Devansh Jain of Inox Group on powering family business and renewable energy growth

Devansh Jain, the next generation entrepreneur of the Inox Group family business in India, says family enterprises have proven themselves quick to adapt and lead in the Covid-19 crisis and will play an increasingly important role in co-investing in emerging asset classes.

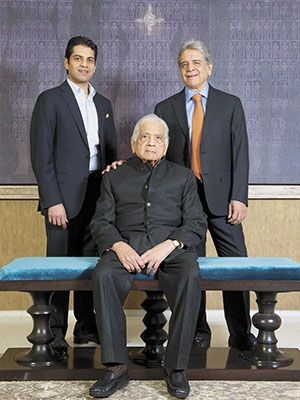

Jain (pictured), 34, is the third-generation founder and executive director of Inox Wind Ltd, the wind turbine arm of the Jain family’s $4 billion Inox Group. Since 2009, Inox Wind has grown into one of the largest and most valued renewable energy companies in the world.

Inox Group is one of India’s largest and most successful business conglomerates, holding interests in chemicals, industrial gases, engineering plastics, cryogenic engineering, entertainment and renewable energy. The group employs more than 20,000 people at more than 200 business units across India and overseas and has a distribution network that is spread across more than 60 countries around the globe.

Before he chairs the upcoming virtual forum held by Campden Family Connect, Devansh Jain told CampdenFB how he absorbed the family business as a youth at the dinner table, what inspired him to venture into manufacturing wind turbines and why ESG investing has not just become a buzzword, “but is the need of the hour.”

What are the key messages you want to send to families as chairman of the virtual Campden Family Connect Indian Family Office Forum on 24-25 November, 2021?

What are the key messages you want to send to families as chairman of the virtual Campden Family Connect Indian Family Office Forum on 24-25 November, 2021?

Family offices, particularly from an Indian perspective, are gaining increasing importance given that this is no longer just about preserving wealth, but increasingly about growing wealth for future generations.

Given the recent pandemic and the challenges everyone has faced, it is commendable to mention that family-managed businesses have been quick to adapt to changes and provide requisite leadership to emerge out of this unprecedented situation.

Various global studies show family run businesses have outperformed non-family-owned companies by a significant margin in this period. In today’s increasingly digitised and globalised world, family offices will be playing an increasingly important role in co-investing in new emerging asset classes in India such as digital ventures, startup funding, late-stage venture capital funding, amongst others. The ability of financing through family offices could play an exponential role in fostering entrepreneurship, risk taking and idea generation from an Indian context.

What inspired you to launch Inox Wind and what was your family’s reaction?

What inspired you to launch Inox Wind and what was your family’s reaction?

Right from my early days as a young boy, I recall that we have always discussed business, be it at the dinner table or going to office with my father and grandfather. Given we ran one of the largest Clean Development Mechanism (CDM) projects in one of our group companies, climate change was a subject which became extremely close to me and I wanted to do something which would have an impact in helping achieve our climate goals.

This was the reason, I wanted to do something connected with climate change, and renewables turned out to be the perfect fit for that. This also meant that while there was an identified area for investment, it required a detailed business plan with proper advice and detailed business case studies; so as to be able to implement a project around this.

We worked closely with McKinsey to work out an execution model and a business plan and then ventured into manufacturing wind turbines with an initial corpus of Rs. 10 crores invested by the family to launch Inox Wind.

Given I was all of 23 years when I wanted to do this, the initial reactions from the family were to stick to getting involved with one of the family businesses and avoid going through the pains of building a new business from scratch. Moreover, some of India’s largest corporates had failed to succeed in this segment, even though there was tremendous interest from global investors in building wind farms in India.

I was fortunate that my father agreed to let me try and build out my own business. While for me there was no question of failure, fortunately it played out well and we have been successful at building one of India’s largest wind turbine companies.

What is your growth strategy at Inox Wind and how do you intend to finance it?

What is your growth strategy at Inox Wind and how do you intend to finance it?

We grew Inox Wind exponentially from all of zero revenues to about Rs. 4500 crores in a span of five years and we were booming. Albeit in 2017, there was a very abrupt stop to this growth given the transition from the feed in tariff regime to the auction regime was not grandfathered in India which led to a lot of pain in the sector, eventually leading to the collapse of many wind turbine manufacturers.

We managed to survive only because we are one of the lowest cost producers of wind turbines globally and we are pretty lean with regards to our debt. The sector has now bounced back and we are once again looking at exponential growth in the years to come. The profitability of the business coupled with leveraging our equity should hold us in good stead in enabling us to ramp up significantly in the coming quarters.

