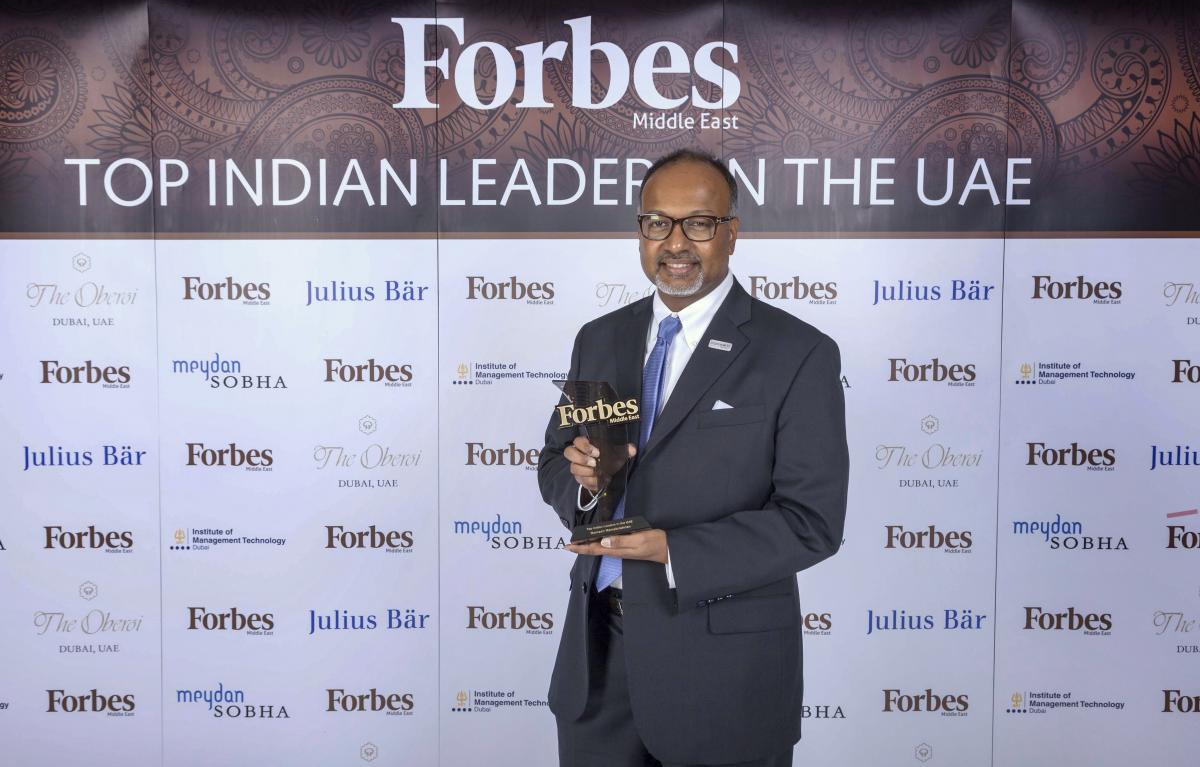

Ramesh S Ramakrishnan of Transworld Group on opportunities, philanthropy and legacy

Ramesh S Ramakrishnan, the chairman of the global family-controlled shipping and logistics group Transworld, says being alert and agile for new opportunities will be vital for families as businesses cope with the new post-pandemic world.

Ramakrishnan spoke with CampdenFB ahead of his chairmanship of the leading Indian Families in Business Meeting, organised by Campden Family Connect, on 21-23 October, 2020.

Ramakrishnan expanded Transworld Group from a shipping agency house his father founded in Mumbai in 1977 to an award-winning fully integrated logistics and shipping conglomerate with its global footprint across all aspects of the supply chain. The group’s expertise covered a range of solutions, from ship owning to project logistics to warehousing.

Ramakrishnan has been a resident of the United Arab Emirates (UAE) since 1989. He was born to the late Shri Sivaswamy Iyer and Smt Valli Sivaswamy and was raised in Quilon, Kerala. After completing high school, he moved to Mumbai with his parents and graduated from Mumbai University, while continuing to work in his father’s fledgling business. He successfully completed the Owner/President Management Programme at Harvard Business School and has chaired Transworld Group for 32 years.

