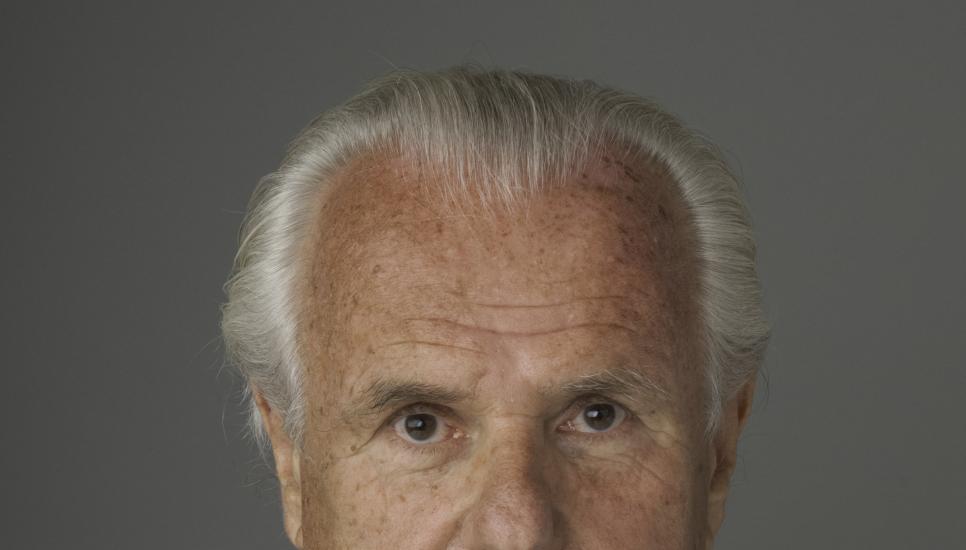

FB ROUNDUP: Lord Paul Myners, Adam Proctor, Wildcat Capital Management

Tributes pour in for Lord Paul Myners, after ‘Tower of strength’ in financial crisis dies aged 73

Lord Paul Myners, a former UK treasury minister, City stalwart and director of multi-family business Rockefeller Capital Management, has died at the age of 73.

Lord Myners served under Labour prime minister Gordon Brown for two years until 2010. Appointed as the City minister in the treasury during the 2008 financial crisis following the collapse of Lehman Brothers, he assisted in the subsequent billion-pound bank bailout package.

“My thoughts are with Paul’s family,” said the former PM. “After a successful career in finance, he was persuaded in 2008 to enter public service and was a tower of strength, helping nationalise key banks and producing a plan to overcome the global financial crisis.”

Former treasury official Nick Macpherson said Myners had been an “Inspired appointment” to the Treasury. “He played a leading role in resolving the financial crisis. Full of commercial acumen. It was a privilege to know him.”

Myners, whose adopted father was a fisherman, established a successful career in the City, working his way up to chief executive of fund firm Gartmore. He also held directorships at NatWest and hedge fund GLG, chaired Marks and Spencer and Guardian Media Group and joined the Bank of England’s Court of Directors.

“Paul was formidable with a brilliant brain, an entrepreneurial spirit and a prodigious work ethic,” said Carolyn McCall, the ITV chief executive who ran GMG while Myners was chairman. “He didn’t suffer fools at all, was a tough taskmaster and had a wicked sense of humour.”

“He was a rare breed,” said Stuart Rose, who servef as M&S chief executive in 2004 and is now chairman of Asda. “Without overdoing it, how can I describe him? He really was a beacon in a sea of mediocrity."

Ex-Citigroup banker leaves Simon Nixon family office for vertical farming firm

Ex-Citigroup banker leaves Simon Nixon family office for vertical farming firm

Former Citigroup Inc executive Adam Proctor is departing the family office of UK-based businessman Simon Nixon after less than a year in the role to advance his stake in a vertical farming business.

Proctor will become chief financial officer at London-based Vertical Future (in which he had previously made a personal investment) as of February 2022.

Founded in 2016 by husband and wife team Jamie and Marie-Alexandrine Burrows, Vertical Future provides vertical farming technology and soil-free farms. After receiving $28.6 million in initial series investment, the business received a further boost earlier this month with investment from Pula, the family office of Stephen Lansdown, founder of the financial services firm Hargreaves Lansdown.

Vertical crop growing in cities is gaining popularity worldwide and is seen as a viable and sustainable alternative for convetional farming. The vertical farming industry is expected to triple between 2021 and 2026 to almost $10 billion (according to MarketsandMarkets).

“I would like to thank Simon Nixon for being so supportive of my move,” said Proctor of the billionaire founder of MoneySupermarket.com and co-founder of Seek Ventures. “This was too good an opportunity to turn down.”

Billionaire David Bonderman’s family office invests in another car wash chain

Billionaire David Bonderman’s family office invests in another car wash chain

Wildcat Capital Management, the New York-based family office of private equity house TPG founder David Bonderman has invested in Rapid Express Car Wash, further bolstering a stake in the car wash industry after previously acquiring Club Car Wash and Express Wash Concepts.

The Rapid Express deal has made the $4.5 billion family office one of the largest car-wash backers in the U.S.

Houston-based Rapid Express currently operates 17 car wash sites in central and south Texas and is developing an additional 25. Wildcat previously invested in Club Car Wash, which has locations in Illinois, Iowa, Kansas and Missouri, and the Ohio-based Express Wash Concepts.

“Wildcat represents a unique partner for Rapid in the next stage of growth, having already partnered with and helped scale two of the top companies in the industry,” said Ahmed Jafferally, CEO of Rapid Express.

“We are confident this partnership will lead to significantly faster growth while maintaining the high standard of quality we provide to our customers.”

Collectively the three companies operate more than 130 sites today with plans to add an additional 150 sites over the next two years.

Wildcat Capital Management was established in 2011 as a single-family investment office. It currently manages in excess of $4.5 billion for a small group of ultra-high net worth individuals with interests in private consumer, business services, software, healthcare and technology-enabled companies.