FB Roundup: Daily Mail and General Trust, Ali Group, L Catterton

Founding Rothermere family mulls bid to take Daily Mail group private again

The British aristocratic billionaire Rothermere family could privately own the bestselling Daily Mail newspaper it founded after almost 90 years if the influential newspaper’s owner sells its insurance and financial assets.

The Daily Mail and General Trust (DMGT) said last week it has been approached by several undisclosed parties to acquire its insurance business Risk Management Solutions (RMS). In March, Cazoo, the used car e-tailer that DMGT has a 20% stake in, announced it is to be floated on the New York stock exchange with a $7 billion valuation.

Pending the closure of both deals, DMGT’s controlling shareholder Rothermere Continuation Ltd (RCL), the family’s Jersey-registered trust, told the DMGT board it would be prepared to make a possible cash offer of about $1.1 billion to acquire all shares not already owned by RCL.

DMGT independent directors indicated to RCL they would be “minded” to recommend the possible offer to DMGT’s shareholders, at $3.48 a share. The proposed RMS sale could be completed in the third quarter of this year. Lord Rothermere has until 9 August to make a formal offer or withdraw.

The divestment of DMGT’s risk insurance business would trail its gradual slimming-down strategy since it sold its regional newspapers in 2012.

The group traded its education technology company Hobsons, energy data firm Genscape and property website Zoopla. It offloaded its reduced 49% stake in the business information publisher Euromoney.

DMGT is a London-listed multinational media, events, insurance and data company, best known for owning Mail, Metro and “i” news operations. The group reported a 10% decline in revenue to $1.6 billion and a 36% drop in pre-tax profits to $99.8 million for the year to September 2020 as advertising collapsed during the peak of the Covid-19 pandemic.

The Rothermeres already own 36% of shares in DMGT. The group’s chairman is Jonathan Harmsworth (pictured above), 53, the 4th Viscount Rothermere. Lord Rothermere succeeded his late father as chairman in 1998 and has owned all voting rights since 2013.

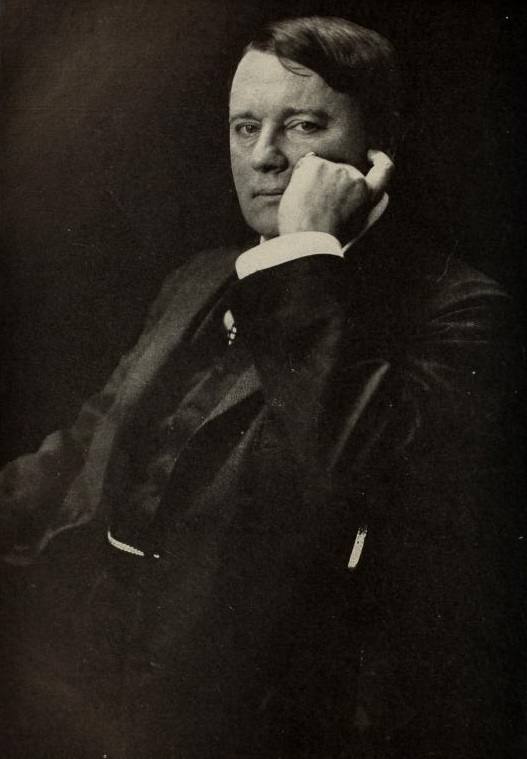

Harmsworth’s great-grandfather, Alfred Harmsworth (pictured above right), 1st Viscount Northcliffe, launched the Daily Mail in 1896. DMGT was set up to manage the family’s newspaper interests in 1922 and it was listed on the London Stock Exchange a decade later. The group began in earnest its diversification from publishing in 1988 with its formation of DMG Events.

Ali Group merges with Welbilt after founder Luciano Berti dies, aged 89

Ali Group merges with Welbilt after founder Luciano Berti dies, aged 89

The Ali Group, controlled by the Berti family of Italy, will merge to acquire Welbilt in a $4.8 billion deal to become the largest catering equipment conglomerate in the world.

