Multigenerational philanthropy: Aligning family values for impact

Philanthropy is top of mind for most affluent families. However, according to BNY Mellon Wealth Management’s Global Family Office Study, only 30% of family offices have documented strategies to deploy wealth in a truly meaningful way [1]. This disconnect is just one of several challenges that families face regarding philanthropic planning.

Over the next 25 years, it’s estimated that Baby Boomers will pass along nearly $48 trillion in assets to their heirs and charities, with Generation X being the biggest beneficiaries [2]. To put things into perspective, total giving in the United States was more than $471 billion in 2020 [3]. The sheer size of the Great Wealth Transfer will make unifying philanthropic goals not only more important but more complex, especially when considering unique financial needs and priorities, as well as different personalities and family dynamics.

Each generation has its own set of beliefs and perspectives, which has led to the need for unity and understanding between those who inherit wealth and their wealth-bearing predecessors. Today, it’s more important than ever to bridge that gap and ensure that, as wealth passes through generations, family values and legacies are not left behind.

DIFFERENT APPROACHES TO GIVING

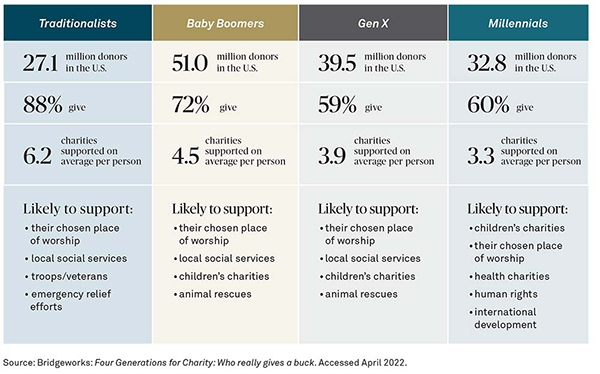

Family philanthropy can be challenging, as each generation is drawn to different causes and has different ideas on how to deploy wealth to support those causes. Baby Boomers are inclined to donate to churches, local social services, children’s charities and animal rescues; while Millennials tend to gravitate toward health charities, human rights and international development. Additionally, Boomers are more likely to spread donations across a greater number of charities and donate a higher dollar amount relative to Millennials (see chart below) [4].

Another key difference is how each generation prefers to make an impact. Due to the acceleration of technology, Generation Z and Millennials are unlikely to limit philanthropic endeavours to traditional donations, viewing social media and online fundraising as avenues for social good. This is in contrast to Boomers, who grew up at a time when marching for a cause and cutting checks to charities were some of the only ways to make an impact.

Social media has enabled individuals to amplify their views, which can play an important role in addressing social causes. Similarly, the proliferation of technology has armed younger generations with information that would have been hard to come by years ago. Those who are more technologically savvy are empowered to do their own due diligence on causes they support as well as charitable organisations.

Despite these differences, the definition of philanthropy remains the same; across generations, it is universally understood to be the catalyst for conversations about the future and the means to create a better world.

GIVING STATISTICS BY GENERATION

BRIDGING THE GAP

While generational hurdles do exist, there are ways to create a seamless transfer of wealth and goals. The good news is that all generations remain committed to giving and are actively engaged in philanthropy in some way, whether it be financially, through volunteerism/activism, or expertise and educating others.

But how can families achieve greater unity when it comes to philanthropy? A good starting point is to hold a family meeting with a candid discussion on shared values and core beliefs. It can also be helpful to discuss the family’s legacy of giving and how it has donated historically. This will identify common threads between each family member’s charitable vision, creating an overarching mission that can serve as a road map for what types of organisations to deploy funds to and the preferred methods to make an impact.

Family members should familiarize themselves with how the prospect of giving has changed with the evolution of technology and impact investing, and they should share their knowledge with each other. The goal is to encourage the sharing of ideas while showing commitment to understanding differing perspectives. Being well-informed helps family members make prudent decisions, both individually and collectively, to achieve philanthropic goals.

Family discussions on philanthropy can also help educate younger generations on entrepreneurship, providing an opportunity to demonstrate leadership while preparing them to manage the family’s wealth responsibly for generations to come. Ways to do this include:

- Supporting ownership of their projects and encouraging accountability for results

- Agreeing on their level of involvement and decision-making in the family’s collective giving

- Gauging their level of interest and acumen for succession planning

- Considering an “unrestricted fund” for their passion projects

Additionally, families should consider ways to support the causes they care about together. Whether it’s volunteering, visiting non-profits or reading “Thank you” and “Update” letters from gift recipients, sharing these experiences helps reinforce the importance of giving as a family, beyond just the financial aspects.

PUTTING A PLAN IN PLACE

Creating a true alignment of views and values across generations is contingent on recognizing what unique skillsets and interests each voice brings to the table, ultimately working toward a common goal. It’s important to acknowledge that there is no one right way to give.

After family members have identified shared beliefs and learned about various approaches to giving, the next step is to define what success looks like for giving initiatives, which will set expectations and determine how to measure and monitor impact. Once they take this into consideration and embark on their own missions, they should reconvene to share results and lessons learned.

It can seem like there are oceans between each generation, but communication is key. Routinely having active discussions on philanthropic goals can help maximise the impact of charitable endeavours while keeping family values alive for generations to come.

At BNY Mellon Wealth Management, we encourage our clients to consider the family’s philanthropic values as part of their overall wealth plan and to focus on shared values instead of generational differences. At its heart, philanthropic planning is about finding the best way to make a lasting impact on the legacies of both families and communities.

To learn more about working with BNY Mellon Global Family Office, visit bnymellonwealth.com/globalfamilyoffice.

[1] BNY Mellon Wealth Management: Shifting Horizons – Insights into How Family Offices Are Responding to Rapid Economic and Social Change. February 2022.

[2] Cerulli Associates: HNW Transfer of Wealth. Accessed April 2022.

[3] Fortune: Americans gave a record $471 billion to charity in 2020. June 2021.

[4] Bridgeworks: Four Generations for Charity: Who really gives a buck. Accessed April 2022.

DISCLOSURE

The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE.

The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland.

Trademarks and logos belong to their respective owners.

BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

© 2022 The Bank of New York Mellon Corporation. All rights reserved. | WM-264844