The third generation of the family business was assured with his son Ritesh S Ramakrishnan working as joint managing director and daughter Anisha Ramakrishnan as director of corporate responsibility and business analytics.

Ramesh S Ramakrishnan is a recognised philanthropist who supports charitable trusts and causes. He promotes Indian art, music and culture in the UAE and India. He backs the development of rural India and women’s health and empowerment with initiatives including Transworld Group’s sponsorship of the Usher School of Athletics, led by Indian Olympian PT Usha.

Ahead of the meeting, Ramakrishnan shared his thoughts on the family values he passes on to his next generation, the sustainable investments he is most passionate about and how family businesses should prepare for the post-Covid-19 world.

What will be the key messages you want to send to family peers in your role as chairman of the Campden Family Connect Indian Families in Business Meeting 2020?

What will be the key messages you want to send to family peers in your role as chairman of the Campden Family Connect Indian Families in Business Meeting 2020?

It is an honour for me to chair this meeting of an illustrious group and I appreciate Campden Family Connect to connect me with peers, share experiences on challenges faced and learn from each other the best practices during these tough times and situations going forward.

Any crisis presents everyone an opportunity to reflect, make amends to the status quo and find new opportunities for the future. Times like these make you humble. The more we accept and embrace the new reality, the easier it gets to find new ways to navigate and come out stronger.

Some of the key messages which I would like to share with other family peers at this meeting are how families will be running their businesses in the new world, making changes, adapting and ensuring their leadership and legacy are maintained. In today's increasingly changing marketplace, families now must contend with the realities of tough ownership decisions, the ability to create flexible management structures as well as optimise intergenerational communication.

What have been your toughest decisions yet in managing the impacts of the coronavirus pandemic on your family business Transworld Group?

What have been your toughest decisions yet in managing the impacts of the coronavirus pandemic on your family business Transworld Group?

Every disruption is test of our inherent strength and tenacity in adapting to changing circumstances. The best part of Transworld is, though it is a family owned business, every employee feels a part of the Transworld family as a “Transworldite”. We did have to take some tough decisions to mitigate the impact of the Covid-19 pandemic. Before Covid struck, we were working on many plans and examining new projects. So when Covid happened and businesses were disrupted, we had to take some tough decisions, not only for the new growth areas, but also to ensure we are able to navigate our existing businesses by making them leaner and stronger.

The strategy and action plans were carefully deliberated and worked out by our senior team members collectively. In fact, we did surveys soliciting suggestions from all levels, right up to the junior most staff on steps to be taken in facing this challenging situation.

Our senior management team members including the board of directors volunteered for a substantial salary reduction, which was subsequently restored. This voluntary reduction was suggested by them so that the junior staff members are not impacted, and they continue to get their salaries. This speaks volumes of our leadership team and putting team and the organisation above oneself.

We have always believed that staying focused and positive in tough times always yields positive results. We have always taken a long-term view on the business side which helps us to take tough calls that are in line with the long-term interest of our businesses and also create value for all stakeholders.

Is this era of geopolitical uncertainty and recession the right time for a family business to invest and acquire or consolidate and preserve wealth?

Is this era of geopolitical uncertainty and recession the right time for a family business to invest and acquire or consolidate and preserve wealth?

The mission of our family office is to pursue long term wealth creation and building legacy for future generations. I believe that family offices should always look for opportunities irrespective of the economic and social situations prevailing. Rather than taking extreme standpoints, the wealth creation strategy should be to manage risks at all times. Economies and markets go through cycles and it is not possible to time the markets. However, when there is disruption, uncertainty and fear all around, like in the present situation, statistics will also confirm that these are the best times to commit long-term capital. Investing in stressed times will more often than not, generate outsized returns on the invested capital. In such times, reviewing the current portfolio of investments, investing from a long-term perspective and at the same time conserving and prudently deploying existing resources can be a possible approach.

I believe next year will provide lot of opportunities to build a long-term portfolio. Technology enabled sectors like healthtech, edtech, etc will continue to outperform. Traditional businesses will have to adapt quickly and undergo changes to cope with the new environment. Hence, agility will be a key driving factor for the family offices to remain nimble and alert for opportunities and new ideas.

