The Russell Investments ESG Manager Survey 2020: Turning up the volume

The Russell Investments annual ESG Manager Survey of active managers assesses the integration of ESG considerations in investment processes among equity, fixed income and private market managers and spotlights firm wide policies, use of data, engagement and integration.

The survey was conducted from 26 May to 17 July, with the results published 6 October, 2020.

Have environmental, social and governance factors increased or decreased in importance?

According to the results of Russell Investments’ annual asset manager survey, the volume has been turned up on responsible investing. The integration of environmental, social and governance (ESG) is now universally recognised as a significant consideration when analysing long-term investment opportunities.

The survey results show that an increased number of firms are incorporating additional ESG metrics into their investment process, expanding their dedicated responsible investment resources and providing greater transparency through reporting. Data providers are integral in providing a broader perspective of companies or entities in the marketplace, with engagement activities also playing a vital role in asset managers gaining and making use of ESG-related information.

The results indicate that there is amplified focus on climate risk in investment outcomes, with these measures continuing to improve.

Amplified focus on ESG factors and climate risk

Russell Investments conducted its annual ESG survey across equity, fixed income, real assets and private markets asset managers from around the globe to assess their attitudes toward responsible investing and how they integrate ESG factors into their investment processes. This year's survey covered a wide range of topics, including the following:

• The respondents’ investment process of how explicit ESG issue assessments are captured

• ESG data sources

• ESG asset class coverage

• How ESG insights were formed

• Climate risk impacts

• Dedicated responsible investing resources

• Engagement activities

• Product offerings

• Reporting

The survey has a longstanding history and has evolved over the past several years, enabling deeper insights into trends and how the attitude towards responsible investing has changed since it launched in 2015.

Russell Investments incorporates ESG factors into its investment process. As a component of our manager research process, manager research analysts assign an ESG score to individual strategies. The ESG survey results contain a rich source of information about how each asset manager approaches ESG. As such, the survey results serve as significant reference points when evaluating investment strategies.

