Medtronic leverages reach to commercialise partner products in growth markets

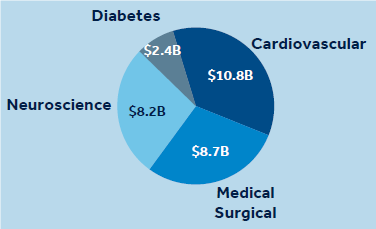

With a global presence in more than 150 countries, Medtronic has a deep footprint in the cardiovascular, medical surgical, neuroscience and diabetes MedTech sectors.

We are pleased to report that in our mission to alleviate pain, restore health and extend life, we have had a positive impact on more than 72 million patients during the year despite pandemic-related challenges.

With our talented workforce of 90,000 and more than 49,000 patents in our portfolio, FY 2021 saw us forging ahead with more than 300 ongoing clinical trials. The source of our $30.1 billion in revenue for the year breaks down as follows: 51% US, 33% non-US developed countries and 16% emerging markets.

Open for partnerships

Energised by current and future prospects, Medtronic is searching for new commercial partners with marketed products to leverage our strength to continue reaching new markets and patient populations with technologies that will improve patient health on a larger scale.

Strengthening our offering further, Medtronic enjoys a seasoned commercial team and infrastructure in most countries. We invite innovative scale-ups and small to medium-size companies with commercially available products to initiate a conversation; let’s evaluate whether our resources would be a good fit to support product growth in new geographies.

Winning share in several businesses

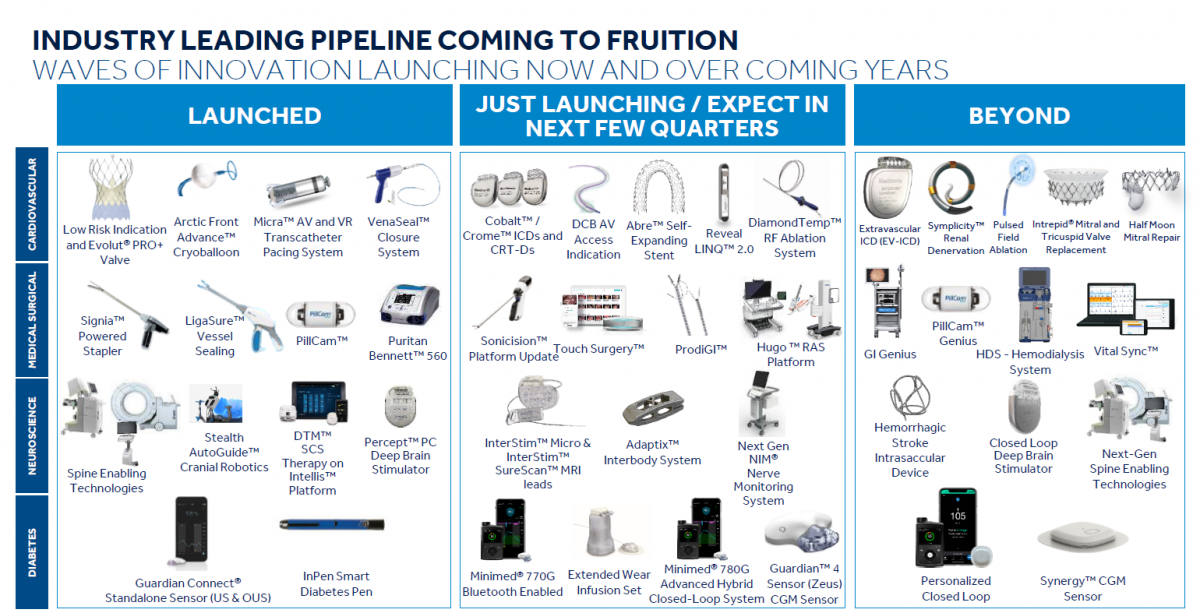

Medtronic is accelerating growth with a combination of a strong base business, recent product launches and a robust pipeline. With a steady stream of product launches, we are leveraging our pipeline to win share in an increasing number of businesses. And we are constantly learning, growing and evolving. Making several changes across the business to make Medtronic more agile, decisive and competitive, the only constant is progress.

Creating and disrupting big markets

With our strong pipeline aimed at significant growth opportunities, Medtronic brings inventive and disruptive technology to large healthcare opportunities. We further accelerate growth to capitalise on new, multi-billion dollar markets. Through its venture arm, we partner with like-minded companies, investing in growth opportunities in both devices and digital health.

Significant growth markets include:

