FB News

Time to value... VALUE

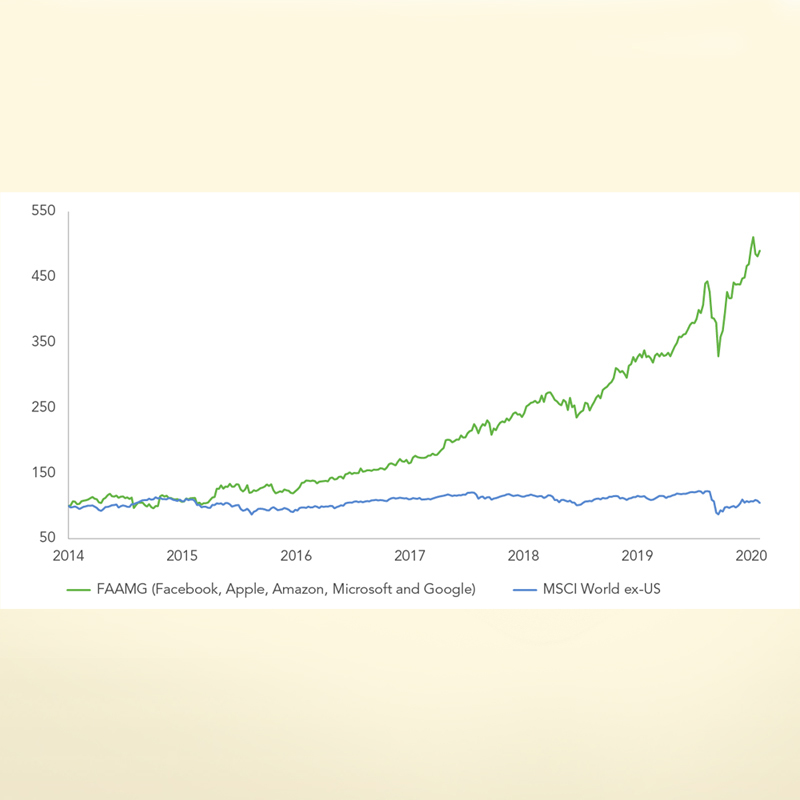

US internet stocks have massively outperformed world markets

The US internet shares have been roaring ahead, particularly in recent months. The coronavirus crisis has accelerated the shift toward online retail and smart communications, and these are the most obvious winners. It has been a giddy ride.

But the divergence in share prices now far outstrips the underlying economic reality. As the chart shows, the top five tech companies by market capitalisation today have risen 500% over the past six years, while over the same period the MSCI World ex-US index has been about flat. Apple alone is now worth more than 80% of the continental European market.1

No one disputes that we are living through a transition. But popular positions are vulnerable when sentiment changes and crises often cause new market leadership. One important side effect of this stampede into a tiny group of stocks with all the momentum, is that traditional sectors – such as banks, steel makers and car companies – are now cheaper and less widely owned than they have ever been.

These ‘economically-sensitive’ stocks (so-called because they respond to the buoyancy of the actual economy rather than hopes around the ‘future’) are being treated as if they were already yesterday’s news: Pony Express in the age of the motor car, or photographic film in the age of the digital camera.

Source: FactSet, data to 31 July 2020.

This looks to be an overreaction. The new does not entirely supplant the old. Electric cars still require steel – as do wind farms. And the crisis is forcing the old to modernise and adapt, using technology to streamline. NatWest, for example, will cut costs by 40% in the next five years.2 Covid-19 has certainly boosted the tech industry, but it also offers clear opportunities for more traditional sectors to reset themselves.

Investors do not need to expect stellar performance in these traditional sectors. It is merely a matter of recognising that current pessimism for ‘old’ economy stocks seems as overblown as enthusiasm for new names. What followed the Black Death? The Renaissance.

Value stocks look historically cheap, then. But they also have a crucial portfolio role. At Ruffer, our equities are just one part of a portfolio designed to deliver positive returns in all market environments. The portfolios have powerful protections against difficult market conditions, whilst the falling interest rates that have boosted the ‘covid-winners’ have also propelled our gold equities and inflation-linked bonds. Therefore, we need at least some part of our portfolio to benefit if events turn out better than currently expected. We need our equities, with their real economy and value focus, to deliver in that environment.

This is not just banking on a vaccine. The virus has accelerated a political sea change, jolting governments into a spending spree to get money from the financial system to the people. We don’t think they’ll be able to stop, hence our holdings in inflation protection. But as governments increase spending, focusing on domestic employment and production, it is the established companies that may benefit more. Their obituaries may well turn out to be premature.

Hermione Davies

Investment Director at Ruffer LLP

Past performance is not a guide to future performance, investments can go down as well as up and you may get back less than you originally invested. The information contained in this document does not constitute investment advice or research and should not be used as the basis of any investment decision. References to specific securities are included for the purpose of illustration only, they are not a recommendation to buy or sell.

Ruffer LLP is authorised and regulated by the Financial Conduct Authority.

1 FactSet, 31 July 2020

2 The Sunday Times, 26 July 2020