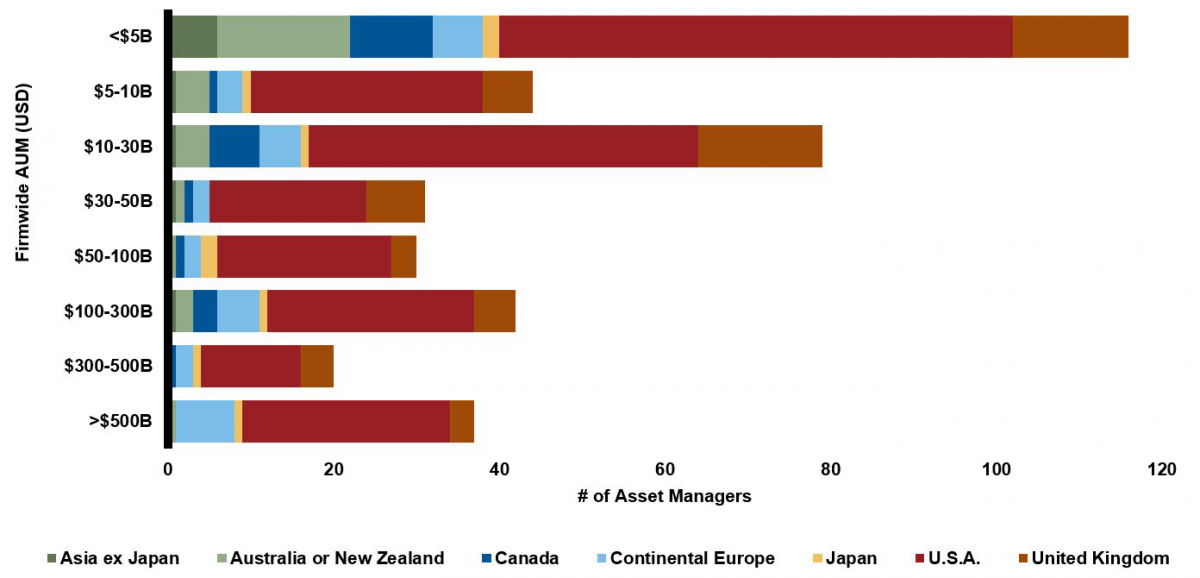

The 2020 survey was completed by 400 asset managers from around the globe, a 33% increase from last year, indicating the amplified focus on responsible investing. The survey participants have broad representation by asset size, region and investment strategy offerings. Of the 400 participants, 300 offer equity strategies, 208 offer fixed income strategies, 127 offer private markets strategies and 121 offer real assets strategies. Some 60% of the respondents are headquartered in the United States, 14% are based in United Kingdom, 8% are based in continental Europe, with the remainder in other regions. Furthermore, 40% of the respondents have assets under management of less than $10 billion. Conversely, 25% of the participants have more than $100 billion in assets.

Survey population

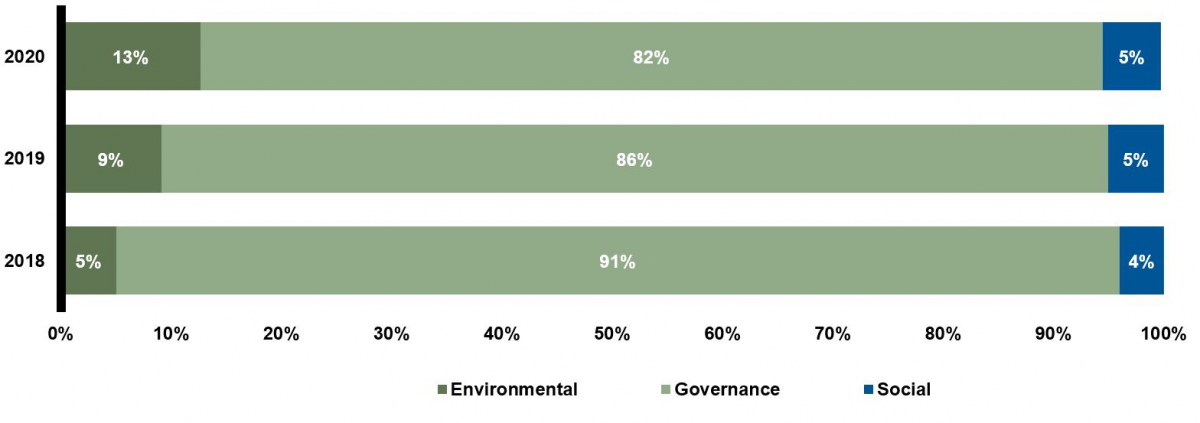

Which ESG factors drive decision-making?

Materiality of ESG considerations is getting greater attention. With broader ESG-related information available in the marketplace, the implementation of ESG considerations has evolved. But the extent of the role that ESG assessments play in actual investment decisions remains unclear, due to the intertwined nature of the ESG assessments with other research activities. To gain greater clarity, we first asked which ESG factors impact the investment decisions the most.

Governance remains the dominant factor. This is no surprise, given that company management has been a critical component in long-term enterprise value. Materiality of ESG elements differ by industries. For instance, environmental aspects might be more material to the industrial sectors like energy. Social elements like human capital management and data securities might be more material to technology or finance sectors than other industries. But the overall corporate governance applies to all companies, regardless of industry.

Governance remains the dominant factor. This is no surprise, given that company management has been a critical component in long-term enterprise value. Materiality of ESG elements differ by industries. For instance, environmental aspects might be more material to the industrial sectors like energy. Social elements like human capital management and data securities might be more material to technology or finance sectors than other industries. But the overall corporate governance applies to all companies, regardless of industry.

That said, we have noticed a reasonable uptick in environmental and social factors, when compared to the previous years’ responses. Environmental issues remain at the forefront of asset owners’ interests. With the rise in electronic vehicle demand and increased regulations to tackle the climate change risk, there appears to be a secular headwind for carbon-intensity industries like energy, which is impacting the valuation of those companies. In the wake of Covid-19, social factors could potentially increase further as investors look to prioritise investing with a conscience.

Which ESG factor impacts your investment decision the most?

