Testing the temperature: Assets, risk and the Indian family office

Locally orientated, ‘risk lite’, with a strong preservation ethic. This has been the traditional profile of Indian family investments, dominated by senior wealth holders with a preference for safe and steady assets. Fuelled by operating businesses where any profits have been funnelled back into the business, diversification has traditionally meant investing in subsidiaries of the family business or real estate, rather than new asset classes. Yet could a new breed of family investors with a desire to professionalise private investment be set to break this mould?

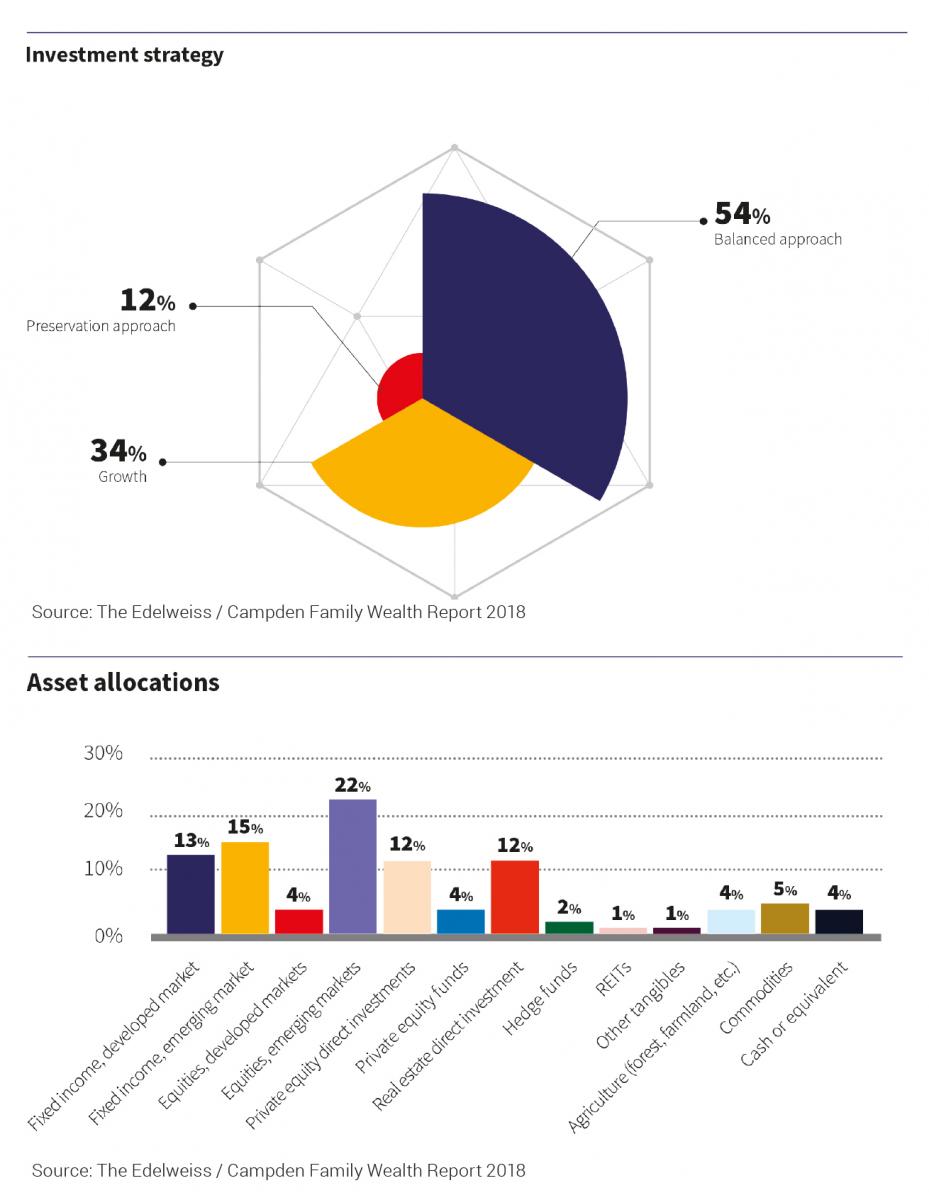

Newly released research, The Family Wealth Report 2018: A Roadmap for the Indian Family Office, confirms this ‘risk-off’ mentality is set to hold strong for the meantime. Just over half of the 78 Indian families of wealth surveyed by Campden Wealth, favour a balanced, preservation plus growth, oriented investment approach. However, another third leaned more towards growth—a signal that some families are discarding this traditionally risk-averse mindset (see charts).

Dr Rebecca Gooch, director of research at Campden Wealth who led the research in partnership with Edelweiss, says this reflects a trend being seen across the larger family office community worldwide.

“While there is a desire to preserve wealth, some of the more illiquid, higher-risk asset classes, such as private equity, performed very well in 2017. Family offices have adjusted their investment strategies accordingly,” she says.

“While there is a desire to preserve wealth, some of the more illiquid, higher-risk asset classes, such as private equity, performed very well in 2017. Family offices have adjusted their investment strategies accordingly,” she says.

At the moment, fixed income represents the largest asset class Indian families invest in, followed by equities and private equity. These three asset classes make up a significant 64% of the average investment portfolio of the families studied within the India report. The study also highlighted the strong local bias among Indian families —99% invested in India, with only 14% investing in North America, 11% in Europe, 10% in Asia-Pacific, 7% in the Middle East, and 5% in Africa.

With an eye to the future, respondents plan to invest more into equities and private equity over the coming 12 months; a stance that broadly reflects family office trends worldwide, Gooch says.

