Why real estate can be an investment strategy to build on

Are you looking for an alternative investment strategy that carries high reward with a strong level of security? Creating a partnership with an experienced real estate developer with a strong track record may just be the right strategy. In this article, Thomas Muir of APG Capital explores how and why the right property developer matched with a strong source of capital can create a win-win long-term relationship as an alternative to mainstream investment opportunities.

Introduction

Thomas Muir, is the founder of APG Capital and explains how and why his property development business works with equity investors to generate strong returns for all stakeholders.

Scaling a property business through Brexit, Covid and political chaos has certainly come with its challenges, however each challenge has presented an opportunity to refine our business model and create investment opportunities that de-risk real estate development transactions as much as possible.

Our group of companies has a wealth of experience in each property industry sector from asset management, large multi-unit construction and lead developer on delivering high-quality accommodation either for sale to or retaining within our residential portfolio.

Over the past 5 years, APG Capital has been involved in the delivery of more than 300 residential units, developed £15 million worth of property from scratch and, in doing so, has successfully raised and managed private investor funds for more than £5 million.

Real estate development

Real estate investment and development is a complex process that requires a great deal of research, planning and expertise. All the components make property development a cash-intensive business of which most transactions are funded using institutional capital mixed with equity in various guises and contributions from the developer (usually proceeds of their last project).

However, a deeper dive into these equity portions of the capital stack offer high reward to investors and capital allocators which, if a transaction is structured in the correct way, can be highly lucrative.

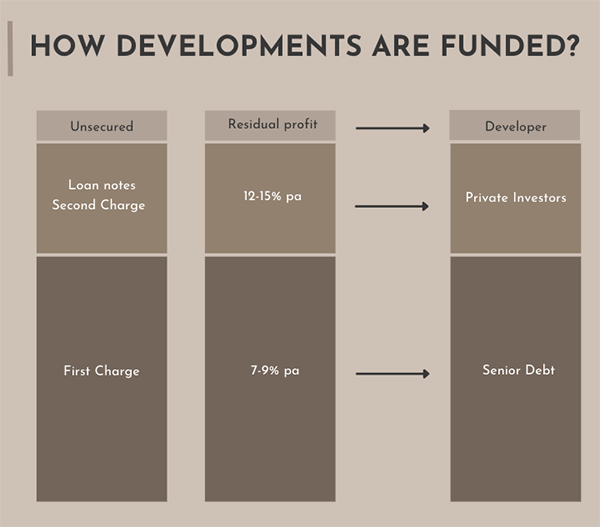

Typical funding structures

Typically, the majority of our projects are 60% net funded by bank facilities at a standard rate anywhere from 6-10%. Once the bank covers this, there’s a large deficit between total costs required to complete the project and what’s being funded by the bank.

In order for us to use the commercial capacity of our operation, we offer our opportunities to our investment partners to provide the equity capital portion for a return on the capital placed.

Investments are made on a project-by-project basis and funds are secured against the development site using different various security formats to suit different requirements.

De-risking the investment

The reality is property development is a risk-management process and taking an investment in an equity position subordinate to the first charge lender could be viewed as a higher level of risk.

Prior to bringing an investment ready for placement, APG Capital works to de-risk each stage of the development cycle to bring its equity partners more comfort and equally as much information as possible to enable a decision to be made if the opportunity is one of interest or not. We believe there are five key risk factors (among others) that we aim to have mitigated prior to onboarding investment funds:

Planning permission – All investment opportunities presented have planning permission in place.

Verification of building values – All asset values are presented with a third-party Royal Institution of Chartered Surveyors (RICS) red book valuation report.

Verification of build costs– All build cost assumptions are presented with a third-party RICS construction costs report.

Exit strategies & options –APG Capital has relationships with a number of acquisition managers who have a strong demand for the finished residential product - where possible deals are presented with their registered interest as an exit ranging from a letter of intent or in some cases legals in process to exchange.

Construction process – As part of the apg group of companies we have an in house main contractor business which holds a strong tier 1 construction management team. managing the construction process effectively in house gives an element of control of costs & programmes and the flexibility of handling issues when they arise without the need for delay.

Security, rewards and returns

1 - Equity capital funds are secured against the asset using a range of agreements. Each transaction/investor holds different needs, therefore we are flexible on our arrangement from second charges to shareholders agreements.

2 - Investment funds on a project basis are typically required from 12-24 months to allow for acquisition, construction and completion of the exit.

3 - In return for equity capital the investor receives a 50% profit share on net proceeds once the development exit is completed.

4 - Typically our aim is to achieve an above 25% ROE (Annualized) for the investor

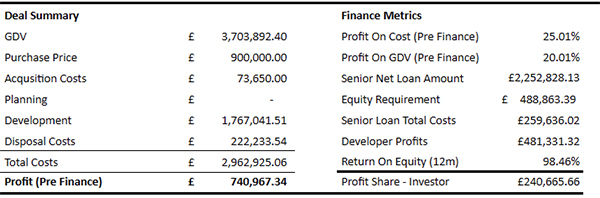

Deal sample

The future

APG Capital currently holds a pipeline of projects with a gross development value of £50 million which it plans to deliver over a period of 18-24 months.

We are seeking to identify investment partners who have capacity to fund our projects on a wholesale basis to give us the financial support to enable us to scale our business and create a mutually beneficial partnership.

Project equity funding requirements range from £500,000 to £1.5 million per project. Our commercial capacity currently ranges between five to six projects at any one time at various stages – for example, acquisition/construction/exit.

Contact us today to learn more about how our opportunities could fit your alternative investment strategy. Email Thomas Muir at tom@apgcapital.co.uk or call on +44 7872 477583.