FB Roundup: Warren Buffett, Maersk, Europa-Park

Slim investment pickings but succession “urgent” for Warren Buffett

Warren Buffett, the influential US investor and family office principal, is having trouble finding the next big acquisition to spend $128 billion on, but his successors may have better luck.

Buffett’s Nebraskan holding company Berkshire Hathaway baffled Wall Street in late 2019 for stockpiling that record amount of cash instead of making the “elephant sized” purchase he said he wanted to do in February 2019. Berkshire spent $2.8 billion on buying back shares while its portfolio performance was modest.

In his latest annual letter to shareholders of Berkshire this week, the “Oracle of Omaha” said his preference was to buy 100% of new businesses that met his three criteria: “First, they must earn good returns on the net tangible capital required in their operation. Second, they must be run by able and honest managers. Finally, they must be available at a sensible price.”

Buffett (pictured) said opportunities with those attributes were “rare” in order to make major deals.

“Far more often, a fickle stock market serves up opportunities for us to buy large, but non-controlling, positions in publicly-traded companies that meet our standards.”

Chairman Buffett turns 90 in August and his vice chairman Charlie Munger is aged 96. Buffett said the duo had entered the “urgent zone” of succession planning long ago. The Mungers' Berkshire holdings dwarfed any of the family’s other investments and 99% of Buffett’s net worth was lodged in Berkshire stock. Buffett reassured shareholders he had no plans to sell his shares and said the company was “100% prepared for our departure”.

Buffett said Ajit Jain, vice chairman of insurance operations since 2018, and Greg Abel, vice chairman of non-insurance operations also since 2018, will be given more exposure at Berkshire’s annual meeting, dubbed the Woodstock for Capitalists, on 2 May.

“They are outstanding individuals, both as managers and as human beings, and you should hear more from them.”

Maersk braces for coronavirus hit on 2020 business

Maersk braces for coronavirus hit on 2020 business

Family-controlled shipping giant Maersk warns its 2020 outlook will be impacted by the coronavirus outbreak, the latest global family business forced to manage the repercussions of the epidemic.

The Danish titan reported improved earnings and free cash flow in 2019, despite weaker market conditions and global container growth, in its latest financial results. However, its outlook and guidance for the new year was “subject to significant uncertainties and impacted by the current outbreak of the coronavirus in China, which has significantly lowered visibility on what to expect in 2020.”

Maersk expected “a weak start to the year” as factories in China were closed for longer than usual in connection with the Chinese New Year and as a result of COVID-19.

It was a choppy 2019 for the shipping group, which reported weaker market conditions and global container growth of only 1.4%, no doubt a consequence of the US-China trade war. The technologically advanced group also had to deal with a labour dispute with dockers in Los Angeles over automation.

While earnings before interest, tax, depreciation and amortisation improved 14% to $5.7 billion compared to 2018 and the EBITDA margin increased to 14.7%, revenue for 2019 decreased slightly to $38.9 billion from $39.3 billion. Free cash flow was $6.8 billion, compared to $5.1 billion and capital expenditure declined by $1.2 billion to $2 billion in 2019.

The group followed Bamford family-controlled manufacturer JCB, the Arnault-owned French luxury conglomerate LVMH and the Swire family-controlled airline Cathay Pacific as global family businesses dealing with the impacts of the coronavirus.

