FB Roundup: LVMH, EssilorLuxottica, Rockefeller Foundation

Arnault heir joins power trio in charge of Tiffany and Co

Alexandre Arnault is being widely regarded as the heir apparent of his father’s French luxury goods empire LVMH with his appointment to the new executive leadership of Tiffany and Co.

Arnault (pictured), 28, is the second eldest son of Bernard Arnault (pictured below), 71, the billionaire chairman and chief executive of LVMH. The next-gen led luggage manufacturer RIMOWA since January 2017, after initiating and leading its acquisition by LVMH.

Arnault junior became executive vice president, product and communications of Tiffany this week at a disruptive time for the premium market during the coronavirus pandemic. The appointment of the new leadership team came at the completion of LVMH’s turbulent record $15.8 billion acquisition for the US luxury jeweller last month.

On Instagram, the millennial paid tribute to his team at RIMOWA in Cologne over the past four years, as well as clients, partners, ambassadors, landlords and LVMH.

“Without you all, we could not have brought the company towards new horizons, which I believe we have reached,” he said.

“You are the best. No matter the distance, RIMOWA will always be in my heart.”

Arnault said he was “humbled [and] honoured to join @tiffanyandco and excited to work with the teams in New York!”

The graduate of École Telecom ParisTech and Ecole Polytechnique started his career in the US in strategic consulting, at McKinsey & Company, then in private equity at KKR in New York. He joined the family business LVMH and controlling family office Groupe Arnault to focus on digital innovation, particularly e-commerce in the high-quality products sector. He was credited with successfully repositioning RIMOWA and elevating its brand image, perhaps giving a sense of where he could take Tiffany and Co next.

.jpg) Arnault was joined in the new Tiffany C-suite by a pair of trusted non-family advisers. The new chief executive is Anthony Ledru, previously executive vice president, global commercial activities at Louis Vuitton within LVMH and formerly senior vice president of North America at Tiffany. Michael Burke, the chairman and chief executive of Louis Vuitton, became chairman of the Tiffany board of directors.

Arnault was joined in the new Tiffany C-suite by a pair of trusted non-family advisers. The new chief executive is Anthony Ledru, previously executive vice president, global commercial activities at Louis Vuitton within LVMH and formerly senior vice president of North America at Tiffany. Michael Burke, the chairman and chief executive of Louis Vuitton, became chairman of the Tiffany board of directors.

At the end of 2020, Tiffany stockholders voted overwhelmingly to approve the modified merger agreement with LVMH announced in October. The acquisition which began in November 2019 appeared at risk of collapse as the two parties engaged in a legal war of words over Tiffany’s performance and subsequent value. Trade tensions surfaced between Washington DC and Paris over the deal and the pandemic decimated the global luxury sector as shops shuttered and tourism ground to a halt.

Founder Leonardo Del Vecchio steps back in EssilorLuxottica power transfer

Founder Leonardo Del Vecchio steps back in EssilorLuxottica power transfer

Eyewear tycoon Leonardo Del Vecchio has voluntarily stepped back from his executive duties at EssilorLuxottica, the Ray-Ban sunglasses making family business he founded, in the latest governance reshuffle.

The $19.6 billion Franco-Italian company announced Del Vecchio (pictured right), 85, had relinquished his executive responsibilities to preserve the “equal powers principle”. He remained non-executive chairman.

The move came as Hubert Sagnieres (pictured below), 65, decided to retire as executive vice-chairman to become non-executive vice-chairman of the company. The board of directors granted executive powers to Francesco Milleri, as chief executive, and Paul du Saillant, as deputy chief executive of EssilorLuxottica until the appointment of the new board by the 2021 annual meeting of shareholders. Du Saillant became chairman and chief executive of Essilor International.

Del Vecchio thanked Sagnieres for his success in turning Essilor into a "world leader" and helping to build EssilorLuxottica into the strong company it was.

“The contributions he made during his career with the company are long-lasting.”

Del Vecchio’s distancing was understood to be triggered by a governance pact which limited the octogenarian’s powers as the major shareholder. The pact had settled a management dispute between the French and Italian sides of EssilorLuxottica.

The company formed from the $58.8 billion merger of French corrective lens maker Essilor and Del Vecchio’s Italian eyewear company Luxottica in 2018. The merged entity included more than 20 brands in luxury, lifestyle and sport markets including Ray-Ban, Oakley, Persol, Bolon and Foster Grant.

Not that the father of six and grandfather appears ready for retirement himself. Del Vecchio is the second wealthiest individual in Italy, after Giovanni Ferrero of the chocolate-making dynasty, and holds lucrative stakes in investment bank Mediobanca, the French real estate company Covivio and Assicurazioni Generali, Italy's largest insurance company.

Rockefeller Foundation divests $5 billion in fossil fuels

The Rockefeller Foundation has turned its back on the original source of the family fortune by announcing it will divest its $5 billion endowment in fossil fuels.

The US private foundation’s board of trustees approved the new policy, prompting the foundation’s investment team to begin more than halving its total exposure to fossil fuels to less than 1% “in the near future”, the charity said.

The foundation’s exposure to fossil fuels declined from 4% in 2014 to 2% by the end of 2020—0.6-0.7% in public commingled funds and 1.3% in fossil fuel private partnership interests. During that time, it also generated average annual returns of 8.3%, more than 3% ahead of its benchmark.

Chun Lai, the foundation’s chief investment officer, said the endowment’s total private fossil fuel exposure declined in recent years in part because of global energy transition trends and heightened sustainability risks in the sector.

“But also because we actively narrowed the resources portfolio to less than a handful of managers who place strong focus on ESG [environmental, social and corporate governance] integration and avoided dedicated investments in the heaviest emitting fossil fuels,” Lai said.

The divestment followed the foundation’s $1 billion commitment over the next three years to catalyse a green recovery from the Covid-19 pandemic. It was hailed as the single largest commitment in the foundation’s 107-year history, which has distributed more than $22 billion since its inception.

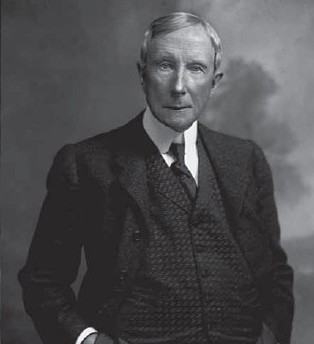

Standard Oil founder John D Rockefeller (pictured) provided an original endowment of $100 million to launch the foundation in 1913. While the family was essentially out of the oil business by 1911, the foundation’s endowment was largely built from the proceeds of the company, which at one time controlled more than 90% of petroleum production in the United States.

Sharon Percy Rockefeller (pictured), 76, is the sole family member on the board of the foundation today. She is married to former West Virginia Senator John D “Jay” Rockefeller IV. They have four children and eight grandchildren.