Private debt?The outlook for 2021: Is the old new again?

Providing loans to companies has historically been one of the main components of commercial banking activity and goes back hundreds of years. Today, private debt comes in many forms, but most commonly involves non-bank institutions making loans to private companies based on cashflows generated by the respective business, or for the acquisition of a hard asset (eg, real estate) or acquiring existing loans on the secondary market.

Since the global financial crisis (GFC), private debt has received increased attention and growth for a variety of reasons, not the least of which include an ongoing low interest rate environment, elevated equity valuations and investors seeking diversification as well as yield enhancement to traditional listed fixed income.

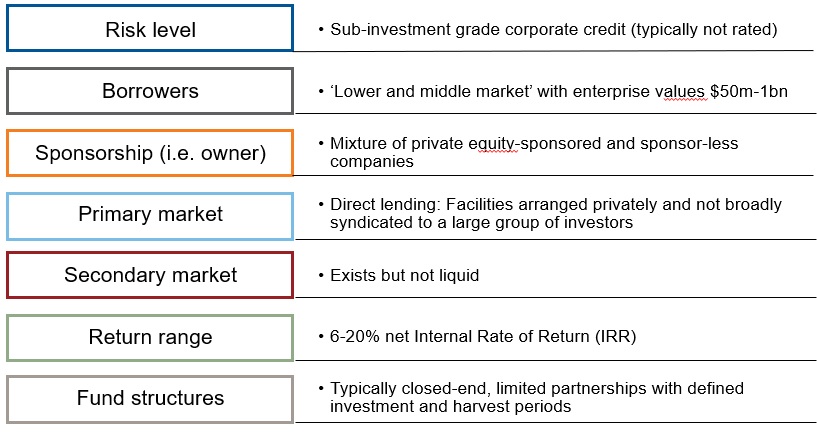

The chart below reflects some of the main characteristics of typical private loans.

Companies always need capital to grow

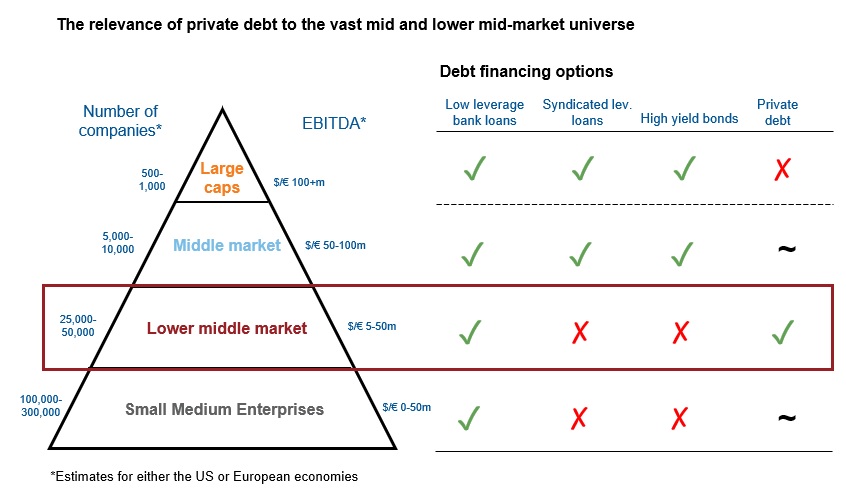

The chart below illustrates the various sources of capital available (or not) to companies of a variety of sizes. Small and lower middle market companies (as measured by EBITDA) have the least access to capital from more traditional sources, such as banks and the syndicated loan market. Therefore, such companies are among the primary users of loans from private providers. The universe of potential borrowers is broad, particularly in the US and Europe, when considering that there are 25,000-50,000 companies in those regions in the lower middle market. As with any private debt investment, due diligence on credit worthiness of borrowers and expertise in structuring the loan and relevant covenants are key elements to a successful investment.

Source: Campbell Lutyens November 2019.

