The changing face of growth equity in Europe

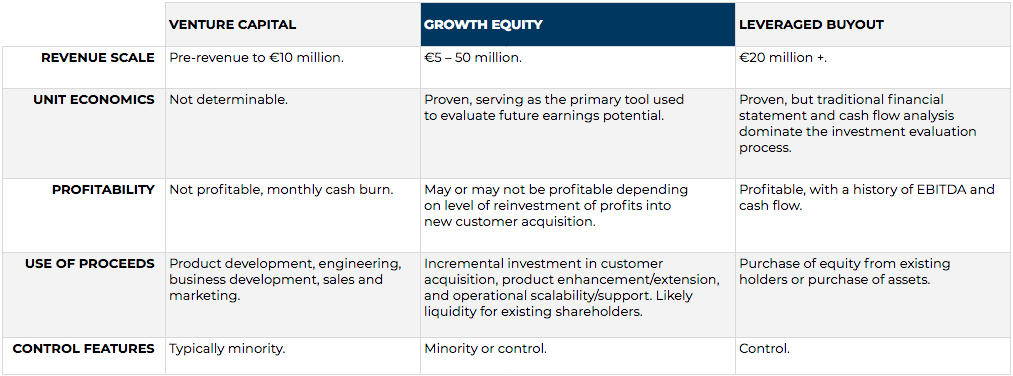

Growth equity is focused on the space between venture capital and traditional private equity. Investments are made often as a large minority stake into companies at earlier stages with proven product/market fit, that are unprofitable or structurally profitable.

Compared to venture capital, there are lower potential losses in growth equity, as companies already have a strong customer base and positive unit economics, and are more focused on expansion, either regionally or within the business itself. Private equity firms often target growth companies in more nascent markets, as the companies are looking to accelerate growth and establish themselves as market leaders. Despite its position between two more well-known asset classes, growth equity has successfully carved out a space of its own.

From slow beginnings to an established asset sub-class

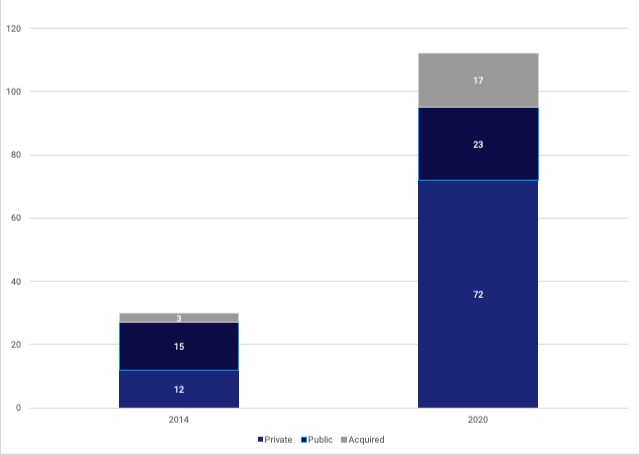

The term “growth equity” made its debut in media and financial publications in 1997, but it wasn’t until 2013 that it was officially recognised by a professional organisation, Cambridge Associates [2]. Today, it’s a distinct asset class that’s been taking up a larger and larger percentage of European fundraising. Within the region, growth funds now encompass 17% of all private equity fundraising. Just five years ago, that figure was hovering at 5% [3]. Of course, fundraising grows hand-in-hand with funds themselves. In 2019, the number of growth equity funds globally had reached more than 4,000 [4].

Growth equity’s quick rise has been relatively recent, with significant acceleration in the past decade. Fundraising in growth equity reached its peak at €15 billion ($17 billion) in 2020, with a record-breaking 159 growth funds raising capital [5]. The year before, that number was only at €2.9 billion ($3.3 billion) [6]. Moreover, €3.7 billion ($4.2 billion) of last year's €15 billion ($17 billion) capital was allocated to first-time funds.

Comparing growth equity to other asset classes

Emerging investment patterns in private equity

Worldwide, digital transformation and the resulting new business models are sweeping across industries and venture capital funding is increasing, positioning many fledgling businesses on the right path for successful growth equity investments. However, digital disruption—recently turbocharged by the pandemic—has had an uneven impact on various sectors.