Which lessons did you learn from your father, Mr R Sivaswamy, in your succession in the family business that you apply to your next generation, son Ritesh Ramakrishnan and daughter Anisha Ramakrishnan?

There are two important lessons I would like to highlight here—vision and human relationships. My father was having only partial eyesight. But that did not deter him form having a large vision and dreaming big. From humble beginnings in a village in Kerala with no capital to start with, he visualised owning a fleet of ships and creating a world-class organisation. Another most important lesson is that our values and ethics is what defines our character. Human touch in our dealings, respecting people, giving back to society is more important than just being successful and accumulating wealth. Being a ‘good human being’ is more important than being a ‘great human being’ is the legacy of my father our family strives for.

It makes me proud to see the next generation, my son Ritesh and daughter Anisha, also being very tuned in to the values and the vision which was set out by my father. They have ensured that the human element is not lost while dealing at the workplace or in business relationships with other stakeholders. I am happy to share that in the last two years, our organisation has been recognised as a ‘Great Place to Work’ by awards in both in United Arab Emirates and India. Furthermore, we have made lot of progress in the corporate responsibility space, where we have aligned our goals with some of the key UN’s Social Development Goals (SDGs).

How can family business leaders attract and retain the best non-family talent at their C-suite level?

How can family business leaders attract and retain the best non-family talent at their C-suite level?

We, at Transworld, are fortunate to have most of our staff, especially the non-family leadership team, working with us for decades. As I think back, mutual trust and respect, transparency, involvement in decision making processes and the ability to speak up and take decisions are some of the key factors that helped develop commitment among our employees.

In my opinion, at the stage of recruitment of a C-suite executive, it is important to ensure that the person apart from being an outstanding performer, also has his or her value systems aligned with those of the family business. Also, a clear job profile and clarity on a growth plan along with proactive feedback to the executives provides comfort and improves the stickiness to the organisation.

It is equally important that the family also develops a mindset to drive the business in more institutional manner and not as a typical family-run business. Good governance practices and having independent minds guiding the family business are equally important to attract best in class talent. Lastly, one can attract the best of talent at a price, but in order to retain them, it is important to provide them with a working environment which motivates them to excel and also conduct themselves in line with the family business values.

In which causes should family philanthropists focus their sustainable investments in the next decade?

In which causes should family philanthropists focus their sustainable investments in the next decade?

Sustainable investing has been a focus area among family philanthropists. However, the outbreak of this pandemic has accelerated the activity and will continue to do so going forward.

In my opinion, environment, food and health are going to be the themes among the family philanthropists considering the impact of global warming, as well as the pandemic this year. It is important that families support businesses which are creating positive societal impact and at the same time generating long term competitive financial returns. I see lot of venture funds also working in this space and families should support such initiatives.

From our organisation perspective, the higher purpose is ‘Delivering Prosperity’, not for ourselves, but for the entire ecosystem around us.Through our Corporate Responsibility (CR) activities we have always focussed on harmonising our core values of integrity, transparency, respect, customer centrality, excellence, and social and environmental responsibility with the UN’s Social Development Goals (SDGs).

We have made the following four areas as the key focus areas to create long term impact:

- Marine stewardship

- Health, food and water security

- Gender equity and inclusion

- Arts, education and civic engagement

Our Employee Volunteering initiative, wherein employees are encouraged to engage in social volunteering activities around pressing social issues, has made our staff members philanthropists in their own right. They drive regular community-based initiatives, awareness campaigns and encourage cross-learning and talent sharing with our organisational partners. The volunteering programme is driven by a group of CR Energisers—a voluntary cross-section team of employees.

Rather than just donating money to a cause, it is important philanthropy is looked upon as our moral obligation to give back to the society and the environment we have lived in and taken so much. More importantly, it’s the thought-seed of giving and caring we should nurture in people that can be truly sustainable than any amount of financial contributions.

Rather than just donating money to a cause, it is important philanthropy is looked upon as our moral obligation to give back to the society and the environment we have lived in and taken so much. More importantly, it’s the thought-seed of giving and caring we should nurture in people that can be truly sustainable than any amount of financial contributions.