Banks pulling back from lending created opportunity in direct lending

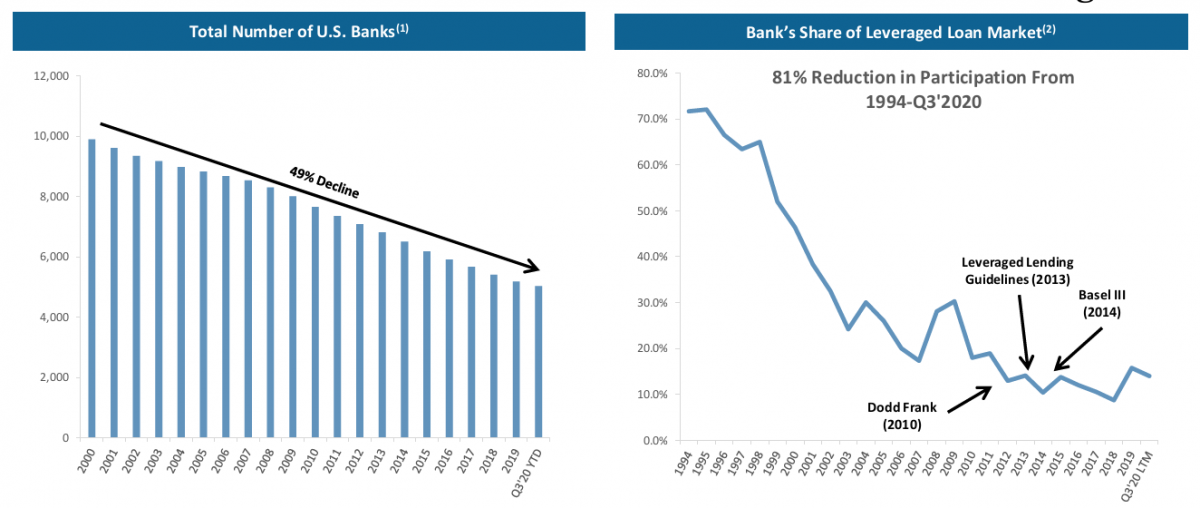

Structural changes in the financial services industry since the GFC have generated demand for nonbank loans. Although banks still dominate corporate lending, they have pulled back from the lower end of the middle market, reducing their exposure to these loans in response to industry consolidation and increased regulation.

The chart below reflects that trend.

1 Source: Federal Deposit Corporation (FDIC), "Statistics at a Glance: Latest Industry Trends."

2 Source: S&P's LCD Q3 Leverage Lending Review.

Asset managers in the US are regulated by the Securities and Exchange Commission (the SEC)—therefore, not subject to the same restrictions as banks. This flexibility is an added benefit to sponsored lending, especially for more complex transactions like buy-and-build, where there are a number of add-on acquisition financings as part of the strategy.

In addition, banks tend to provide larger syndicated loans to big corporations and fewer loans to smaller to mid-market companies. Because of the supply/demand imbalance, middle market companies are willing to pay higher interest rates for access to capital, attracting nonbank lenders to fill the gap. This trend has enabled middle market companies needing financing to obtain it. Additionally, private lenders are able to offer higher investment yields to investors.

In addition, banks tend to provide larger syndicated loans to big corporations and fewer loans to smaller to mid-market companies. Because of the supply/demand imbalance, middle market companies are willing to pay higher interest rates for access to capital, attracting nonbank lenders to fill the gap. This trend has enabled middle market companies needing financing to obtain it. Additionally, private lenders are able to offer higher investment yields to investors.

There are distinctions between syndicated loans and direct loans and the differences are relevant to investors. Syndicated loans are distributed by banks to large groups of institutional investors. Since they are traded on secondary markets, they are more liquid—resulting in lower yields and higher volatility, compared with direct loans.

In contrast, direct loans are generally held to maturity rather than traded, resulting in lower volatility, which is a benefit to investors seeking diversification, relatively higher returns and reduced volatility. Also, syndicated loans have experienced higher default and loss rates, partly due to less stringent covenants, less rigorous due diligence and less oversight of loans made by institutions that hold the loans to maturity, or until an exit or a re-finance.

Differences in how direct loans are structured and issued has made that segment attractive for investors. As mentioned, private loans are generally held to maturity rather than traded, which reduces their volatility. In addition, like bank loans, direct loans can be senior in the capital structure and they can also benefit from protections that help to reduce credit risk.

The main take away is that broadly syndicated and direct lending have different levels of liquidity, risk and return. So investors should be clear about their goals, as well as the risks of the various loan types.

Why private debt for investors?

In addition to companies needing to borrow money, there are several reasons investors may want to consider private debt, depending on their circumstances:

• Diversification from traditional assets

• Higher annualised income than traditional fixed income

• An illiquidity premium for investing in less liquid structures

• Investment opportunities for total return that may not be available in more liquid investments.