It has been most strongly felt in e-commerce, travel and tourism, advertising, and entertainment—with finance, education, HR, and Ops&Dev tools currently in the midst of their own transition. Health, real estate, industrials and the energy sector are lagging behind. These industries are expected to take similar advantage of cloud and mobile technology in the near future, unlocking opportunities for fast-paced growth. Turn by turn, as industries benefit from digitalisation to extend their reach and access greater scalability.

Growth equity in Europe

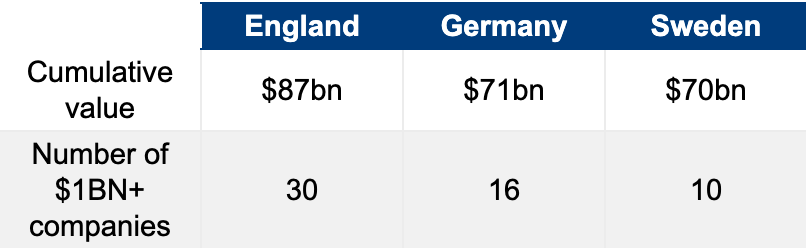

As the European ecosystem matures with venture capital continuing to grow in the region—with rapid company and value creation and repeat entrepreneurs—it creates a virtuous cycle which increases the need for growth stage capital. The number of businesses reaching a billion-dollar valuation has spiked, and cities across Europe are investing more deeply in their business and technology ventures, with a handful of hotspots like Berlin and London leading the way [7].

Number of European $1 billion companies

Behind the successes of these companies is a trend of increasing investment in the region. In the past few years, we’ve seen an astounding 232% growth in invested capital across European technology companies, with a 116% jump in the last year alone [8]. However, especially during growth fundraising, European technology companies account for a much lower percentage of invested capital compared to US businesses. In 2020, the industry in Europe saw just 17% of total invested capital in both first and second stage growth rounds (50-100m, 100-200m), while the US took 66% [9].

Capital invested in European technology companies ($ billion)

European growth equity investments and successes

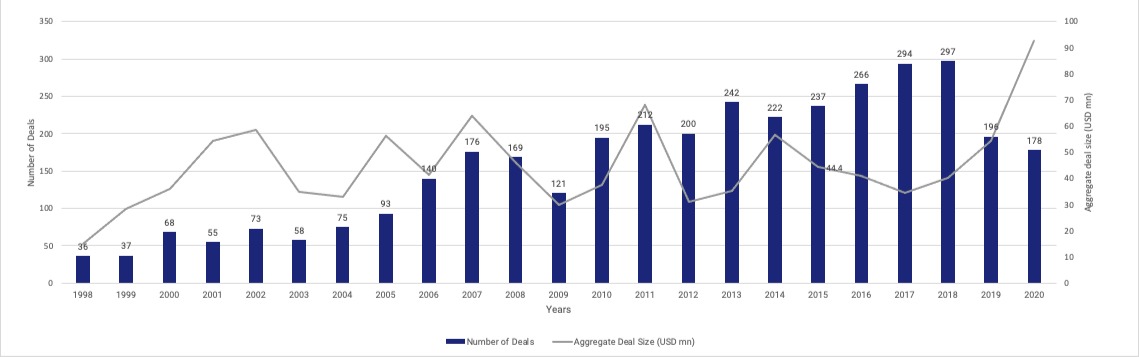

As with deal volumes, the average deal size in European growth has also experienced an extraordinary rise in the past few years, and as growth equity continues to accelerate throughout the region, there’s been no shortage of success stories for funds and their target companies.

Number of deals and aggregate size (European growth)

Source: Preqin

Adyen, a Dutch digital payments company, undertook an IPO in 2018 and generated more than $3 billion for Index Ventures [10]. Index Ventures had invested in Adyen during its growth stage, well-aligned with and ready to support Adyen’s vision of taking a strong global lead in the market.

Mollie, another Dutch company and payment service provider, raised €665 million ($756 million) in a round led by Blackstone Growth, Blackstone’s private equity focused business [11]. Mollie is slated to double operations, from processing €10 billion ($11.3 billion) in transactions in 2020 to €20 billion ($22.7 billion) in 2021. According to General Atlantic, one of the investors in the fundraising round, “Mollie is now one of the top five most valuable privately-held fintechs in Europe, and one of the top 20 in the world.”