Active ownership continues to rise in prominence

When asked to identify the primary source of ESG information, engagement activities are viewed as the most frequent primary source of ESG-related assessments. To support this trend, asset managers are increasing their engagement activities with underlying companies, or in some cases, governments, in order to influence entities' potential outcomes such as greater transparency, improved behaviours and reduced uncertainty and risk.

Almost all of the firms with assets under management greater than $100 billion always, or occasionally, included ESG discussions in meetings with senior management, compared to 74% of firms with asset size less than $10 billion. Some 10% of the respondents cited that they don’t engage in any way with companies, and those firms include systematic equity managers, fixed income, private markets and real assets managers.

The survey also indicates that engagement activities increased even among fixed income managers, where 92% of fixed income managers regularly engage with underlying companies, they invest in. Bondholder engagement has become a crucial part of the responsible investment approach and process. A growing number of bond investors hold the view that engagement activities can provide greater insights into the underlying companies or entities, improve transparency and influence business practices. As the importance of active ownership continues to increase, so will the consensus among investors to incorporate active management across all asset classes.

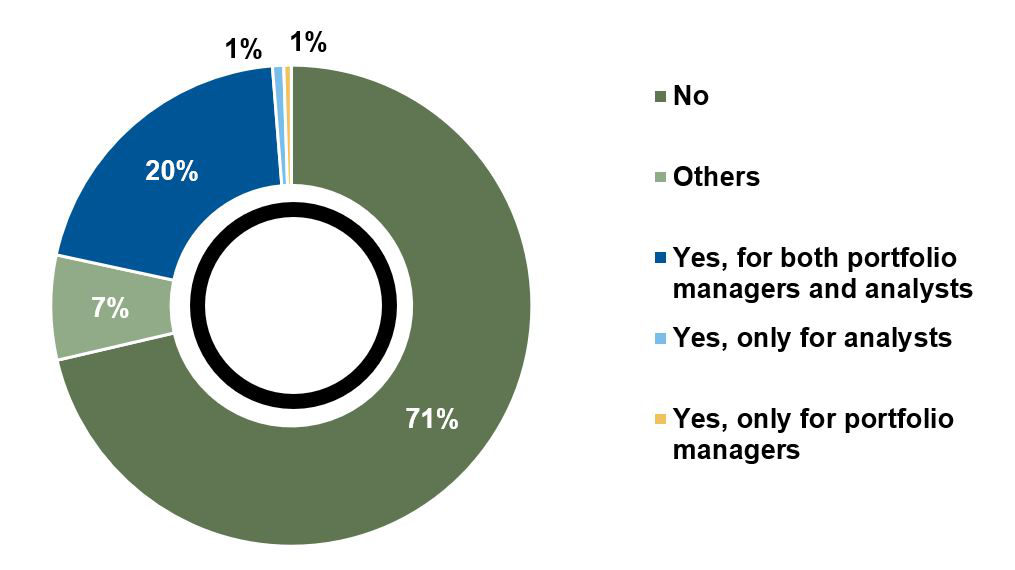

ESG accountability: Client or financial driven?

While asset managers are broadening their perspective of ESG measures, the question remains whether such efforts are client-demand-driven or financial-result-driven. To gain a deeper understanding, we asked participants if they have portfolio performance measures that have direct ties to ESG profiles or climate-risk criteria for the strategies that are not labelled as responsible investing or ESG offerings. In other words, do they use ESG or climate-risk without marketing those efforts?

Only 22% of the respondents have portfolio performance measures for portfolio managers and/or analysts with direct ties to ESG-profile or climate-risk criteria. This shows that ESG profile accountability is weak among key investment professionals, suggesting that ESG impacts alone have less weight to investment performance outcome than the hype of ESG integration suggests. Despite the weak accountability, we believe it is essential for asset managers to integrate ESG within the investment process. Regulations across the globe evolve. European regulators seek to support the Paris Agreement via extensive regulations that quickly come into force over the next few years, starting 2021.

Only 22% of the respondents have portfolio performance measures for portfolio managers and/or analysts with direct ties to ESG-profile or climate-risk criteria. This shows that ESG profile accountability is weak among key investment professionals, suggesting that ESG impacts alone have less weight to investment performance outcome than the hype of ESG integration suggests. Despite the weak accountability, we believe it is essential for asset managers to integrate ESG within the investment process. Regulations across the globe evolve. European regulators seek to support the Paris Agreement via extensive regulations that quickly come into force over the next few years, starting 2021.