Nitai Utkarsh, a family office executive based in India, says most Indian family offices, unlike other high net worth investors, manage asset allocations across multiple portfolios, on average three or four per family. There may be one portfolio specifically meant to provide a risk-free “safety cushion” for the family with 100% fixed income allocation. Another portfolio may be orientated towards growth in sectors where the family’s risk appetite is higher.

Utkarsh describes a family’s capital markets portfolio as the counterbalance between those two allocations, then there are goal-orientated portfolios, such as for an acquisition on a liquidation timeline.

“About 20% of our portfolio is the conservative portfolio, which covers any contingencies which happen and is completely fixed income, no credit risk, no duration risk and no interest rate sensitivity,” he says.

“Another 20% is where we invest mostly in ventures and private equity then the remaining 60% is in capital markets where we invest in equities and high-yield debt instruments.

“That is our domestic portfolio, there is some money offshore as well, but we are restricted by the amount we can send offshore as per Reserve Bank of India regulations. Finally there is the portfolio that holds all the operating assets of the family, whether completely or partly owned with other investors.”

“That is our domestic portfolio, there is some money offshore as well, but we are restricted by the amount we can send offshore as per Reserve Bank of India regulations. Finally there is the portfolio that holds all the operating assets of the family, whether completely or partly owned with other investors.”

As chief investment officer of the Dinesh Hinduja Family Office, Jai Rupani oversees investments across all asset classes: real estate, stocks, bonds, structured products, private equity, and venture capital.

The family office was created after the Bangalore-based Hinduja family sold its stake in Gokaldas Exports to private equity firm Blackstone in 2007.

Some 50% of the family’s assets are in real estate; mostly as a legacy of operating 45 garment factories over four decades.

Of the other 50%, 10% is in alternatives, such as venture capital, 20% stable in debt and 15% is equity, with 5% in cash and equivalents.

“Our real estate [allocation] was close to 75% five years ago,” Rupani says.

“It is now at 50% because 75% is way too high and we are targeting to get that down to 40% and we’ll retain 40%.”

Rupani says the family equities allocation was down to 10% about five years ago, but they wanted to increase it to 20%.

“It is that concept of being able to educate the families, saying, ‘Hey, if you do not make 12-14% per annum, your money’s not working for you’. You need a diversified return of 9% post-tax, but to get that you have to do the ratios and explain we need to change these [investment] buckets and when things are good, we need to sell and be proactive,” explains Rupani.

“There’s an old saying: ‘What you don’t monitor does not grow, so you have got to monitor it, every day, to know what is going to happen.”

Managing portfolios

Nearly half of the families studied within the Campden Wealth report use some form of family office services to manage their investments.

Close to a quarter (22%) use hybrid family offices (family office services that are ‘embedded’ in the family business), 19% use single family offices, and 8% multi family offices.

“Outside of this, roughly a third of the wealth community use external advisers; a proportion that is matched by those who do not use any form of wealth management services,” Gooch says.

Dinesh Hinduja Family Office manages their asset allocations by digital monitoring, using dashboards on smartphones that collate reports from an investment adviser’s real-time results, says Rupani.

Every time there are new returns from a sale or movement in the portfolio, the family office makes a plan for the family to approve it in committee. The asset ratio is clear, the manager meetings are scheduled, and deployment happens within 90 days.

“I am very particular,” Rupani says.

“I respect money a lot. If you have money you have got to respect it, not waste it or throw it around. You protect it and if you do not do it right you are going to lose it. You have to run the family office as a business or you will not get the focus you need to deliver on the results that everyone expects you to deliver.”

On trends

Utkarsh says families have been taking more risk than usual because savings are high, but investments are not bearing down. Savings and investments used to be blurred, but now families are investing more in risk assets such as equities, both listed and unlisted, and real estate. There is a growing perception that huge cash flows from a family’s operating business can manage most of the risk so the appetite for risk has increased over the years, he says.

Rupani says he is seeing many more alternative assets trending with one new venture or private equity firm in his office pitching him for money every week.

“That is just showing the market has matured on the alternative investments side and I think people are excited about that space,” says Rupani.

Utkarsh also sees an increasing focus on venture capital with the potential returns as one of the drivers. There is also a degree of self-preservation.

“Instead of being hit by a surprise, these families have started to invest in these start-ups themselves. If tomorrow their core business model was disrupted, they [then] all have a seat at the table with the new business model and can quickly transition from the old to the new. The venture capital-private equity space has seen a lot of asset movement.”

Suresh Chitturi is the award-winning vice chairman and managing director of Srinivasa Farms—a multigenerational family business and pioneer in the poultry industry. The business was established in 1965 and group turnover was about INR774 Crore ($108 million) in 2017.

Chitturi intends to set up a family office now his family has operated its business for more than 50 years. The family has been traditionally focused on real estate for investments.

“One thing in India that is not growing is land,” Chitturi says.

“We get a lot of appreciation; we buy it and hold it long enough and our returns are pretty high. But it is also extremely illiquid and this land does not give us any ongoing revenue.”

He says about 80% of the families assets are tied up in land assets. However, he wants to decrease that allocation to about 50-55% and invest 13-20% in assets that return some annuity.

The family scored headlines earlier this year over its plans to invest in start-ups in sectors like agri-businesses, although Chitturi clarifies: “Right now, start-ups are more of an aspiration. We are doing a little, here and there, but it is not structured and that is what makes me a little uncomfortable.

“On the family side, close to one-third of what we make each year we intend to invest in start-ups, but I want to allocate up to one-quarter to start-ups, primarily agricultural,” Chitturi iterates.

“Whatever contributes to ideas that will transform the way things are done now, such as more biofuel usage, those are the things I’m interested in.”

From venture capital and private equity to Chitturi’s openness to new technologies, India’s family offices are breaking the traditional investing model and rewriting the rules on risk for the 21st century.