshire’s operations. The remaining $29 billion was delivered to us in December when Congress rewrote the US tax code.”

The 87-year-old also announced he would step down from the board of Kraft Heinz, which Berkshire part-owns. He dismissed subsequent speculation he was ready to retire altogether, saying he had “never felt better”.

Last month Buffett promoted two executives: Ajit Jain and Greg Abel to vice-chairmen as part of a gradual succession plan.

Family firms have worse management practices, says study

New research has shown that second-generation family chief executives tend to exhibit poorer management practices, and that their firms suffer as a result.

All in the Family? CEO Choice and Firm Organization, by the Centre for Economic Performance at the London School of Economics, is the first study showing a causal link between dynastic family firms and poorer performance.

All in the Family? CEO Choice and Firm Organization, by the Centre for Economic Performance at the London School of Economics, is the first study showing a causal link between dynastic family firms and poorer performance.

“Although there is mixed evidence on whether family ownership is a good thing, the weight of the evidence is that dynastic family CEOs are usually bad news for productivity,” writes researcher Daniela Scur in her summary of the study, which looked at more than 800 companies around the world.

The report showed that family-owned firms have worse management practices and this could reduce productivity by up to 10%. This effect was only seen where firms were run by family executives. The study also discovered a preference for male heirs, as when succession loomed firms were 33% more likely to stay in the family if the owners had sons.