Meanwhile New Zealand, recently mandated support for the TCFD. And the US Department of Labor has moved to steer Employee Retirement Income Security Act of 1974 (ERISA) governed plans away from investing in products with ESG-related themes. This increase in regulation will encourage further transparency amongst asset managers, providing investors with clarity and reducing the risk of green washing.

Do you use any portfolio performance measures that have direct ties to ESG profile or climate-risk criteria?

The bottom line: ESG is amplified

The Russell Investments ESG Manager Survey 2020 revealed a high level of ESG awareness and increasing ESG factor integration among the asset management community. The survey results conclude that ESG integration enables a more comprehensive ability to analyse underlying companies, beyond the traditional company analysis.

An increased number of asset managers are gathering ESG-specific assessments into their investment process. However, despite the increase, the degree of ESG integration and the methodologies vary, especially by region, by firm asset size and by asset class. As local ESG and responsible investing regulations increase, this trend is also influencing how asset managers are incorporating ESG criteria into their investment processes, with greater transparency and reporting. We believe recognising those regional and AUM differences is important when evaluating peer-relative investment strategies.

An increased number of asset managers are gathering ESG-specific assessments into their investment process. However, despite the increase, the degree of ESG integration and the methodologies vary, especially by region, by firm asset size and by asset class. As local ESG and responsible investing regulations increase, this trend is also influencing how asset managers are incorporating ESG criteria into their investment processes, with greater transparency and reporting. We believe recognising those regional and AUM differences is important when evaluating peer-relative investment strategies.

ESG metrics expanded, along with ESG data providers, where more asset managers are using multiple data providers to broaden ESG-related awareness and perspective. More asset managers form their ESG insights with inhouse views supplemented by external ESG data providers. As engagement was cited as the most popular ESG information source, these activities increased even among fixed income managers.

Russell Investments integrates ESG in its manager research practice, and this ESG survey helps form our assessment of managers' ESG integrations as a part of manager strategy evaluation. The results of this survey point to a marketplace that has reached universal recognition of the importance of ESG integration. We believe that the industry is transitioning toward further embracing ESG integration, using broader inputs, ESG-specific data and dedicated resources. At the same time, measurements of actual impact on investment decisions remain vague. When financial materiality of ESG-specific consideration is high, investors take such information into consideration. But anecdotally, such instances appear rare. The link between ESG effort and a direct tie to portfolio performance directly to ESG factors is weak, suggesting that ESG criteria in isolation are rarely a strong driver in overall investment decisions.

Our research demonstrates that the investment community is seeking better information, deeper resources, broader consideration and clearer regulatory standards. However, the key question remains—‘to what degree’? The goal is to achieve the best-practice ESG integration. Agreement on how to reach that goal? The world is clearly not there yet.

Unless otherwise specified, Russell Investments is the source of all data. All information contained in this material is current at the time of issue and, to the best of our knowledge, accurate. Any opinion expressed is that of Russell Investments, is not a statement of fact, is subject to change and does not constitute investment advice. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

Issued by Russell Investments Implementation Services Limited. Company No. 3049880. Registered in England and Wales with registered office at: Rex House, 10 Regent Street, London SW1Y 4PE. Telephone 020 7024 6000. Authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN. Russell Investments Limited is a Dubai International Financial Centre company which is regulated by the Dubai Financial Services Authority at: Office 4, Level 1, Gate Village Building 3, DIFC, PO Box 506591, Dubai UAE. Telephone + 971 4 578 7097. This material should only be marketed towards Professional Clients as defined by the DFSA. Russell Investments Ireland Limited. Company No. 213659. Registered in Ireland with registered office at: 78 Sir John Rogerson’s Quay, Dublin 2, Ireland. Authorised and regulated by the Central Bank of Ireland.

KvK number 67296386

©1995-2020 Russell Investments Group, LLC. All rights reserved.

MCR-00886/01-10-2021 EMEA 2091