Make family business great again' What can family business expect now Donald Trump has America in his hands

Donald Trump's election as the 45th US president has thrust a family business leader into the most important job in the world. What will be the impact on family businesses in the US (and beyond) of having a family business-friendlier figure in charge? Nicholas Moody and James Beech report

The insinuation could not have been clearer. In an interview with ABC America's This Week programme on 8 January, the former US president Barack Obama, warned his soon-to-be-successor, the self-styled real estate tycoon Donald J. Trump that: “As soon as you walk into this office after you've been sworn-in, you are now in charge of the largest organisation on earth.” Then for the killer blow. “You can't manage it the way you would manage a family business.”

Obama's statement reinforced the negative stereotypes of family business, implying that they weren't well run, notes Andrew Keyt, clinical professor in family business at Loyola University, Chicago. Intended as advice, this closing barb drew a pejorative link between Trump's mode of operation and family-run organisations.

Whatever your political views, the elevation of Trump, who heads up a largely domestically focused second-generation real estate-to-entertainment business, is a big deal for family businesses in the US (and potentially many families outside the US). Or is it? Will Trump's pronouncements to repeal the 'death tax', but eliminate the step-up in basis for estates of more than $10 million eventuate? Will Trump be friendlier to businesses, and family businesses in particular? Or will his proposed brand of protection-led trade liberalism starve those family enterprises trading in international markets?

CampdenFBapproached a range of commentators to discuss Trump's presidency and its impact on family businesses. Their responses unanimously pointed to benefits around proposed reduced regulation and a simplified and lower tax structure.

“President Trump and the GOP-led Congress will lower or eliminate the estate tax, or at least lower how ownership in family companies is valued, [which is] a boon to the relatively small number of family companies affected by these taxes,” says John A. Davis, chair of the Families in Business programme at Harvard Business School and chairman of adviser Cambridge Family Enterprise Group. “He will try to reduce regulations, which could be helpful, depending on which regulations are reduced or weakened.”

“President Trump and the GOP-led Congress will lower or eliminate the estate tax, or at least lower how ownership in family companies is valued, [which is] a boon to the relatively small number of family companies affected by these taxes,” says John A. Davis, chair of the Families in Business programme at Harvard Business School and chairman of adviser Cambridge Family Enterprise Group. “He will try to reduce regulations, which could be helpful, depending on which regulations are reduced or weakened.”

William Goodspeed agrees the only area where family businesses might benefit more specifically would be if the US estate tax rate is reduced, which would allow less expensive intergenerational transfers of stock ownership in family companies.

Goodspeed, a member of the Huber family and long-time Huber executive, has extensive experience in family businesses and serves on several family company firms, including Sheetz, ABARTA, Granger, and Longo's.

Otherwise, Goodspeed cautions, they should not expect special treatment: “Family businesses will not be selected for favourable treatment under President Trump. There will likely be corporate and individual tax rate reductions, which will help all businesses.”

Keyt doubts whether a complete repeal will happen and flags the potential effects on succession. “The estate tax actually can create a sense of time urgency and incentive for the parents to pass ownership to the next generation. I anticipate that the estate tax rates will be reduced which will be positive for family business owners.”

Keyt doubts whether a complete repeal will happen and flags the potential effects on succession. “The estate tax actually can create a sense of time urgency and incentive for the parents to pass ownership to the next generation. I anticipate that the estate tax rates will be reduced which will be positive for family business owners.”

Joseph Astrachan, the Wells Fargo Eminent Scholar Chairman of Family Business, at Kennesaw State University, Georgia has a novel suggestion: “I would like to see Trump appoint a commission for supporting family businesses in the US.”

This innovation could be welcomed by members of Family Enterprise USA—a group that lobbies for family businesses in Washington DC. Its 2016 survey of 168 members and non-members found, in spite of revenue and job growth, participants were concerned about government regulation of their businesses and taxes.

Alarmingly, 69% of participants reported it was harder to operate their family businesses in 2016 than it was five years earlier. This is significant because just 50% of participants in 2011 reported revenue growth, and just 33% planned to add employees.

“Actions by the new administration that reduces business regulations, taxes and eliminates the estate tax will be actions that are supportive of family-owned businesses,” says Mike Hamra, chairman of Family Enterprise USA.

Will having a family business-friendlier figure in charge at the White House benefit family enterprises then?

Davis doubts it: “I disagree with the characterisation of President Trump, because he leads a family business, as being “friendlier” to family business. His sleazy business practices and personal image are not the kind of images I want to represent family companies. Mr Trump is probably sympathetic to the struggles of family companies, but we know little about his policies, beyond his tweets.”

