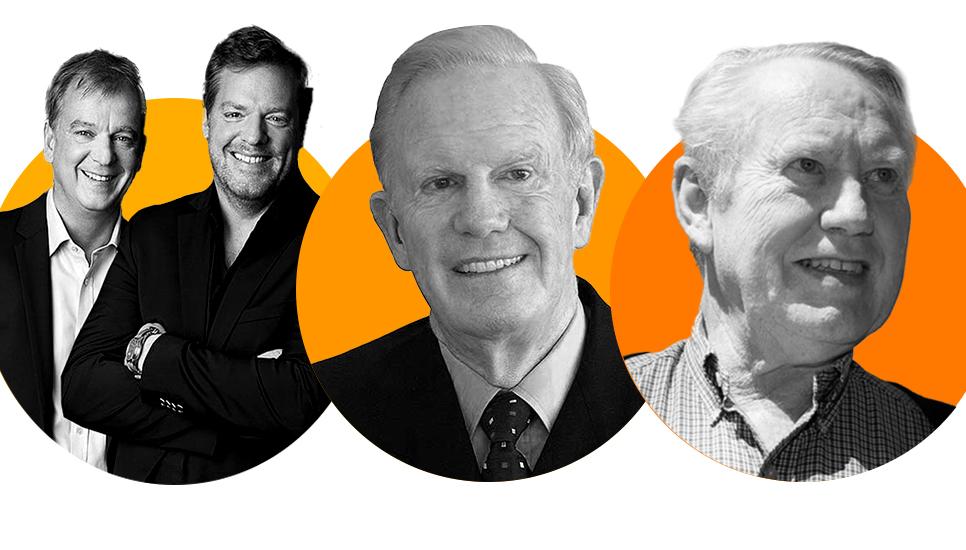

FB Roundup: Alex and Christian Birkenstock, Ted Rogers, Chuck Feeney

Birkenstock brothers’ net worth rockets after high-profile IPO

Following a well-received initial public offering (IPO) and launch on the New York Stock Exchange, brothers Alex and Christian Birkenstock are now worth an additional $3.4 billion, according to the Bloomberg Billionaires Index.

Even after shares in the 250-year-old shoemaking family firm dropped by 13% in the worst opening for a New York listing of $1 billion or more in more than two years, as reported by Fortune, the IPO marks a major pay day for the heirs after they handed over majority control of the German cobblers to private equity firm L Catterton in 2021 for more than $3.2 billion.

The Birkenstock legacy began with Johannes and Johann Adam nearly 250 years ago, when the two shoemakers set up shop in Langen-Bergheim, a village 25 miles northeast of Frankfurt. Johannes’ children and grandchildren continued the family business, until his descendant Karl Birkenstock introduced the company’s famous sandal in 1963.

Alex and Christian both joined the firm in the 1980s as teenagers and were later joined by their older brother Stephan joined in the 1990s. Together, the three siblings oversaw Birkenstock’s global expansion, seeing a boom in the ubiquitous sandals’ popularity. The brothers subsequently stepped back from the business beginning in 2009.

L Catterton is part-owned by luxury corporation LVMH and its founder Bernard Arnault, the second-richest person on the planet. Arnault’s son, Alexandre, is set to join Birkenstock’s board after also becoming part of the new executive leadership of Tiffany and Co. in January 2022.

Ted Rogers’ daughter sues family firm over board access

The daughter of Canadian billionaire Ted Rogers, the late president and CEO of media and communications company Rogers Communications, is suing the family business claiming that “she’s been frozen out of board meetings and blocked from getting information.”

According to a personal letter found in court filings, Melinda Rogers-Hixon claims she is the target of a “personal vendetta” by her older brother Edward Rogers (the current board chair of Rogers Communications), following a public battle for control of the board in 2021 which Edward Rogers won in court.

Since Ted Rogers’ passing in 2008, there has been ongoing strife within the family, according to the court documents. In early 2022, family members agreed to park their disagreements while they sought regulatory approval for the $20 billion takeover of Shaw Communications Inc. However, Fortune reports that while “the Rogers siblings were close to an agreement that would have resolved their longstanding differences, Edward Rogers reneged on it, according to the September 20 missive by Rogers-Hixon, which was sent to Chief Executive Officer Tony Staffieri.”

Rogers Communications is Canada’s largest wireless mobile supplier and cable television provider, as well as the owner of the Toronto Blue Jays baseball team. The Rogers family’s controlling stake in the public company is believed to be worth close to $8 billion.

“This matter should be resolved privately,” said Rogers Communications spokesperson Sarah Schmidt to Fortune. “We’ve demonstrated that we will not be distracted by these actions - we have significant momentum in the market, our merger is tracking ahead of plan, and we remain squarely focused on doing what’s right for our customers and stakeholders.”

Tributes paid to philanthropist billionaire Chuck Feeney

Charles “Chuck” Feeney, the co-founder of the Hong Kong-based DFS duty free shopping empire, who famously gave up his billions through his philanthropic foundation, has died at the age of 92.

From the early 1980s, the Irish-American businessman made grants totalling more than $8 billion through his Atlantic Philanthropies foundation to numerous causes mainly in the US, Ireland, Britain, Northern Ireland, Australia, South Africa, Vietnam, Bermuda and Cuba.

“Chuck Feeney was an exceptional entrepreneur, citizen of the world and friend to people in need,” said Peter Smitham, a former board chairman of the foundation.

“In an unprecedented act of generosity, he secretly gave away nearly all of his wealth in the early 1980s to advance opportunities and better outcomes for those who are unfairly disadvantaged or vulnerable to life’s circumstances.”

Known as the “James Bond of philanthropy” because of his secret donations, Feeney had a net worth of around $2 million when he died earlier this month in San Francisco, according to Forbes.

Feeney made his fortune after launching the first DFS store with co-founder Robert Miller at Hong Kong airport in 1960. Focused on selling luxury goods to tourists, DFS has since grown to more than 400 outlets around the world and reported a turnover of $3.1 billion in 2021, according to Statista.

In 1996, French luxury conglomerate LVMH bought a majority share in DFS Group after buying out three of its partners, including Feeney.

After becoming a billionaire, Feeney became keenly interested in philanthropy, later described by Microsoft founder Bill Gates as the “ultimate example of giving while living”. Feeney’s generosity later inspired Gates, billionaire investor Warren Buffett and others to set up The Giving Pledge in 2010.

“He was a private man who, following the creation of The Atlantic Foundation, chose to live frugally,” a spokesperson for the organisation said. “He was well known for his signature $15 watch, plastic bags for a briefcase and his preference for flying economy. In the past three decades, he did not own a car or home, preferring to stay in modest rented apartments.”