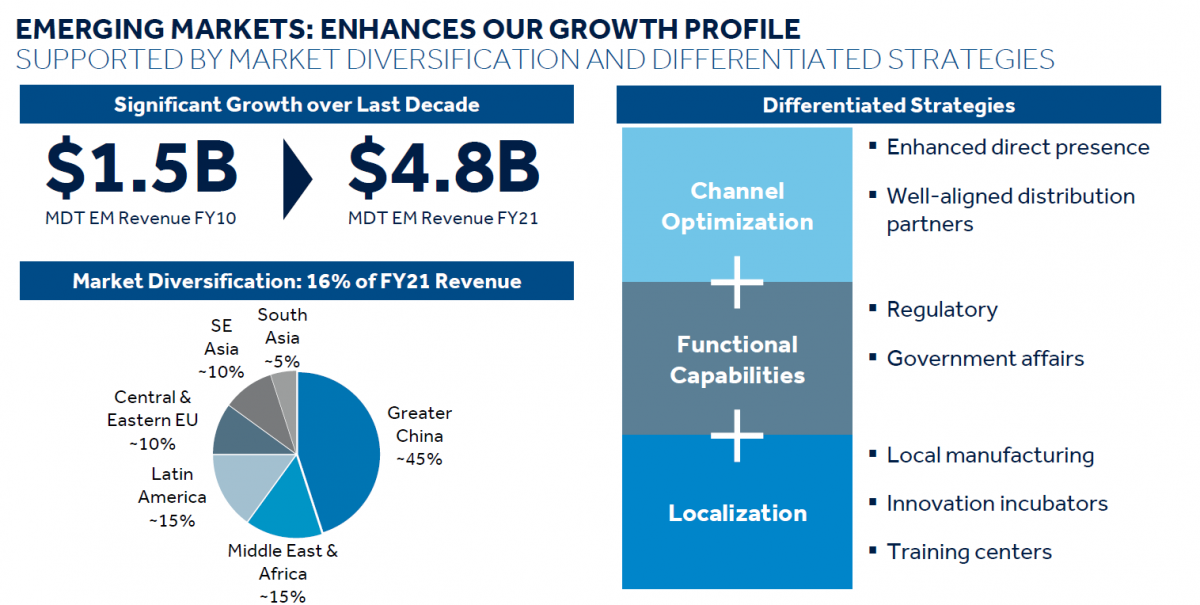

Enhancing our growth profile in emerging markets

Supported by market diversification and differentiated strategies, we’ve grown significantly over the last decade, from $1.5 billion to $4.8 billion in emerging market revenue. Through a combination of channel optimisation, functional capabilities and localisation, we make the most of our opportunities. Our extensive channels provide an enhanced direct presence and well-aligned distribution partners. Our functional capabilities encompass both regulatory and government affairs. And finally, our localisation strengthens our local manufacturing capabilities, innovation incubators and training centres. This dynamic mixture of resources delivers a robust capacity to partner and successfully launch commercial products in new markets.

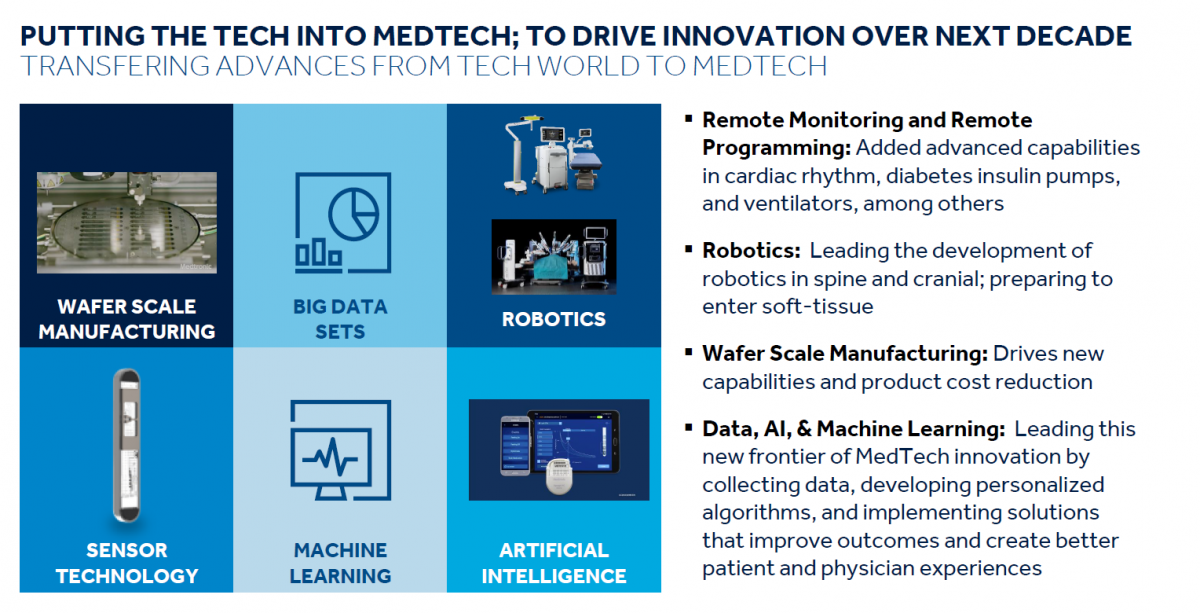

Driving innovation over the next decade: transferring tech advances to MedTech

Driving innovation over the next decade: transferring tech advances to MedTech

Here are just a few examples of how we apply the most elegant science of technology to enhance MedTech innovations:

Remote monitoring and remote programming

Adding advanced capabilities in cardiac rhythm, diabetes insulin pumps, and ventilators, among others

Robotics

Leading the development of robotics in spine and cranial; preparing to enter soft tissue

Wafter scale manufacturing

Driving new capabilities and product cost reduction

Leading this new frontier of MedTech innovation by collecting data, developing personalised algorithms, and implementing solutions that improve outcomes and create better patient and physician experiences

Continuous investment in our innovation pipeline enabled by creative capital allocation

In FY 2022, our forecasted organic R&D spend is more than $2.7 billion, 10% more than FY 2021. Through seven mergers and acquisitions we invested $2.3 billion during FY 2021. We have minority investments in 40 companies worth $500 million. Through strategic partners we have access to third party investment to leverage our own R&D investment and accelerate growth.

Partnering with Medtronic EMEA

If your innovative MedTech or Digital Health company has a commercialised product/portfolio which is complementary to our portfolio and you would like to explore collaboration opportunities to scale your business, please contact me, Ralph BMH van Aken, via ralph.vanaken@medtronic.com.