Goodspeed and Keyt are also skeptical about any special influence family businesses might hope to gain.

“In all my following of President Trump and the campaign, I've never heard him extoll the virtues of family-owned businesses,” says Goodspeed. “He seems quite agnostic to ownership structure, except a strong preference for American-held companies. Recently, he pressured both Carrier (a widely-held public company) and Ford Motor Company (a family-controlled public company) to change plans on moving production to Mexico.”

“I have not heard him talk about a desire for a legacy, a desire to prepare his next generation, or much of what most family business owners talk about. In general Trump will create a more positive domestic environment for businesses of all types,” adds Keyt.

“I have not heard him talk about a desire for a legacy, a desire to prepare his next generation, or much of what most family business owners talk about. In general Trump will create a more positive domestic environment for businesses of all types,” adds Keyt.

Will family businesses benefit or suffer from Trump's desire to bring more employment back in the US?

It really depends on the industry, suggests Goodspeed. “Trump isn't doing anything to favour family businesses, but rather has a nativist/protectionist view of trade.”

Davis also urges caution about the impact of Trump's proposed trade policies.

“If he gets tough on our trading partners, how will his policies affect family companies who have a considerable part of their business engaged in cross-border business? Let's see. And then we can already see the Trump family business being lampooned by comedians and we know it will be boycotted by many. Will that negative image of nepotism and family privilege help family companies?”

“The risk is the impact that his trade policies will have on the global economy,” says Keyt. “Larger publicly-traded companies have more resources to weather the storms of a trade war than most family businesses, so while the domestic business climate may improve the macro economic environment may be more challenging.”

Trump's ascension has not been without controversy for other family businesses. Several family enterprises are among 38 companies singled out by the #GrabYourWallet campaign which urged consumers to stop shopping at retailers who did business with the Trump family—in response to Trump's comments about women. These included Nordstrom and Walmart—although most of these were linked to Ivanka Trump's products, rather than Trump himself.

Trump's ascension has not been without controversy for other family businesses. Several family enterprises are among 38 companies singled out by the #GrabYourWallet campaign which urged consumers to stop shopping at retailers who did business with the Trump family—in response to Trump's comments about women. These included Nordstrom and Walmart—although most of these were linked to Ivanka Trump's products, rather than Trump himself.

LL Bean heiress Linda Bean landed the Maine-based family retailer on the prominent 'entities to consider boycotting' list as part of the same campaign after contributing $55,000 more than allowed to president-elect Trump's campaign.

President-elect Trump responded to the controversy: “Thank you to Linda Bean of LL Bean for your courage and support. People will support you even more now. Buy LL Bean.”

Hobby Lobby (Green family), Kushner Properties (Kushner family), and Ultimate Fighting Championship (Fertitta family) were among other family businesses outed as possible boycott targets.

There has been some controversy about how Trump hands over his family business to his family during his presidency, particularly his degree of continuing control. Under the proposals Trump's eldest sons, Donald Junior and Eric, will run the firm, along with Allen Weisselberg, a long-standing Trump executive. Questions have been raised about corporate governance (the Trump Organisation is a sprawling mass of more than 500 entities) and transparency (proposals suggest only limited financial accounts will be made public). Could this mean there are negative connotations surrounding family enterprises and succession?

There has been some controversy about how Trump hands over his family business to his family during his presidency, particularly his degree of continuing control. Under the proposals Trump's eldest sons, Donald Junior and Eric, will run the firm, along with Allen Weisselberg, a long-standing Trump executive. Questions have been raised about corporate governance (the Trump Organisation is a sprawling mass of more than 500 entities) and transparency (proposals suggest only limited financial accounts will be made public). Could this mean there are negative connotations surrounding family enterprises and succession?

“It may only be a temporary succession until the time he is no longer president,” says Astrachan, “[But] I do not think this has had a profound negative impact on the public's perception of family business as there are so many positive examples at every level of the economy and in every corner of the country.”

There is a stereotype of family businesses in US society as being slower, smaller, and less professional, suggests Keyt.

