North American family offices turning off co-investment?

The popular belief that family offices in North America regularly invest together has been challenged by the Global Family Office Report 2014, finding instead that they are the least likely to co-invest.

According to the report, 61% of family offices in North America co-invested together last year, while in European offices this figure sat at 86%.

Almost half of North American family offices said they had never taken part in syndicated deals facilitated by banks, while two-thirds of family offices in Asia-Pacific reported high engagement in these types of deals.

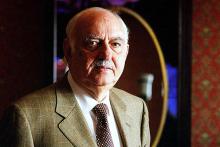

Daniel Goldstein, senior managing director at Manchester Capital Management, a North American family office, hears from some families that they believe co-investment is a sign of inexperience.

“Many family offices in North America are doing direct deals, but many are keeping it under the radar. Actively investing families do not want others to ride on their coat tails. There may be a bit of naiveté among some European families who hope to attach themselves onto deals from more experienced families.”

Goldstein questions why a family office would co-invest if it already had good deal flow and capital. “Why would you trust that somebody else is not just cherry picking and offloading their most risky deals?”

Goldstein questions why a family office would co-invest if it already had good deal flow and capital. “Why would you trust that somebody else is not just cherry picking and offloading their most risky deals?”

Goldstein, who has worked on both sides of the Atlantic, says an added concern is that family offices often don't have a robust legal framework to assist when deals go wrong.

“Co-investment sounds great when everything goes well and suffers when deals go bad. The last thing you want is to just have a handshake and be sent on your way,” he says.

Worldwide, legal services are the least likely to be provided in-house, the report found, embedded in just 6% of family offices. In the last year, the number of family offices in North America using in-house legal services has almost halved, from 9% to 5%.

Goldstein says family office structures in North America will undergo sweeping changes when Millennials, those born between the 1980s and 2000s, assume control.

“Family offices are going to be leaner and more focused on achieving societal gains while looking for financial gains. They will change constructs of what they do and the way they deploy capital,” he says.

The Global Family Office Report 2014 found that North American offices were most likely to outperform against their benchmarks, whether the goal was wealth preservation or capital growth.