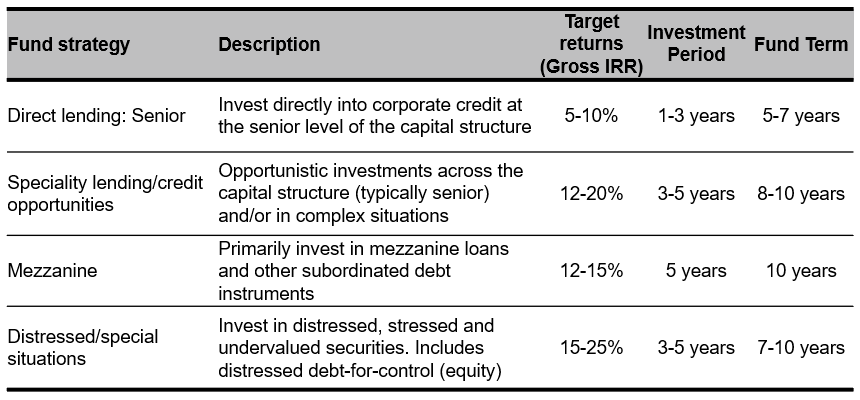

The chart below shows some examples of the types of lending strategies, estimated internal rate of return (IRR) targets and term of the fund life among funds of some of the main private debt strategies. Fund terms range from 5-10 years, and although relatively illiquid when compared to public credit, they are not as long a life as private equity or opportunistic private real estate funds, which are generally 10 years, nor private infrastructure, which are 10-12 years. Due to its very nature as a loan, private debt generates cash sooner and more regularly than private equity, which is one of its attractive features as part of a total portfolio.

It should be noted that, although private markets funds have a long legal life, they also generate cash flow, which is sometimes overlooked by investors and can help mitigate some concerns about relative illiquidity. Russell Investments has recently published research on this topic.

Dislocations create opportunities, but there are also risks

Dislocations in various markets have occurred due to the global Covid-19 pandemic, creating opportunities in private markets. Publicly traded debt and equity securities have surged in price since 2020, after central banks and governments across the world unleashed trillions of dollars’ worth of stimulus to dull the economic blow from the pandemic.

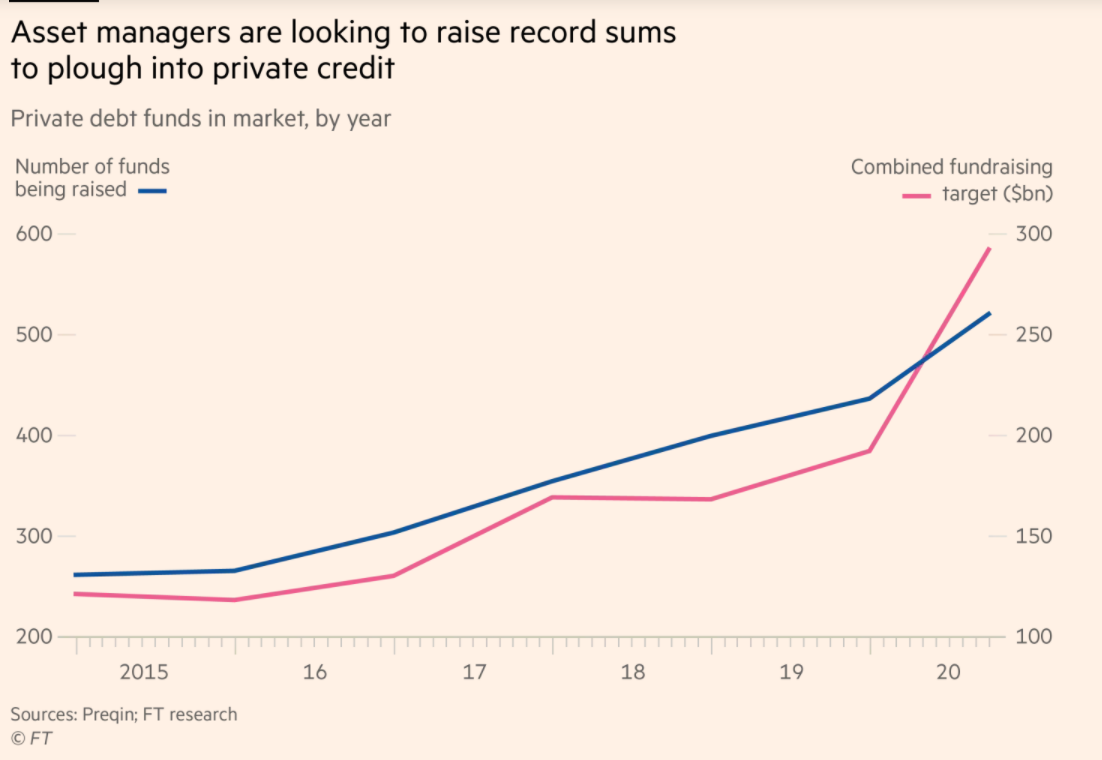

Some private markets participants perceive that it may not end well. Evidence of this is reflected in the chart below, from the Financial Times (FT) and Preqin, which illustrates the recent growth in private debt funds. The blue line is the number of funds being raised, and the red line is the amounts debt managers are aiming to raise. Both rose sharply in 2020. The FT also reported that 520 private credit funds were available to investors in October 2020, up from 436 at the beginning of that year, and just under 400 in January 2019. Average fund sizes grew also, with the combined fundraising target of $292 billion—up from $192 billion in January 2020.

