An opportunity at our fingerTIPS

Market sell-offs can provide the chance to buy quality assets at attractive valuations. Of course, if you can preserve capital as prices fall, then you’ll be better placed to take advantage of any opportunities that arise.

But buying equities isn’t the only way to dial up risk in portfolios today.

We see the recent falls at the long end of the US bond market as an opportunity worth grabbing.

Rather than licking our duration wounds (scratches not gashes for the Ruffer strategy, thanks to interest rate options), we have been adding risk by increasing exposure to bonds, not equities.

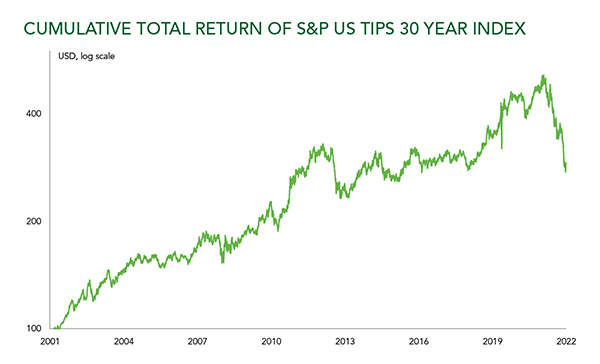

This month’s Green Line shows the cumulative return of 30 year US Treasury Inflation Protected Securities (TIPS) since 2001. Investors have been well rewarded, until this year’s sharp drawdown. These bonds now trade at levels last seen in 2016.

So with real yields now positive, US TIPS look like an attractive risk to take on. In a world full of uncertainty, if you were offered a return above inflation of almost 2% for the next 30 years, with no default or deflation risk, and in a sovereign, dollar denominated asset, wouldn’t you be tempted? We are, and long-dated US bonds are the one asset that has lured us out of cash in recent weeks.

We think inflation is close to peaking, and bond markets could be the first to sniff out a Federal Reserve pause. Adding TIPS also provides the chance to diversify our inflation protection – and to make money should tightening pressures ease. In fact, it’s hard to imagine a scenario in which equities can rally without a move in yields first.

That makes these bonds a two way bet: a money-making opportunity if the Fed does pivot or pause, and an asset that could provide some protection in a recession, when bond yields tend to fall.

But hold on, discussing peak inflation feels like a big moment for a strategy which is synonymous with concerns of higher inflation…

Well, our view remains that we are firmly in a new structural regime of inflation volatility, and the recent actions of governments and central banks have only reinforced this view. However, shorter term, we can foresee inflation falling (just not all the way to current central bank targets) and recession risks continuing to rise. As a result, we have positioned the portfolio to navigate an environment where rate hikes will slow or even pause in the next few months. Bonds will help us do that.

Crucially, Ruffer has been here before. At the covid nadir, the severe dislocation in the TIPS market (though only showing as a blip on this chart) gave us an entry point to participate powerfully in the subsequent summer rally, without needing to add to equities. Having preserved capital over the first quarter of 2020, we could take opportunities when others were taking cover. This is the true value of an unbenchmarked, unconstrained strategy: the ability to look at investments through a different lens and find the most appropriate way to add risk in the circumstances.

Sources: Bloomberg, Ruffer

The views expressed in this article are not intended as an offer or solicitation for the purchase or sale of any investment or financial instrument, including interests in any of Ruffer’s funds. The information contained in the article is fact based and does not constitute investment research, investment advice or a personal recommendation, and should not be used as the basis for any investment decision. References to specific securities are included for the purposes of illustration only and should not be construed as a recommendation to buy or sell these securities. This article does not take account of any potential investor’s investment objectives, particular needs or financial situation. This article reflects Ruffer’s opinions at the date of publication only, the opinions are subject to change without notice and Ruffer shall bear no responsibility for the opinions offered. This financial promotion is issued by Ruffer LLP. Read the full disclaimer.