In Germany, Lingoda recently announced a $68 million investment from growth equity firm Summit Partners. An online language-learning organisation, Lingoda is currently working towards its aspirations as a global leader in the field. The funds have been bookmarked to accelerate the company’s already-booming growth, and pave the way for new market expansion.

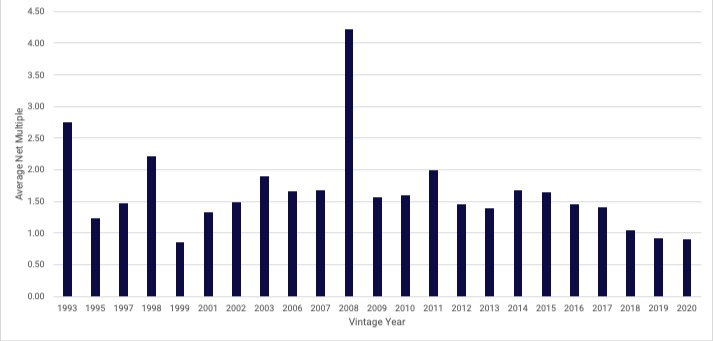

Average net multiples in European growth equity

In summary

Gone are the days of private equity being synonymous with buyouts in established, mature companies. Growth equity has emerged as an asset class in its own right, and has been strongly supported in recent years by the incredible successes of European venture capital. Today, there is a substantial requirement for growth stage capital support for companies as they choose to stay private for longer. With an attractive risk-reward profile, growth equity is a particularly interesting option for investments in Europe—a fragmented region with multiple centres well-positioned to nurture up-and-coming unicorn companies.

[1] Invest Europe (presentation)

[2] Cambridge Associates, “Growth Equity Is All Grown Up,” June 2013.

[3] Cipio Partners

[4] Preqin (as of 11 June 2019)

[5] Invest Europe

[6] Invest Europe (presentation)

[7] Europe’s start-up ecosystem: Heating up, but still facing challenges, McKinsey, 2020.

[8] State of European Tech, Atomico, 2019

[9] Titans of Tech, GP Bullhound, 2020.

[10] Forbes

[11] General Atlantic

Disclaimer

The views, opinions and estimates expressed herein constitute personal judgments of certain members of the Titanbay Ltd. (Titanbay) team based on current market conditions and are subject to change without notice. This information in no way constitutes Titanbay research and should not be treated as such. Titanbay does not make investment recommendations, and no communication, including this document, should be construed as a recommendation for any security offered on or off the Titanbay investment platform. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production.

This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, investors should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own professional advisers, if any investment mentioned herein is believed to be suitable to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that investment in private placements involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance is not indicative of future results. Non-affiliated entities mentioned are for informational purposes only and should not be construed as an endorsement or sponsorship of Titanbay.

Investments in private placements, and private equity investments via feeder funds in particular (such as through the Feeder), are speculative in nature and involve a high degree of risk. The value of an investment may go down as well as up, and investors may not get back their money originally invested. Investors who cannot afford to lose their entire investment should not invest. Past performance is not indicative of future performance. Please refer to the respective fund documentation for details about potential risks, charges and expenses. Prospective investors should carefully analyse the risk warnings and disclosures for the respective fund or investment vehicle set out therein. For private equity investments via feeder funds, investors will typically receive illiquid and/or restricted membership interests that may be subject to holding period requirements and/or liquidity concerns. Investments in private equity are highly illiquid and those investors who cannot hold an investment for the long term (at least 10 years) should not invest. The external Alternative Investment Fund Manager is Avega Capital Management S.A., a public limited company (société anonyme) formed under the laws of Luxembourg, with registered office at 2, rue Edward Steichen, L-2540 Luxembourg, Grand Duchy of Luxembourg, and registered with the RCS under number B 246.691.

The representative in Switzerland is ARM Swiss Representatives SA, Route de Cité-Ouest 2, 1196 Gland, Switzerland. The paying agent in Switzerland is Banque Cantonale de Genève, 17 quai de l’Ile, Geneva, Switzerland. The Prospectus, the Articles of Association and annual financial statements can be obtained free of charge from the representative in Switzerland. The place of performance and jurisdiction is the registered office of the representative in Switzerland with regards to the Shares distributed in and from Switzerland. Titanbay is an Appointed Representative of Brooklands Fund Management Limited which is authorised and regulated by the Financial Conduct Authority with firm reference number 757575.