The agreement was announced last week, six months after the death of Luciano Berti (pictured left), the founder and honorary chairman of the group, from natural causes at the age of 89.

The Ali Group, the $1.15 billion diversified foodservice equipment industry leader, said it will acquire Welbilt, a Florida-based commercial kitchen equipment supplier, in an all-cash transaction for $24 per share. The agreement amounted to $3.5 billion in aggregate equity value and $4.8 billion in enterprise value. The deal was unanimously approved by the boards of directors of both companies. If Welbilt shareholders approve and closing conditions are met, the deal was expected to close in early 2022.

Filippo Berti (pictured right), son of Luciano Berti and the chairman and chief executive of the Ali Group, said he looked forward to combining the complementary brands to create a comprehensive product portfolio.

“The transaction marks a significant milestone in Ali Group’s history and will position us to better serve our customers and capitalise on attractive growth opportunities,” he said.

“We are excited to welcome Welbilt and its employees to the Ali Group family as we strengthen our global presence and continue to build on our culture of quality and innovation.”

Filippo Berti was appointed its chief executive in 2016. The next-gen joined the Ali Group in 2008 with its acquisition of US commercial refrigerator manufacturer Beverage-Air, where he was president.

In January 2021, he paid tribute to his late father Luciano Berti as a “charismatic leader and a true titan of the foodservice industry, often described by his peers as a visionary.”

Luciano Berti died peacefully on 18 January 2021, eight days shy of his 90th birthday. His wife, Giancarla, died in 2019 after 52 years of marriage. They are survived by children Filippo, Marina and Agostino and their six grandchildren.

The Stanford scholar and philanthropist invested in a small Milanese automated warewashing company in 1962 then founded ALI Comenda a year later. With the initial help of Giancarla, Luciano Berti built the Ali Group into a foodservice equipment industry giant, which employs more than 10,000 people in 30 countries and operates 58 manufacturing facilities worldwide.

_-_2017.jpg) Arnault family’s L Catterton tipped to acquire Etro family business

Arnault family’s L Catterton tipped to acquire Etro family business

The Arnault family-backed $30 billion private equity firm L Catterton has the Italian family-managed fashion company Etro in its sights, according to Italian media reports.

The Connecticut-headquartered L Catterton has agreed to acquire a 60% stake in Etro in a deal which values the luxury Milanese fashion house at $590 million. The parties have yet to comment however, it would follow a similar pattern as L Catterton’s rumoured, then confirmed, acquisition of the majority stake in Germany’s sixth-generation shoemaking family business Birkenstock for an estimated $4.7 billion earlier in 2021.

Etro was founded by Gerolamo “Gimmo” Etro (pictured right) as a textile design company for the growing ready-to-wear market in 1968. The label become renowned for its paisley motif from 1981. The 83-year-old patriarch remains an adviser, but the family business is managed by his four children, Jacopo, Kean, Ippolito and Veronica.

Etro was founded by Gerolamo “Gimmo” Etro (pictured right) as a textile design company for the growing ready-to-wear market in 1968. The label become renowned for its paisley motif from 1981. The 83-year-old patriarch remains an adviser, but the family business is managed by his four children, Jacopo, Kean, Ippolito and Veronica.

L Catterton is 60% owned by the partners of L Catterton and 40% jointly owned by LVMH and Groupe Arnault, the French family office. Billionaire family principal Bernard Arnault (pictured), 72, chairman and chief executive, built his LVMH Moet Hennessey Louis Vuitton empire of 70 brands on a series of aggressive acquisitions.

LVMH’s purchases began in 1993 with the luxury leather goods maker Berluti, the family business founded by the Italian shoemaker Alessandro Berluti in 1895. Arnault’s son, Antoine Arnault, 44, one of two heirs apparent, was appointed its chief executive in 2011 and turned the shoe brand into a global luxury menswear label.