Why family businesses need not fear the blockchain

There’s no denying that blockchain is the wave of the future but, for some, it’s currently too nebulous and intangible to consider heavily investing in.

Following the crypto crash earlier this year, the crypto market has seen colossal corrections and some sizable recoveries. That uncertainty is perhaps understandably set to continue but blockchain VC fund Mocha Ventures believes these corrections are healthy for the industry as a whole, and are providing tremendous opportunities for savvy investors to step into the digital assets market at the right time with the right partner.

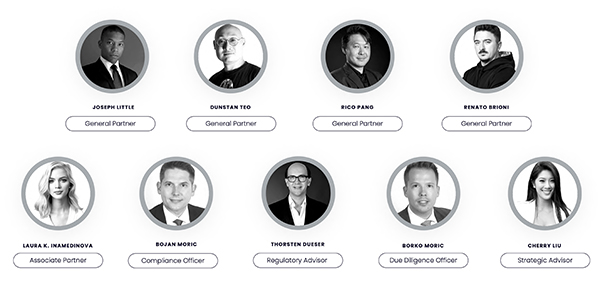

The team behind Mocha Ventures is on a mission to reassure that “Blockchain networks and digital assets are landmark innovations that will fundamentally reshape the global financial system, and investors should be able to participate in this transformation”.

By working with early-stage blockchain projects and offering professional data-driven solutions for digital-asset investors, they are presenting a new way to understand and invest in the space.

Ahead of partnering with Campden Wealth at The 24th European Family Office Forum in London on November 1 and 2, Mocha Ventures’ general partners discuss how they are capturing some of the most innovative technologies in the blockchain revolution and why family offices should be getting involved…

You focus on early stage blockchain companies with global growth potential. How do you identify those companies and what is the criteria they need to fulfil?

Renato Brioni: As VCs, we transitioned in 2020 from standard investments into the blockchain because we saw the remarkable opportunities after one of our funds took on tremendous multiple returns on exit. We felt that was something happening there.

We decided to not get involved with bitcoins and cryptocurrencies because they're completely unpredictable. So we thought, why don't we be different? During the crypto crash in summer of 2022 we analysed more than 200 crypto companies, and discovered patterns that revealed to us what separates the winners from the losers. Of those firms, 100 simply disappeared, 60 were surviving and 40 were thriving.

So we went through a deep-dive analysis asking what it was about those 40 firms that made them so successful. As a result, we defined seven different pillars of success that we now use in our due diligence – Founder, Team, Go To Market, Technology, Utility, Innovation and Community. This scorecard allows us to grade the seven things that the successful companies have really nailed and helps us to define the potential return on our investment. We like proper due diligence, we like things to be put in order.

What would you advise to family offices looking to get into blockchain venture capital but don’t know where to start?

Joseph Little:One of the hardest things that family offices face when they first hear about blockchain is understanding what it all means – really, what’s the difference between blockchain and my kid’s World Of Warcraft account?

Our main goal is to, as a fund, make money, but our secondary goal is to grow this community. Just as we’ve seen how the internet evolved and became a part of all our lives, we see the same thing happening with blockchain and how it's going to integrate with our technology.

So to help individuals, as well as to also aid further monetisation, we really believe in bringing tangible assets into the digital asset class, such as using NFTs to help facilitate real estate transactions. We believe that assets a consumer, business or investor can actually see and use are vital to the adoption of crypto and blockchain – not only vital, but an inevitability.

Renato Brioni: If you look at family offices investing directly into digital assets, typically led by the younger generation, our data shows that allocation is currently about 2% of the family office’s total assets. The problem there is if you're looking globally, there are not currently many regulations around the world, apart from Europe and Dubai at this point in time. So when we spoke to family offices and tier-one VCs from Australia, Singapore and Dubai, they said what they lack is three things: ‘We need a crypto fund that is regulated. We want to sleep at night knowing the people we’re working with won’t disappear overnight. And we want people who are going to navigate us through uncharted waters of digital assets.’

So when we help family offices, we sit with them and explain to them that this can be a risky business if you don’t know what you’re doing. They need to work with somebody they can trust, who is regulated and who has a previous track record of success.

At the end of the day, we invest in blockchain and crypto projects that are; solving real business problems, have existing users and paying customers, can survive and thrive in the bear market and explode in the bull market.

In Campden Wealth’s North American Family Office Report 2021, we found that digital asset adoption is on the rise, with 31% of North American Family Offices already investing in cryptocurrency. However, there is a still a hesitation to invest digitally, why is this?

Renato Brioni: There’s perception and there's reality. The perception is that there's a whole bunch of people there who will not invest in this field because they find it risky and they don't understand it. If you don't understand it, you don't touch it.

Family office trustees can find it hard to trust younger family members – the generation that more readily understands the benefits of digital assets.

When somebody teaches you how to drive a car, they also have control of the pedals. We let you drive but we also can take control and guide you. Once you have seen some returns and you see those returns are realistic, then people start changing their opinion.

Joseph Little:The reality is that it will take time to change hearts and minds but people are coming around to it. When web 1.0 came out in the 1990s and into the early 2000s, no one was going to sign a document and send it over email. But then towards the end of web 2.0, DocuSign came up, and we realised this is a non-fungible asset, a real-use case for technology. Technology has now adapted or has evolved – we now use DocuSign every day, it is even admissible in court. Blockchain is just the next iteration, it's a continuation of the internet we know and use. Where we were able to secure documents, now we're able to secure an individual’s privacy and those individuals also now have power and control over that information.

Mocha Ventures are main partners at Campden Wealth’s 24th European Family Office Forum in London on November 1 and 2. For further information and to register, click here.