Some private markets participants perceive that it may not end well. Evidence of this is reflected in the chart below, from the Financial Times (FT) and Preqin, which illustrates the recent growth in private debt funds. The blue line is the number of funds being raised, and the red line is the amounts debt managers are aiming to raise. Both rose sharply in 2020. The FT also reported that 520 private credit funds were available to investors in October 2020, up from 436 at the beginning of that year, and just under 400 in January 2019. Average fund sizes grew also, with the combined fundraising target of $292 billion—up from $192 billion in January 2020.

The fundraising target would add to the significant pot of dry powder, worth approximately $300 billion, that managers already have to deploy. Dry powder is the amount of commitments made by investors that has not yet been called by the private markets manager and is thus awaiting investment into an underlying opportunity.

Where do we see opportunities?

We are continuously researching private debt managers and identifying opportunities that we believe will deliver the best outcomes for our clients. Some of the most attractive opportunities we are seeing currently are senior-secured corporate debt, real estate debt, opportunistic corporate and asset-backed debt. These strategies are attractive from a return perspective, but also have enhanced downside protection. In particular, we have a positive outlook for the following strategies:

• Senior-secured loans to lower-middle market sponsored and non-sponsored buyout transactions. Generally, first lien but also second lien. A lien is a legal right to assets used as collateral to satisfy a debt in the event of default.

• Commercial real estate mortgages on stabilised properties in cities with highly developed real estate markets. In the US, these include cities such as Boston, Chicago, the Washington, DC, metro area, Los Angeles, New York and San Francisco.

• Full capital-stack solutions to restaurant franchise-lending, primarily in the form of senior-secured and stretch-senior, often with warrants.

• Debt-financings for technology companies, often with attached warrants, as equity-injections are considered expensive and dilutive.

• Completion financings in US agribusiness, which sits behind broader farm credit.

Where do we see risks?

Notwithstanding the opportunities available in the current environment, there are three areas of particular focus when we are selecting managers for client portfolios: higher default rates, managers’ ability to minimise loss and patience in deploying capital.

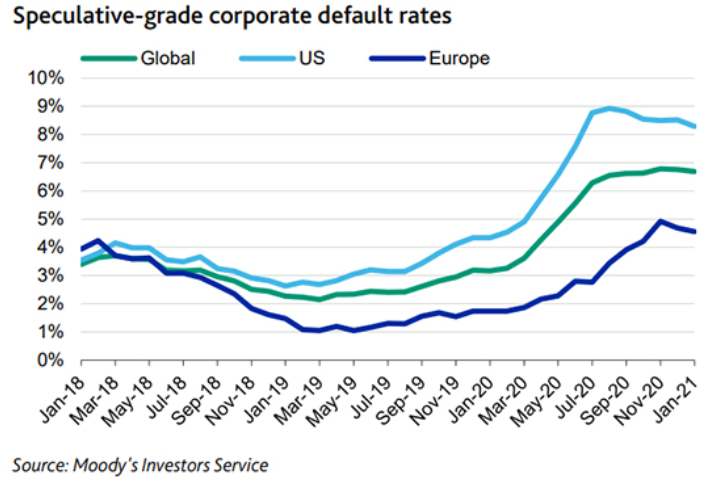

Credit defaults have remained around historic lows for about 10 years, following a high in 2009 in the wake of the global financial crisis. But, as reflected in the chart below, default rates for speculative-grade corporates rose in 2020 and are a watchpoint.

Several factors influence default rates of borrowers, including the amount of leverage, debt coverage ratios, profitability, growth prospects and size, among others. Managers must balance all these factors to minimise defaults and maximise the recovery in case of default. Part of our analysis when researching managers is examining their ability to handle potential defaults, and experienced teams post-Covid-19 will be a key differentiator and an indicator for further allocations we may make.

The third area we continue to watch closely is managers’ prudence in allocating capital. As reflected in the chart below, dry powder is on the rise across all of private markets, including in private debt. Significant investor demand can lead to deterioration of lending standards, which could in turn increase risks, as well as defaults. Our objective in allocating to mangers is to choose those that are prudently allocating capital, lending to high-quality borrowers and have high-quality assets as collateral in the event of a default. All of these are key to long-term success.

The third area we continue to watch closely is managers’ prudence in allocating capital. As reflected in the chart below, dry powder is on the rise across all of private markets, including in private debt. Significant investor demand can lead to deterioration of lending standards, which could in turn increase risks, as well as defaults. Our objective in allocating to mangers is to choose those that are prudently allocating capital, lending to high-quality borrowers and have high-quality assets as collateral in the event of a default. All of these are key to long-term success.