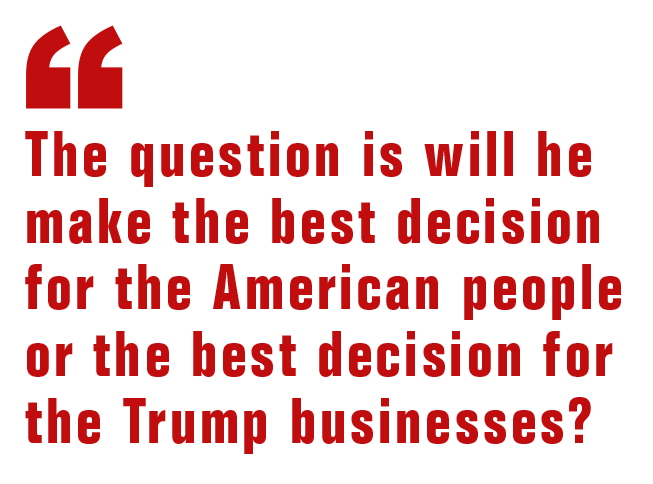

“I do not think that this is what is behind the concern about his handing control of the business to the next generation. The concerns are around the conflicts of interest that are inherent in such close connections between the US president and the management of an operating company he owns. Trump's decisions as president can influence its operating businesses both positively and negatively. The question is will he make the best decision for the American people or the best decision for the Trump businesses?”

“I do not think that this is what is behind the concern about his handing control of the business to the next generation. The concerns are around the conflicts of interest that are inherent in such close connections between the US president and the management of an operating company he owns. Trump's decisions as president can influence its operating businesses both positively and negatively. The question is will he make the best decision for the American people or the best decision for the Trump businesses?”

Trump is doing nothing substantial to distance himself from his family company, adds Davis.

“Since he is maintaining ultimate control of it, he can be informed easily about its issues, and he will surely make the big decisions about the business. I fear that Trump will reset the image of family business leaders to the old robber baron image. We certainly do not need that.”

Despite the concern about the possible fast-tracking of Trump's next generation into the upper echelons of political power, Davis says Trump can be proud of his business succession plan.

“As far as I can tell, I think Trump has developed a sound next generation for his family company and he has strong non-family management as well,” says the chair of the Families in Business programme at Harvard Business School.

Goodspeed agrees: “The Trump children have a reputation of being very competent. Not a single media story that I have seen even hints that there are internal candidates who would be better taking over.”

Goodspeed agrees: “The Trump children have a reputation of being very competent. Not a single media story that I have seen even hints that there are internal candidates who would be better taking over.”

“The bias against the nepotism represented by these promotions bring forth the stereotypes of the 'entitled and unqualified successor',” says Keyt. “The assumption is that because they are a part of Trump's family they cannot possibly be as qualified as someone else. The reality is that many family business successors are equally if not more qualified than their parents or outsiders to be running their family business.”

Following an acrimonious election campaign and protest-ridden inauguration, what advice is there for US family businesses?

“Hold on for a rough ride for the next few years,” says Davis. “Stay focused on the long-term. Keep doing the right thing for your company and society. We need to build a good image for this sector and your actions will matter.”

Common appeal, uncommon privilege

American politicians are no strangers to wealth and many have had family business roots. Very few congress members don't come from a position of privilege; research from the Center for Responsive Politics found that, as of January 2014, more than 50% of congress members had an average net worth of $1 million-plus.

Hyatt second-generation member Penny Pritzker was the incumbent US commerce secretary under President Obama, while John Kerry is a progeny of the Forbes and Dudley–Winthrop families. Michael Bloomberg as mayor of New York City and Jay Rockefeller as a long-time senator of West Virginia are further examples.

Like Ross Perot in 1992, Trump was chairman and president of his operating business until his inauguration. The Economist said of the Trump Organisation: “Far from being a global branding goliath, it is a small, middle-aged and largely domestic property business”, but since then it has done the crunching. It aggregated the financial data of 170-odd entities, which were filed in 2015, and calculated Trump Inc is worth about $4 billion, with $490 million of annual revenue. Were it listed it would be the 833rd-largest firm in America by market value and 1,925th by sales.

Forbesputs Trump's net worth at $4.5 billion, considerably less than the $10 billion figure he has publicly claimed. The second-generation head of the Trump Organisation since 1971, inherited about $40 million from his late father, real estate developer Fred Trump. He since expanded it beyond its traditional real estate holdings, to include everything from hospitality and entertainment to financial services.

Trump's family business became a victim of his political ambitions early on in the presidential race.

After controversial comments about Mexicans in his June 2016 presidential bid announcement, Spanish-language TV network Univision ended its contract to broadcast Trump's Miss USA pageant. In July, Fortune magazine listed the following organisations as also cutting ties with Trump business interests: NBC Universal, Televisa, Farouk Systems, 5 Rabbit Cerveceria, Ora TV, Macy's Department Stores, and “Trump Home” mattress maker Serta.

The impact on Trump's business interests may be the biggest casualty of his presidency.