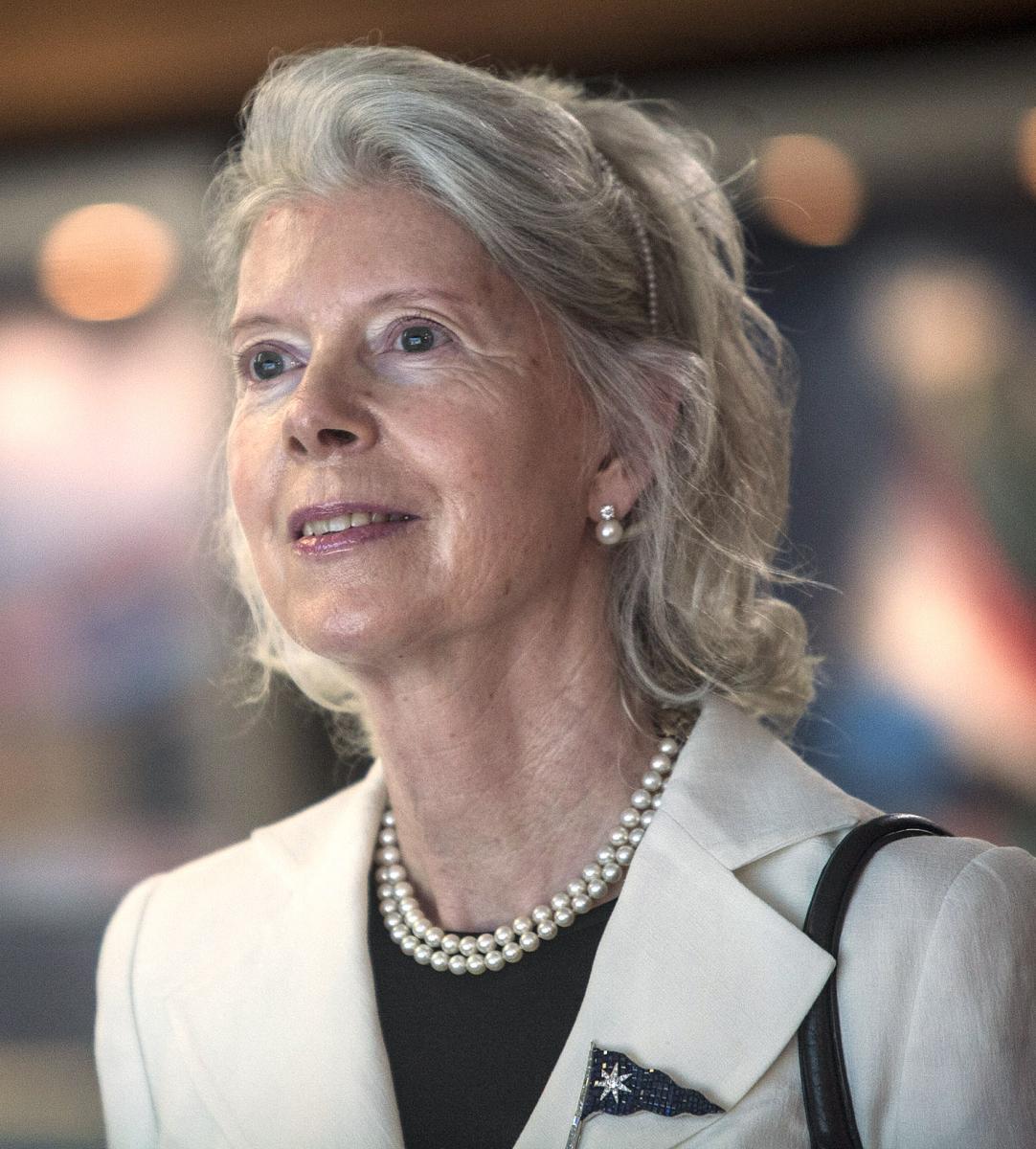

Ane Maersk Mc-Kinney Uggla (pictured), 71, youngest of three daughters of the late shipping magnate Arnold Maersk Mc-Kinney Moller, is vice chairwoman of the Maersk board. She sits alongside her son Robert Maersk Uggla, 41, on the 10-person board.

Mack family makes a splash with biggest ever $197 million Europa-Park extension

Mack family makes a splash with biggest ever $197 million Europa-Park extension

The founding family patriarch behind Germany’s largest theme park says he is “extremely happy” with visitors’ reactions to a €180 million ($197 million) investment in new attractions.

The vast 95ha Europa-Park, south of Strasbourg near the Franco-German border, opened for its 5.6 million annual visitors its new water world called Rulantica with great fanfare in November 2019 after 26 months of construction and two decades of planning.

Rulantica is the single biggest investment by the Mack family since it opened Europa-Park in 1975. The Scandinavian-style year-round indoor adventure playground boasts nine themed settings and 25 water attractions.

Europa-Park also opened last year its sixth themed visitor accommodation offering called Kronasar—The Museum Hotel next to Rulantica. The four-star hotel and water world expanded the Mack's multi award-winning €900 million ($992 million) resort by 450,000 sq m.

“Rulantica had a great start and visitors give it top marks, which makes us extremely happy as the water world is new territory for us,” Roland Mack (pictured), 70, entrepreneur and founder of Europa-Park told CampdenFB.

“The hotel Kronasar which opened in May 2019 has also done extremely well with an occupancy rate of over 90%.”

In the run-up to his 70th birthday in October, Roland paid tribute to his brother, Jurgen Mack, 61, and wife of 45 years, Marianne Mack, for the success of Europa-Park. Their sons Michael, 40, certified in business administration, and Thomas, 38, a certified hotelier, with Jurgen manage daily business operations. Roland’s daughter Ann-Kathrin, 29, an architect, contributed to the design of Rulantica and Kronasar.

Members of the Mack family have worked in the amusement industry for 235 years. Michael Mack accepted on behalf of the Macks the Top Family Business Award at the CampdenFB European Families in Business Awards 2016.