Families are increasing their investments in sustainability— 70% of respondents in the new Investing for Global Impact: A Power for Good 2021 research report by Campden Wealth see the transition to a global net zero emissions economy as “the greatest commercial opportunity of our age”. What is your advice on the risks and rewards?

Globally, ESG has not just become buzzword, but is the need of the hour. The recent Intergovernmental Panel on Climate Change report was arguably the hardest hitting wakeup call for individuals, governments, industries to do their bit ASAP to save our future generations and make the world a liveable place.

This is now not a question of risk or rewards, but is becoming an increasingly important aspect, with global investors and customers looking at ESG compliance and giving premium to companies who are carbon neutral.

In the years to come, I believe the buzzword will shift from carbon neutral to carbon negative. So, it’s increasingly important that all the family businesses adapt to this reality be it in terms of sourcing renewable energy and green raw materials; or building green supply chains amongst various other such initiatives. These could lead to a significant re-rating of companies by investors for early movers given that in due course of time people will anyways need to make this an inherent part of their organisations. Clearly, it’s not a question of risk because laggards will be significantly beaten down by global funds and investors as well as customers.

Which have been your toughest business decisions during the Covid-19 pandemic and what are your expectations for the recovery?

Of the two toughest decisions during this pandemic, one was deducting salaries, which we chose not to do. While we had a tough time in the wind sector in the past 3-4 years, given the transition pain, but keeping in mind the long-term growth of the sector and the aspirations of the team, we decided to bear the brunt of not cutting salaries.

The other tough decision we decided on was to take an enabling resolution to dilute equity to some extent so as to be able to handle the situation as the need may be, given that there was no visibility of cash flows under the lockdown scenario.

Post Covid lockdown-1, we have seen a significant recovery across various sectors and even though Covid lockdown-2 had a significant impact on many industries again, we truly believe that business should be back to pre-Covid levels in the near future.

One significant change underlying this recovery is that stronger corporates and larger companies are increasingly becoming stronger by gaining market share, given their access to capital and their ability to withstand short term pains.

Which family values do you abide by in your ventures?

I think there are three family values which come to my mind in all our ventures—firstly resilience, secondly perseverance and thirdly staying away from debt.

I think being dogged about goals in the face of adversity and failures is extremely important for long term success. And as difficult as it may sound, perseverance is key to overcoming challenges as well as achieving long term objectives.

The third important family value which we follow is to stay away from debt. I firmly believe this holds companies in good stead and can enable long-term growth without the challenges of short-term cycles. It ensures that you are always the last man standing in your industry despite any downturn.

You have won awards for your leadership; what qualities does a robust family business leader need in the 21st century?

The most important qualities required are resilience, perseverance, being optimistic and being nimble footed given the significant changes occurring globally. Being resilient is to be able to cope adaptively and bounce back after changes, challenges, setbacks, disappointments and failures.

Being optimistic and nimble footed is equally important to have a positive mind-set which motivate people to achieve goals. Passion and empathy are things which are equally important to build successful business leaders.

How will you manage the risks some business families anticipate this year and next, namely rising inflation and interest rates?

Inflation is something which all businesses need to deal with in today’s global scenario. The way we are dealing with it is looking at costs very closely, relooking at supply chains very closely domestically as well as globally and also increasing the product prices to ensure bottom lines are protected to the greatest extent possible.

On the interest rates front, from our perspective, I think the best solution we are looking at is probably making ourselves virtually net debt free so that we do not deal with any potential interest cost increases as we move forward. And we are working towards that both from achieving operational profitability as well as raising adequate equity. I think this is something which all businesses should look at closely to kind of deal with both these impending realities.

How were you engaged by your family to join the family Inox Group business?

From the earliest days as I have mentioned earlier, I have always wanted to be a part of the business. We are a business family and have always discussed business at dinner and all my conversations with my father are around business. So, it was not a question of them wanting to engage, but a question of me wanting to get engaged in the business at the earliest. In fact, instead of a typical four-year degree, I did a dual degree in three years. I was always in a hurry to get back and do something on my own on the business side.

My initial days of engagement involved working closely, following and trailing the senior management of various group companies as well as my father, so that I could understand the nitty-gritties and the realities of dealing with people, situations and scenarios.

Where do you see yourself in the succession plan of Inox Group?

Our role as owners or promoters of the Inox Group is to build strong management teams and oversee governance as well as strategic actions so that strong professional teams can run the operations of these companies on a day-to-day basis.

I think, having spent the past 14 years in various businesses and building Inox Wind from scratch, I have been groomed to a significant extent to oversee various companies in the group as well as embark on new ventures of which we have already started working on some.