Philanthropy versus impact investing in the world of the wealthy

This is an extract from the How To Change The World Report, a guide to philanthropy and impact investing by family office recruiter, Agreus. Download the full report here.

In 2020, more than 200 billionaires collaborated to ride the storm that was the coronavirus pandemic. Together they donated more than $5 billion to foundations, NGOs and hospitals while transforming hotels into quarantine stations and redirecting production lines of cars and household appliances to meet the demand for ventilators.

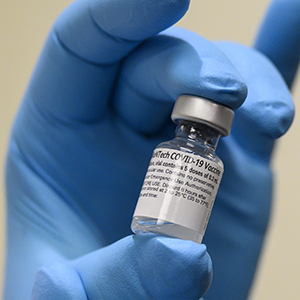

Cumulatively, they had an incredible and immediate impact but at the same time, another selection of family offices reaped the rewards from longer-term targeted impacts instead – the most prominent cause being vaccine production. One such family office gained some $12 billion, helped boost German GDP and arguably saved millions of lives by funding the world’s first coronavirus vaccine.

Both subsections of the ultra-wealthy community made a monumental impact socially but just one made a financial return. Do family offices always need a return when it comes to giving or making an impact and is it possible to have it both ways?

Here we delve deeper into the impact investment cited above and compare it with a donation of exactly the same amount, made at the same time - during the height of the pandemic.

THE IMPACT INVESTMENT

In a small family office in Munich sit Andreas and Thomas Strüngmann [pictured], two brothers who have helped saved millions of lives, boosted Germany’s economy and enabled nations across the world to re-open in the middle of a pandemic. The family office is Athos Service GmbH. The same Family Office who through a controlling stake of 50.3% own BioNTech, the creators of the world’s first and most effective coronavirus vaccine.

In November 2020, Athos Service GmbH became one of few single family offices globally to have a single holding in their portfolio valued at more than $12 billion. BioNTech was listed on Nasdaq NDAQ -0.5% with a market cap on November 9 of $25.3 billion, valuing Athos Services’ stake at $12.73 billion. Stock price has exponentially increased by 499% since and it seems the two organisations are not the only ones to have benefited.

BioNTech has boosted German GDP by 0.5% alone with economists predicting a national growth of 3.7% by the end of the year. Then of course you have the fact that economies such as the UK and USA have opened up almost entirely thanks to their impressive vaccination programmes with Athos-backed BioNTech, the most popular choice of jab.

Financials aside and BioNTech with the backing of Athos Service GmbH family office have potentially saved the lives of millions of people with more than 9.7 billion shots given in the US alone and the BioNTech, Pfizer and Athos partnership creating the vaccination of choice.

Through a single impact investment, this single family office has possibly saved millions if not billions of lives, generated billions of dollars in revenue for both their own portfolio, the company they invest in and of course, a global economy. Could anything else make as big an impact?

THE DONATION

In the same year that Athos Service Family Office developed a holding in their portfolio valued at more than $12 billion while saving perhaps millions of lives and boosting German GDP, the board of executives at the World Bank approved a donation of the same amount.

The World Bank announced a $12 billion donation to vaccinate residents of developing countries against the coronavirus. As part of this public announcement, it was estimated that two billion people would be offered access to testing or vaccinations as part of the donation.

This astonishing amount of money will continue to be dispersed over a 12-18 month period and will, undoubtedly host a huge impact by vaccinating residents of developing countries, saving lives and contributing to the re-opening of a global economy.

But the impact stops there.

While the incredible and generous offering will be written in history books as one of many heroic and kind responses to the pandemic, the only return generated was social and as a result, the pool of resources dried there.

While the World Bank have to pool more resources to fund more impact, Athos Service have at least $12 billion in their portfolio which they can use to fund impact time and time again. While there will always be a need for short-term and immediate change, can philanthropy ever make as much impact as impact investing?

Download the full report here.