Global Family Office Report 2016 Key Findings - Impact investing

According to legend, The Rockefeller Foundation coined the term 'impact investing' in 2007, putting a name to investments made with the intention of generating both financial return and social/environmental impact. Has the concept reached maturity nearly a decade later?

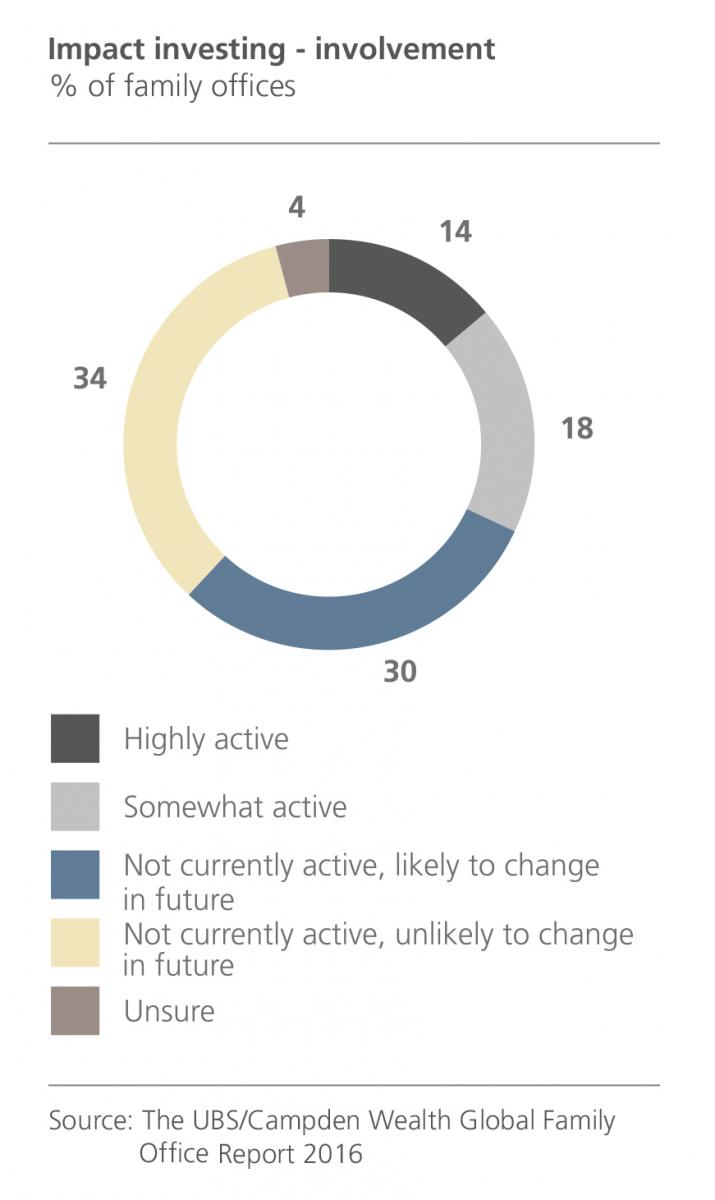

Family offices around the world are far more active in impact investing than originally thought, with almost two-thirds (61%) now active in the area or likely to be in the near future, according to the Global Family Office Report 2016.

In a sign of its growing maturity, the wider social considerations of impact investing have even seeped into the traditional investment practices of family offices—two of the single family offices profiled in the report even said social or environmental considerations are now factored into all investment decisions.

Millennials—those born between 1980 and 2000—are reportedly a key catalyst in the move towards impact investing, yet office executives have wised up to the benefits of socially responsible investing with nearly half (47%) responding that it is a more efficient way of achieving impact than philanthropy.

Christopher Lavender, who set up the charitable foundation of the Kadoorie family in Hong Kong in 1997, thinks impact investing is likely to become increasingly important to family offices in the coming years. He suggests it also attracts individuals who may not have previously been engaged in charitable projects.

“Whether you call it impact investing, social investing, or social entrepreneurism, it is a marvellous way to help people and get a financial return out of it, which you can then reapply to helping people who need that assistance,” he explains.

“I am sure it is an area that is going to expand, and I welcome it in the sense it attracts certain individuals who probably wouldn't get involved in that side of philanthropy.”

According to the report, supporting charitable causes continues to be a priority for many family offices. The average level of philanthropic giving by office respondents in 2016 sits at 2.5% of their assets under management—equivalent to almost $19 million*.

One-third of participants were likely to increase their philanthropic allocations, while another two-thirds said their allocations would likely remain the same. Education was identified as the biggest beneficiary of family office philanthropy this year.

One-third of participants were likely to increase their philanthropic allocations, while another two-thirds said their allocations would likely remain the same. Education was identified as the biggest beneficiary of family office philanthropy this year.

Andy Hart, co-managing partner at Delegate Advisors, a San Francisco-based family office adviser, believes the interest in impact investing is being driven by family offices across the US and Europe and by increasing importance on measurement systems, which is noted in the report.

“We know that there is a push towards measuring impact, but we believe that any measurements should really come from the family philanthropic objectives,” Hart explains.

“In other words, the measurements used by the family should help them understand if their philanthropy is having the intended effect.”

When providing an example, Hart said if a family's mission is to support access to education for lower income students, a better measurement than just looking at scholarship payments might be the number of scholarship recipients successfully graduating and matriculating to college programmes.

When providing an example, Hart said if a family's mission is to support access to education for lower income students, a better measurement than just looking at scholarship payments might be the number of scholarship recipients successfully graduating and matriculating to college programmes.

“The point is to avoid the pitfall of allowing the concept of measurement to drive charitable giving rather than the broader vision,” Hart explains.

“Just because something might be hard to measure, does not mean it shouldn't be pursued as long as it helps achieve the larger family objective.”

The 61% of family offices now active or likely to be active in impact investing highlights a new challenge for the notoriously discreet wealth sub-sector: establishing a new methodology for the way that investments are made and monitored.

Find out more about the Global Family Office Report 2016 at www.globalfamilyofficereport.com